How HSBC Premier’s international education support plan helps families overcome challenges when children study abroad

- Personalised banking and wealth management services, supplemented with comprehensive overseas education support, tailored to meet needs of families worldwide

- Bank provides suite of solutions for parents and children throughout their international education journeys, says Winnie Ng, HSBC’s head of Jade, Premier and International Propositions, Hong Kong

[Sponsored article]

Four out of 10 Hong Kong middle class families plan to send their children overseas to continue their education – citing reasons such as better education arrangements, the stressful Hong Kong curriculum and lower exchange rates – according to research carried out for the “HSBC Premier 2022 New Middle Class Study”.

The study of “middle class” Hong Kong people, or those with an average of HK$5.9 million (US$755,000) of liquid assets, published last November, found parents put aside at least HK$3.85 million for their children’s education in places including destinations such as the United Kingdom, Canada, Australia, New Zealand and the United States. HSBC Premier provides international banking support for overseas education in these foreign destinations.

Studying abroad offers children a range of different advantages – including gaining a wider international perspective, broader experience of different cultures and types of education, improved language skills and self-confidence and a greater sense of independence.

Such a change also throws up many challenges that families must overcome. HSBC Premier has drawn up a detailed international education support plan to ensure parents can carefully manage their finances and overcome any potential obstacles.

“HSBC Premier offers a wide breadth of banking solutions and has the international expertise to provide support at every stage of your child’s overseas study journey,” Winnie Ng, HSBC’s head of Jade, Premier and International Propositions, Hong Kong, says. “With partners in over 30 countries and regions, we are able to respond quickly to your needs along your global journey.”

The first step – planning and pre-departure

Many parents dream of their children studying at top overseas schools and universities, but the complicated steps that are involved mean they often lose direction and grow uncertain about how to start this journey. HSBC Premier offers the ideal solution, by providing end-to-end help, starting by raising awareness of the need for overseas education.

Once the decision is confirmed, there are many factors to consider – from selecting a school to putting together an application and preparing for entry examinations – which can be daunting, especially for first-time applicants. However, by tapping into HSBC Premier’s extensive wealth solutions, partnership network of schools and overseas education consultants, this process can be straightforward, Ng says.

“With the HSBC International Education Community, which is an industry first, we can connect parents with exclusive education events and webinars, and offer them access to free consultations with education partners,” she says. “This gives parents the opportunity to take advantage of the latest insights and trends in the world of overseas education.”

Parents can also make the most of HSBC’s global banking solutions to plan ahead for their children’s financial needs. Thanks to the comprehensive help provided throughout the process, parents are able to easily set up an overseas bank account via HSBC Hong Kong. They can also apply for a Premier Next Generation – Junior Account, which gives their children access to secure and seamless HSBC Premier Family service overseas, such as health offers, international education payments and foreign currency solutions.

Round-the-clock access to emergency support

Even after their children have settled into their new environment abroad, parents are still faced with a range of concerns, including ensuring that they will be able to safeguard the everyday living needs and welfare of their child.

“HSBC Premier offers children round-the-clock access to emergency support,” Ng says. “With HSBC Global Money Transfers, parents can also send money to their child quickly, whenever they need it. Money can be sent to almost 50 countries or regions with our mobile app, fee-free, as quickly as one working day.”

Should overseas students find themselves in a tight spot, they can access up to US$2,000 in cash from HSBC outlets worldwide. They also can rely on HSBC’s extensive ATM network and 24/7 foreign currency exchange. Parents can also apply for a supplementary HSBC Mastercard debit card for their children, so they can shop online, make purchases and withdraw cash with 12 major currencies at HSBC Group ATMs around the world – all fee-free.

In addition, the HSBC Premier suite of services also includes the HSBC Premier Mastercard credit card, which offers perks such as free access to telemedicine (the use of technology to provide patients with remote medical diagnosis and treatment), free global data roaming, and airport lounge access at a special rate. The HSBC home&Away programme provides a unique rewards experience, which unlocks a world of dining, travel and shopping offers.

Going beyond – caring for less-privileged students

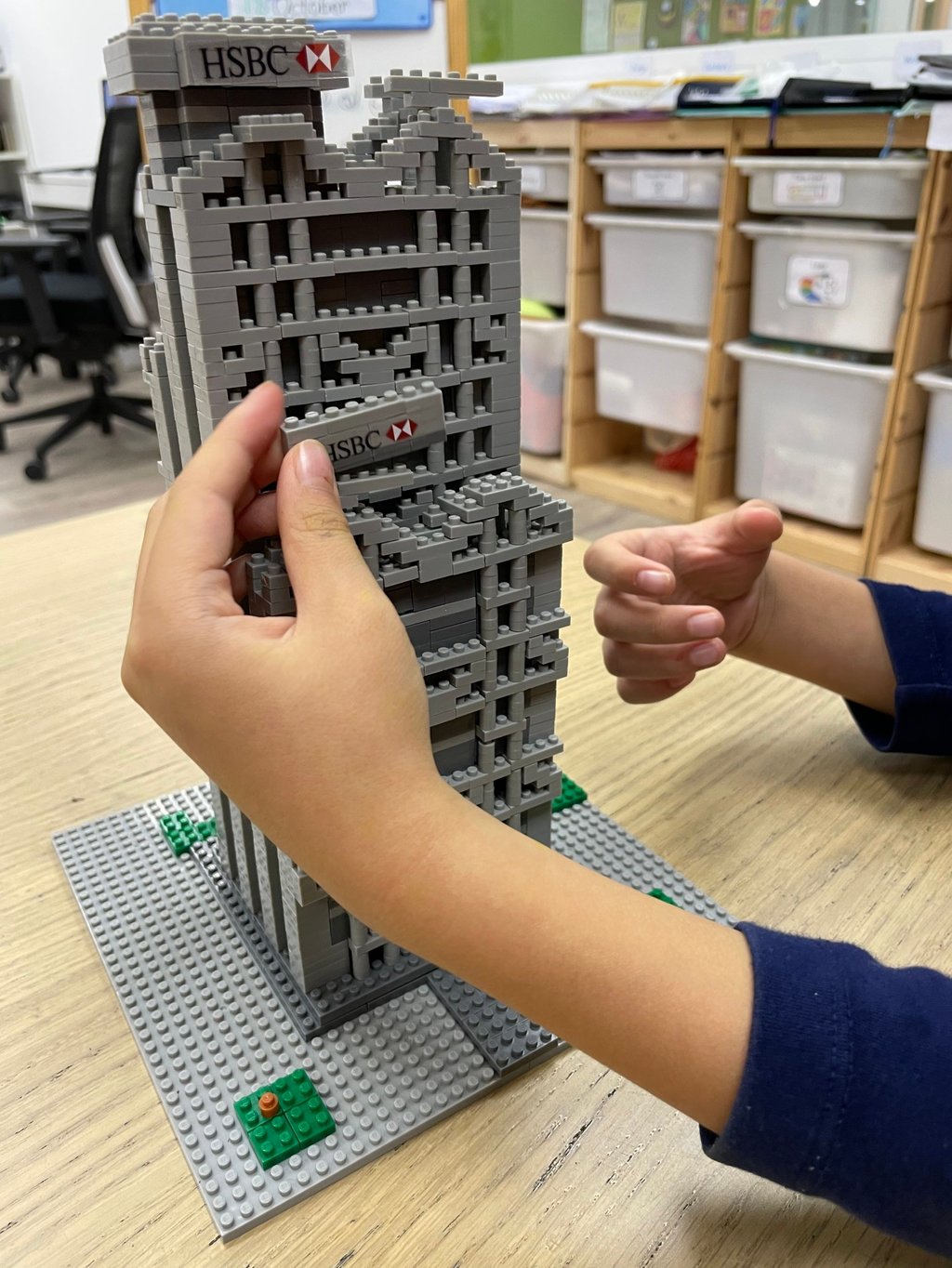

As part of last year’s HSBC corporate social responsibility (CSR) programme, HSBC Premier teamed up with two Hong Kong international schools – Dalton School Hong Kong and the American School Hong Kong – to organise the HSBC Building BIG (Belief, Inclusion and Generosity) Challenge.

This fundraising endeavour saw students at each of the schools use Lego bricks to build models of some of Hong Kong’s iconic buildings, with donations made for each brick that was used. The money collected helped to support the Autism Partnership Foundation (APF) – a non-profit organisation that aims to improve the quality of life of individuals with autism and raise public awareness about the condition.

“CSR has long been a core value for HSBC,” Ng says. “We truly care about every child in Hong Kong.”

Christopher Coates, director of the American School Hong Kong, says: “Through this programme, the students were able to get a taste of what an intrinsic reward is, versus an extrinsic reward.

“It was a fun activity for sure – which kid doesn’t love Lego? But most importantly, they were able to help other people, which is very satisfying.”

Shaun Porter, principal at Dalton School Hong Kong, also welcomed the programme. “When a huge organisation like HSBC puts the spotlight on important issues such as equal education opportunities for autistic children, I believe it will have a trickle effect on not just the education sector, but the private sector as well.

“At Dalton, we have a programme called L.E.A.D., which was designed specifically to provide specialised services for autistic children. We’re always thinking about how to be a more inclusive school, so when we saw that the efforts were going to benefit the APF, we were very much on board.”