The future of wealth: DBS Treasures leads with AI-powered and predictive banking solutions

DBS embeds customer-centric predictive technology in more financial solutions to empower customers to better manage their wealth

[The content of this article has been produced by our advertising partner.]

To maintain its position as a leader in the constantly evolving wealth management sector, DBS Treasures is committed to integrating the latest technologies to deliver new options and best-in-class service.

As part of this digital transformation, DBS Bank Hong Kong’s (“DBS”) personalised premium banking and wealth management platform for affluents offers data-driven, customer-centric solutions that meet today’s banking and investment needs.

Predictive analytics and other online tools are set to open up a world of opportunities, affording clients easy-to-use trading platforms and valuable insights into the broad trends and emerging themes in the market and how they affect investment decisions.

“Our ongoing digital enhancements are key pillars of a broader fintech strategy for wealth management, focusing on delivering seamless, efficient and highly personalised experiences,” says Belinda Hsieh, managing director, head of Treasures Investment Products and Advisory, Consumer Banking Group and Wealth Management, DBS Bank Hong Kong. “By integrating cutting-edge technologies like artificial intelligence (AI), machine learning and natural language processing, we are reshaping how clients engage with their investments, making it easier for them to access markets and make informed, real-time decisions.”

Digital enhancements range from account opening and performing transactions to managing investments and receiving financial advice. This comprehensive approach enables more intuitive, intelligent banking in the form of smart “nudges” from the system, as well as tailored insights and data-driven interactions which DBS Treasures refers to as “next best conversations”. These advisory tools are designed to help customers make more informed decisions and, as a result, manage their finances more effectively.

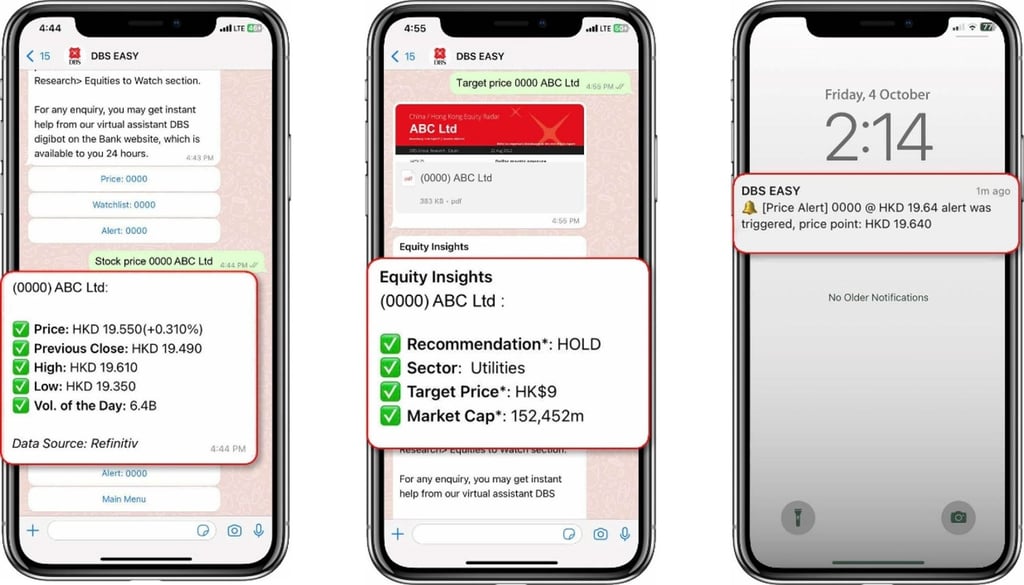

DBS Easy, or “equity assistant for you”, is one example. The WhatsApp-based chatbot provides users with ready access to equity-related services including Hong Kong and US stock information, price alerts, DBS research reports and personalised watchlists. By simplifying equity management for investors who prefer on-the-go solutions, this innovation marks a significant milestone in DBS’s overall digital strategy.

“By leveraging WhatsApp, we give clients timely information and empower them to make smarter decisions with minimal friction,” Hsieh says. “We continuously enhance DBS digibank HK, our equity trading platform, and have recently introduced real-time streaming of US stock quotes and five real-time bid-ask queues for Hong Kong stock quotes.”

With unlimited free access to these services, clients have up-to-the-minute information at their fingertips. Soon, DBS Hong Kong customers will also have access to virtual-asset-related products via the platform, expanding the range of investment opportunities.

In this context, the use of a chatbot is a significant step for Hong Kong’s fintech ecosystem. It sets a new benchmark for how financial institutions can leverage popular communication platforms to deliver timely services to clients.

“This development highlights the trend towards conversational banking, where customer interactions are increasingly powered by AI through widely used platforms,” Hsieh says. “It can expand participation in financial markets and signals a broader convergence between finance and technology in Hong Kong, ultimately fostering a more inclusive and tech-savvy environment.”

Additionally, Hong Kong’s initial public offering (IPO) market is set to revive amid growing signs of recovery, with several well-known companies ready to list. In response, DBS will introduce a new channel that will allow clients to apply for stock IPOs directly through the DBS mobile app. “This feature will complement our existing internet banking IPO application channel, providing greater flexibility and convenience to our clients,” Hsieh says.

To meet the specific needs of professional currency traders and foreign exchange investors, DBS will launch a similarly tailored range of digital enhancements, including price alerts and a real-time function which allows clients to monitor selected currency pairs and track market movements. In addition, on-screen options with three chart types and seven technical indicators can be customised to help analyse currency trends and fine-tune trading strategies in real time.

“With these tools, clients have online channels and all the essential features to navigate the dynamic foreign exchange market confidently,” Hsieh says. “They also have the connectivity to trade anytime, anywhere.”

Other investment technologies include the redesigned DBS digibank HK, which now offers greater flexibility and convenience when actively managing a portfolio. Clients can invest in more than 260 funds and unit trusts in up to 10 currencies. Further enhancements to the bank’s online fund investment platform will include services provided by the Chief Investment Office and DBS Group Research, which monitor market performance, provide analysis and advise investors on fund choices that align with their investment profiles. “This will make it easier for clients to proceed with fund transactions online,” Hsieh says. “They can make lump-sum subscriptions, and will be able to switch between funds, or set up regular fund investment plans directly through the app very soon.”

Even with all these enhancements, the DBS Treasures team recognises the importance of continuing to refine and upgrade digital services, ensuring they are intuitive and can be adapted to meet each client’s unique financial situation.

“A key learning for us has been the value of integrating digital solutions into platforms that clients already use, like WhatsApp,” Hsieh says. “By meeting clients where they are, we have improved accessibility, which allows clients to manage their investments more conveniently and efficiently.”

To better empower self-directed customers, the bank will further enhance technology infrastructure and talent, embedding intelligent banking predictive features and functions in still more financial solutions.

“Our focus will remain on expanding AI and machine learning capabilities to provide even more personalised and intelligent banking experiences,” Hsieh says. “We will ensure that our platforms are flexible, user-friendly and aligned with our clients’ growing expectations for digital wealth management.”