How savings help entrepreneurs fund strategic plans and boost business success – even during Covid-19

- Hong Kong survey in August found nearly half of small- and medium-sized enterprises fear for survival beyond next six months without government support

- Despite sluggish economy, companies with healthy cash flow and clear digitalisation strategies have been able to uncover fresh opportunities amid pandemic

[Sponsored article]

The continuing Covid-19 pandemic, which has resulted in severe disruptions to travel, trade and retail, has created profound challenges for businesses.

By the end of the year, the global economy could enter the deepest recession since the end of the second world war, the World Bank estimated in June.

Many Hong Kong companies are also feeling the brunt of the pandemic. In August, a survey conducted by the Hong Kong General Chamber of Commerce found that nearly half of all small- and medium-sized enterprises did not expect to survive beyond the next six months without new government support measures.

However, entrepreneurs that continue to be successful in the face of profound challenges are often those that remain open to new opportunities by making strategic investments throughout their business journey.

Yet implementing such plans often involves making substantial investments, which highlights the need for business owners to have extra funds at their disposal.

In the case of the outbreak of the coronavirus disease, Covid-19, some businesses have found new opportunities by turning to digital transformation and innovative solutions.

We look at three entrepreneurs with a healthy cash flow and clear digitalisation strategies, who have successfully uncovered fresh opportunities despite a sluggish economy.

Innovative dual response to Covid-19

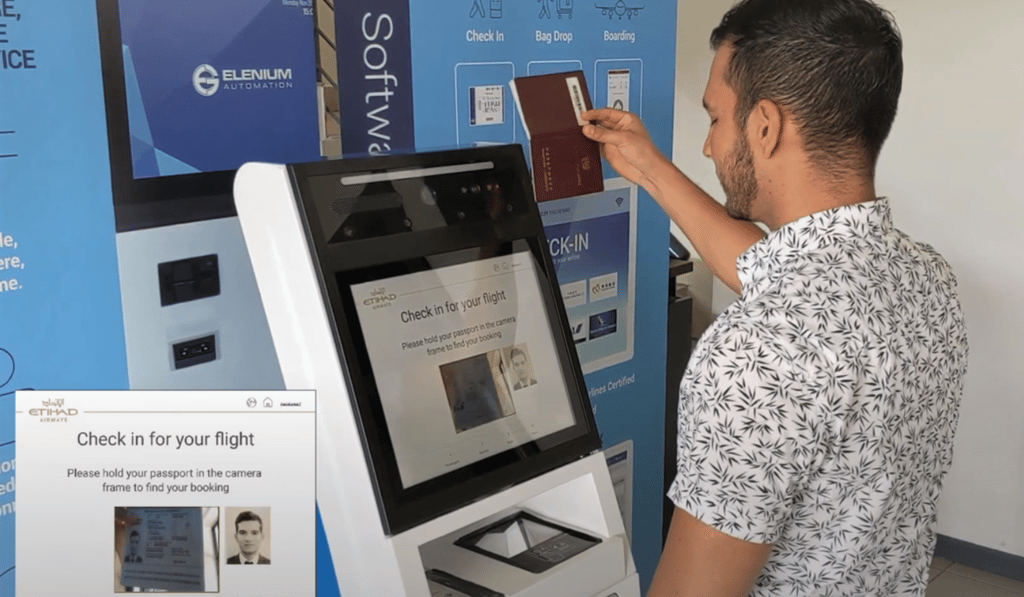

Aaron Hornlimann, founder and CEO of airport tech start-up Elenium Automation, is a good example of how businesses can make new investments diligently to solve the pressing needs of society.

Since 2016, the company has been developing solutions to help passengers move quickly through airport terminals and board aircraft and assist people with mobility issues.

However, when airports around the world suddenly grew empty after the introduction of widespread travel bans because of the pandemic, the company’s technology became less relevant to the needs of the industry.

Yet Hornlimann had funding already available to respond quickly – and in April his company unveiled a smart, portable, cloud-based kiosk that serves a dual role – as a health-screening device and self-service check-in machine.

He and his team provided the kiosk with hands-free technology to assess a traveller’s vital signs for possible symptoms of an illness, so airport staff can intercept symptomatic passengers before they board the aircraft, and boost confidence in the resumption of flights.

His idea to invest in the innovative technology in response to Covid-19 was possible partly because of his company’s healthy cash flow.

In April last year the start-up had received US$11 million in funding, giving it the flexibility to develop timely new solutions after the pandemic hit.

The strategy has enabled Hornlimann and his company to capture new business opportunities beyond the aviation industry. He is now working with health care networks, elderly homes and even military facilities to implement the technology and protect public health.

Last month, Elenium raised another US$22 million in a new round of funding, allowing it to further develop and promote its technology worldwide.

Walk towards more secure future

Having extra cash flow also helps those companies whose business models do not involve a heavy use of technology to undertake digital transformation.

Walk in Hong Kong, a travel agency that has been running walking cultural tours since 2013, has also successfully moved online amid the pandemic.

Hong Kong’s strict border control has proved devastating for the tourism industry. In September, the number of visitor arrivals in Hong Kong was down 99.7 per cent compared with a year ago.

Faced with the sharp decline in bookings, the company’s founder, Paul Chan, came up with the idea of moving the cultural tours online.

The veteran traveller, who has visited 85 countries, believes that interactive tours that explain Hong Kong’s cultural heritage will appeal to curious travellers who are eager to explore new places.

As part of its digital transformation, the company has invested in a studio that allows a tour guide to interact with participants when the field team travels between locations.

Specialist guests, such as architects and academics, have also been hired to answer questions. The company also bought new camera equipment, including pivoted supports, for streaming the video.

Chan’s investments have created a new lifeline for the company amid the challenging business landscape. The tours have become popular among locals and tourists alike – with one recent tour attracting 70 participants overnight – providing new growth opportunities for the company.

Shopping gets new facelift

Joel Leong, a Singaporean entrepreneur who co-founded ShopBack, a Southeast Asian e-commerce reward platform, has also formulated the right strategy for capturing new business opportunities amid the pandemic.

The platform, founded in 2014, has teamed up with more than 4,000 brands across Asia. It allows online shoppers to receive a percentage of cash back on every item bought using the app.

As the pandemic forced many people to stay home, Leong realised that the e-commerce market would grow significantly. He predicted there would be big demand for internet services, lifestyle products and food delivery as consumers were forced to shop online.

His company then strategically linked up with merchant partners, allowing it to boost orders by about 10 times, according to Singapore-based online media Vulcan Post.

ShopBack has also expanded into new markets through tactical acquisitions. In April, amid the height of the pandemic, ShopBack also entered the South Korean market by acquiring Ebates Korea, the largest online cashback platform in the country.

The company’s success in capturing new growth opportunities has been made possible thanks to its clear vision in promoting online shopping. Having a steady cash flow also allowed it to implement the most effective strategic plans at the right moment.

Flexibility to make big business decisions

While digitalisation can often provide new growth opportunities with businesses, it can often be very costly. A survey by the Hong Kong Productivity Council last September found that two-thirds of entrepreneurs said a lack of cash flow was the biggest barrier to implementing digital transformation strategies.

One of the ways for entrepreneurs to boost long-term savings is to invest in products that provide a regular source of guaranteed income, so you can utilise such funds as short-term cash flow when needed in the future.

ManuCentury is a life insurance plan offered by insurance company Manulife Hong Kong. It provides a regular income by offering a guaranteed cash payment which is worth 5 per cent of a policy’s notional amount every year* – all the while boosting your potential returns through a non-guaranteed terminal bonus.

As long as the policy is in force, the guaranteed cash payments are made for up to 100 years after the policy comes into effect*. You may choose to cash out the guaranteed cash payments or accumulate them in the policy with non-guaranteed interest.

The plan also offers you the option to withdraw the accumulated guaranteed cash payments when you need them the most, providing entrepreneurs with the flexibility to make critical business decisions at the right time.

From the 15th policy anniversary onwards#, you can lock-in up to 50 per cent of your non-guaranteed terminal bonus to earn non-guaranteed interest^, by exercising the realisation option.

You also have the opportunity to withdraw the realised terminal bonus, providing you with extra cash to invest and grow your business when you need it.

*Guaranteed cash payment equal to 5 per cent of the notional amount is payable every year starting from the first policy anniversary.

#From the 15th policy anniversary and on every policy anniversary thereafter.

^The aggregate lock-in percentage in any 15 consecutive years shall not be more than 50 per cent.

Disclaimer: Our advertising partner, Manulife Hong Kong, provided overview information about the insurance product “ManuCentury” for general reference only. Please visit Manulife Hong Kong’s website for the product leaflet of this product which includes more details, including a section called “Important Information” that shows the product risks.