How Standard Chartered continues to make its mark in fintech with launch of myWealth service

- Digital wealth management tool within its mobile app allows investors to build their investments in a convenient, personalised and holistic way

- Bank was sponsor of Hong Kong FinTech Week 2022, which discussed new developments and innovations in the financial technology sector

[Sponsored article]

Amid the surge in virtual banks and online trading platforms, the digitalisation of the traditional banking industry has been proceeding rapidly. Over the past few years many banks have been steadily rolling out new, innovative and user-friendly ways to help their clients manage their investments online.

The growing importance of the use of technology to provide financial services, known as fintech, was highlighted at Hong Kong FinTech Week 2022, which ran from October 31 to November 4. The event brought together company founders, venture capitalists and regulators to discuss new developments and future innovations in the sector.

For the fifth year in a row, Standard Chartered was a sponsor of the conference, and executives from the bank took part in talks and panel discussions on topics including sustainability to Web3 – a potential next phase of the internet that will be decentralised and run on the record-keeping technology blockchain.

They included Sushil Anand, executive director and chief product owner of its Group Wealth Management division, and Alison Chiu, director and senior product owner, Group Wealth Management. Anand and Chiu ran a session at Standard Chartered’s booth about myWealth – the bank’s digital solution within the bank’s mobile app, which allows investors to build their wealth in a convenient, personalised and holistic way.

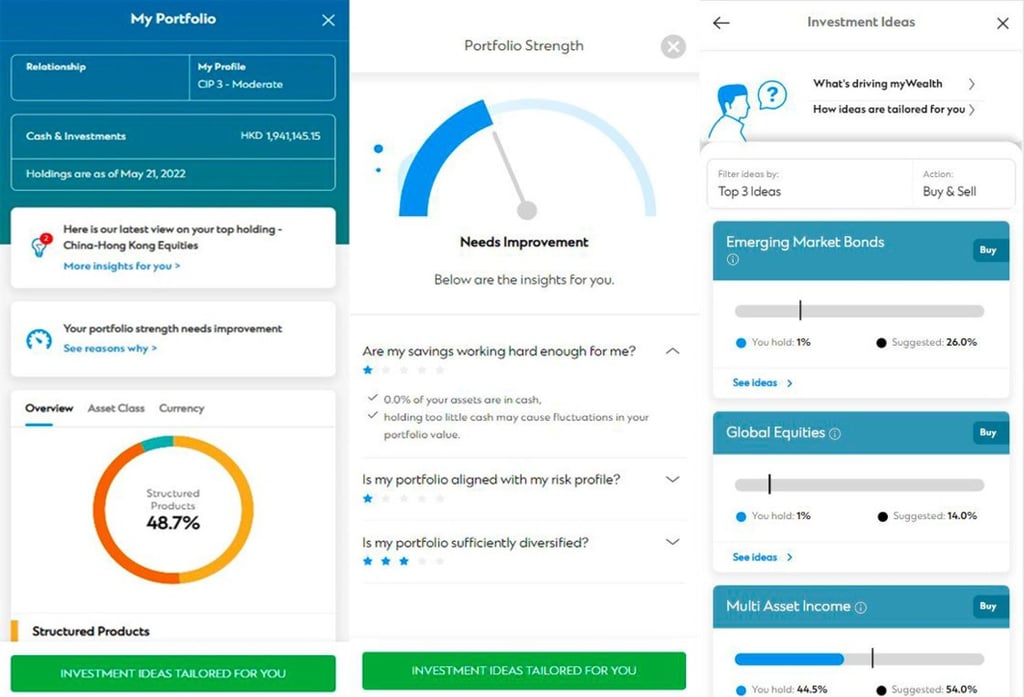

“Personalisation is important for our clients because everyone has different goals, needs, investment behaviours, preferences, risk appetite and circumstances,” Anand says. “Our newly launched myWealth service in Hong Kong offers personalised insights and investment ideas directly to clients.

“It helps clients analyse the strength of their investment portfolios, keep up with changing market conditions with relevant house views from the Chief Investment Office and receive personalised buy-and-sell investment ideas. Each insight and idea are specially tailored to clients, based on their current holdings, transaction history, investment profile and preferences.”

Seamless, user-friendly journey

The myWealth service is Standard Chartered’s latest digital wealth management tool that provides clients with features including an overall view of their portfolio, updates on the latest market trends and access to a myriad of investment funds from major fund houses.

The service is available 24/7, which facilitates seamless access for clients. Rather than customers needing to contact their relationship manager, they can easily tap into investment services by using the myWealth platform at their convenience. This allows them to review their portfolio while on the go and quickly respond to market opportunities when they arise with only a few simple clicks of their smartphone.

The myWealth tool is offered as a free service to Standard Chartered’s priority and priority private customers. Clients can begin building their portfolio with as little as HK$1,000 (US$127) – or its equivalent in many foreign currencies – and without any lock-in periods. Customers are also able to combine the tool with advice from their relationship manager.

Tap into a personalised portfolio

Personalisation has become a crucial aspect of the customer journey, with all businesses, from streaming services to global retailers, delivering experiences that are tailored to the unique needs of each user. With myWealth, investors can take advantage of personalised buy-and-sell investment ideas that are customised to their specific goals and requirements.

These insights are generated from the client’s perspective. The myWealth service conducts a built-in portfolio health check for each individual, which comprehensively evaluates their existing assets based on their latest holdings with the bank in investments and cash, risk appetite and portfolio objectives. This is then combined with the bank’s house views, based on the most up-to-date market insights and potential returns from different investment funds to offer clients suggestions about how to improve their portfolio.

Using this information, investors can create a diverse portfolio of stocks, bonds and cash. Such diversification across negatively correlated asset classes allows them to systematically manage risks – especially amid the current turbulent market conditions – so that the underperformance of any single investment may be offset by gains made on other holdings.

Driven by data and technology

The myWealth service, which combines advanced algorithms and analytics with the bank’s market research expertise, is the latest example of Standard Chartered’s commitment to creating a comprehensive digital ecosystem that customers can leverage to increase their wealth.

Using a four-step proprietary process, myWealth’s sophisticated algorithms analyse a client’s holdings with the bank and categorises them based on underlying asset classes. Factoring in the individual’s risk profile, the platform compares the client’s current asset allocation against the bank’s model portfolio, which is designed by experts who balance potential risks and returns among all asset classes with the latest market findings. It then rates the investment ideas delivered to the client into a number of intuitive categories – including “Strong Buy”, “Buy”, “Strong Sell” and “Sell” – based on the gap in the suggested asset class.

This makes myWealth an ideal tool for busy individuals who do not have the time to pore over pages of extensive market research. Instead, users can benefit from the bank’s data-driven solution and team of investment experts, who digest massive amounts of market data from various information sources to provide clients with distilled, relevant and actionable investment ideas that they can act on in a timely fashion.

Despite the current heightened volatility, the market is ripe with opportunities that savvy investors can capitalise on to construct a diversified and robust portfolio. With myWealth, clients can conveniently draw on data-backed, tailor-made insights to optimise their investments and grow their wealth.