South Asian investment opportunities for Hong Kong manufacturers

- Hong Kong Trade Development Council offers free research into overseas production sites of India, Bangladesh, Cambodia and Myanmar

[Sponsored article]

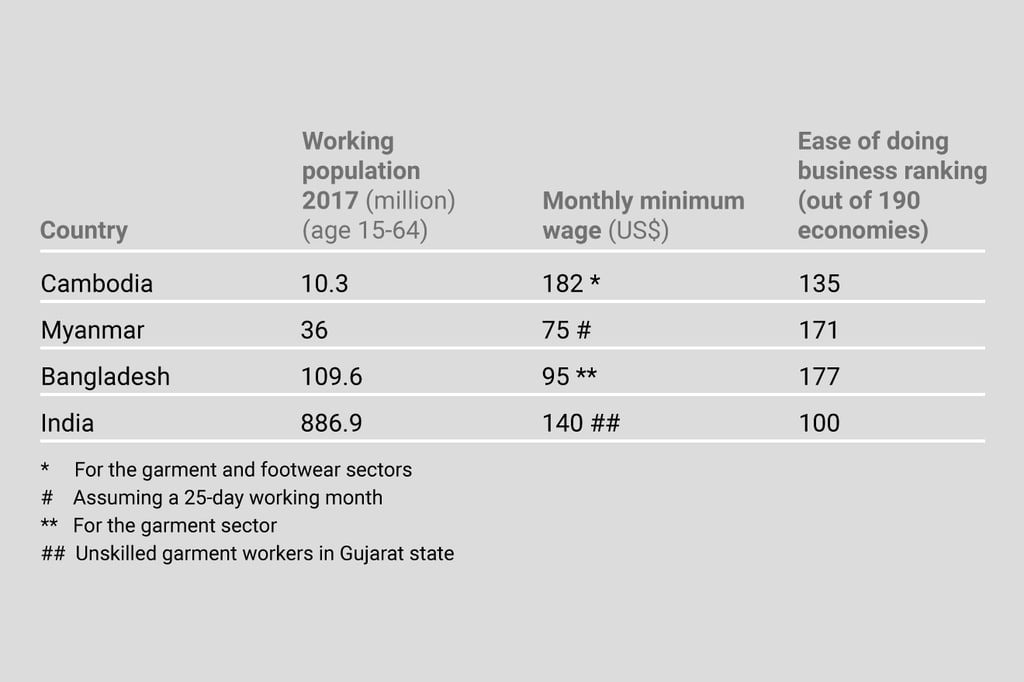

Hong Kong-based manufacturers have started looking beyond its nearest Asian countries, such as Vietnam and mainland China, as they seek to cut costs and diversify their operations geographically.

The Hong Kong Trade Development Council (HKTDC) has researched a wealth of information that these manufacturers need to consider.

The region’s other billion-strong country with a fast-growing economy, India, and its neighbours are now on Hong Kong manufacturers’ radar as production sites and giant markets in their own right. Access to the Indian Ocean and a position along the Maritime Silk Road, along with massive populations and low costs, are drawing increasing attention to these countries.

Emerging markets present a variety of pros and cons that manufacturers must weigh up before making their move.

In the second of a three-part series, the HKTDC summarises prospects in the South Asian nations of Bangladesh and India, and the Southeast Asian countries of Cambodia and Myanmar.

Cambodia: better access to US, EU and Japan markets

Basic garments and footwear are among the suitable industries in the centre of the former Khmer empire. The Better Factories Cambodia (BFC) project with the country’s garment industry grew out of a United States-Cambodia trade agreement, under which Cambodian garment exporters would be given better access to US markets in exchange for improved working conditions.

The investment incentives to foreign investors include: exemption from import duty on materials and equipment used in production; exemption from value added tax (VAT) for exports; and corporate income tax exemption of up to nine years.

The Cambodia Special Economic Zones Board has approved 25 special economic zones (SEZs) – of which nine are in operation – located near the borders of Thailand and Vietnam, as well as in Phnom Penh, Kampot and Sihanoukville.

The exemption period for the tax on profit is up to nine years. The import of equipment and building materials to be used for infrastructure construction in the zone shall be allowed and exempted of import duties and other taxes.

Manufacturers interested in Cambodia can find out more from these HKTDC guides:

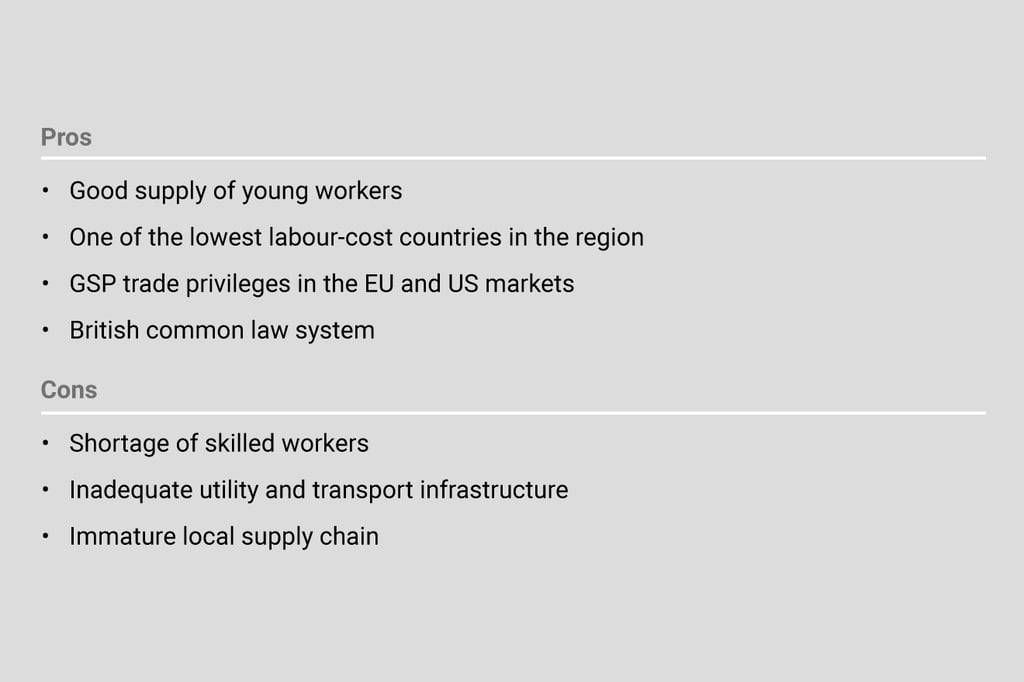

Myanmar: among Asia’s lowest labour costs

Suitable industries for Southeast Asia’s westernmost country include garments and footwear. Industrial zones and SEZs have been set up across Myanmar.

There are three SEZs – in Thilawa (open), Dawei and Kyaukphyu (under construction) – and each has a Foreign Investment Law to provide additional incentives, including exemptions and relief on import tax and commercial tax, in designated sectors, including garments and food processing. The Kyaukphyu SEZ is in a good position to develop as a logistics hub over the longer term.

Income tax exemptions last for three, five or seven years, depending on location. There is exemption of customs duty on raw materials for export-processing, machinery and construction materials.

Manufacturers interested in Myanmar can find out more from these HKTDC guides:

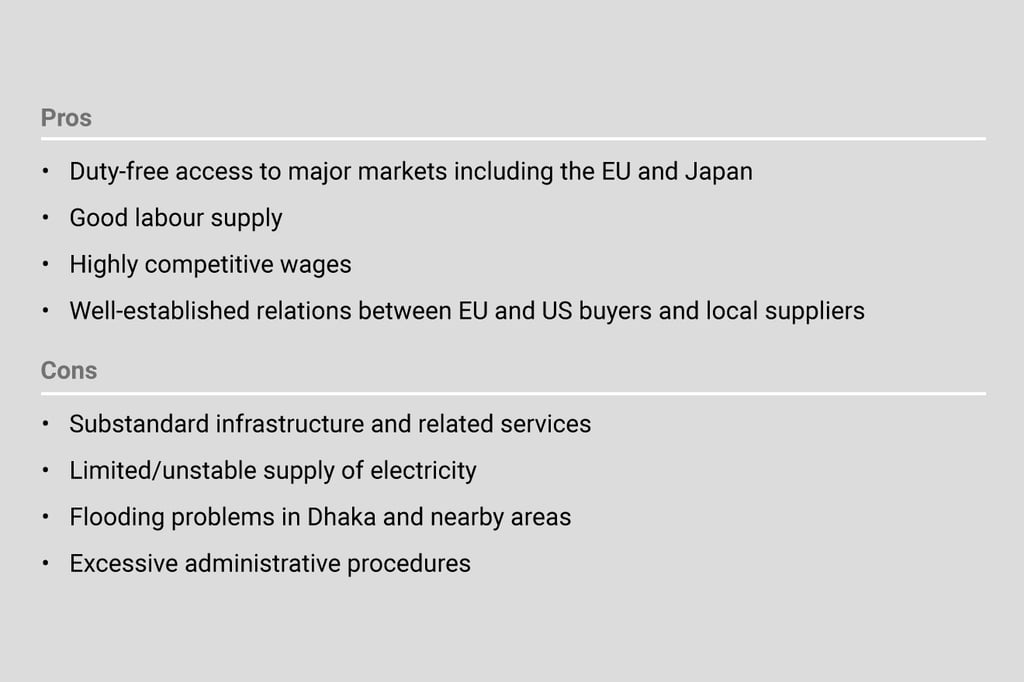

Bangladesh: second-largest clothing exporter after mainland China

This river-delta country’s suitable industries include garments and leather goods. Bangladesh has evolved into the world’s second-largest clothing exporter after mainland China. There is a considerable level of Hong Kong company participation in the garment sector. Leather goods manufacturing may benefit from local supply.

Across Bangladesh are export processing zones (EPZs) and economic zones, and each may have specific incentives.

General incentives for EPZs include: the valued-added tax rate on exports is zero; for companies that only export, import duties are waived for imports of capital machinery; and import duties are also waived for EPZ industries for imports of raw materials.

General incentives for economic zones include: tax holidays of five to seven years for new enterprises in textiles, pharmaceuticals, plastics, ceramics, iron and steel, fertilisers, computer hardware, petrochemicals, agricultural and industrial machinery.

Manufacturers interested in Bangladesh can find out more from these HKTDC guides:

India: massive domestic market potential

This massive country’s suitable industries include textiles, garments and electronics. Initiatives specific to manufacturing them in the major industrial state of Gujarat include: interest subsidy; VAT concession; assistance for environmental compliance; and assistance for apparel training.

An increasing number of global electronics manufacturers have relocated some production lines to India, which offers two major allotments for promoting electronics manufacturing: the electronic manufacturing clusters (EMCs) and the SEZs. The EMCs provide support to states for developing infrastructure and common facilities. Production units in SEZs enjoy tax holidays, duty exemption and other benefits.

There are numerous SEZs in major cities offering incentives that include: minimum alternative tax (MAT) exemption for 10 years; 100 per cent tax exemption on export profits for first five years; 50 per cent of export profits for the next five years; 50 per cent of export profits for a further five years if profits are reinvested; exemption from customs duty on imported inputs and capital goods; VAT exemption; exemption from excise duty on procurement of domestic good; and exemption from sales tax on interstate purchases of goods.

Manufacturers interested in India can find out more from these HKTDC guides: