What is behind the bright outlook for Asia Pacific’s Real Estate Market in 2022?

[Sponsored Article]

By Dr Henry Chin, Global Head of Investor Thought Leadership and Head of Research, Asia Pacific at CBRE, and Ada Choi, Head of Occupier Research & Data Intelligence and Management, Asia Pacific at CBRE

2021 marked a year of significant change, as governments, businesses and communities continued to navigate the challenges brought about by Covid-19. This change was also evident in the real estate sector, which saw the acceleration of existing trends – and the emergence of new ones – that are shaping how occupiers and investors in Asia Pacific will seek to adapt and drive growth in the year ahead.

All eyes are now on what the future holds for 2022 and beyond.

The outlook for Asia Pacific’s commercial real estate market is positive, according to CBRE’s 2022 Asia Pacific Real Estate Market Outlook. The report delves deeper into our forecasts on the region’s economic outlook as well as perspectives on key trends and growth opportunities in the office, industrial & logistics, retail and investment sectors.

Economic recovery to continue

Despite the emergence of new Covid-19 variants, economic growth for Asia Pacific is set to normalise and return to pre-Covid levels, with steady economic expansion expected throughout the year, led by outsized growth in India and mainland China.

There are variations in inflation expectations in Asia Pacific. Price levels in the region remained relatively stable in 2021, and inflation largely sits within governments’ range. The accommodative interest rate environment across the region is likely to continue as governments seek to provide supportive conditions for an economic recovery in 2022.

Meanwhile, pandemic-related disruption to regional and global supply chains resulted in elevated shipping costs last year. We expect disruption to regional supply chains to continue in the first half of 2022, but this will gradually normalise from the second half. We also expect shipping costs to moderate over the course of the year.

Tech, financial services sectors to drive office demand

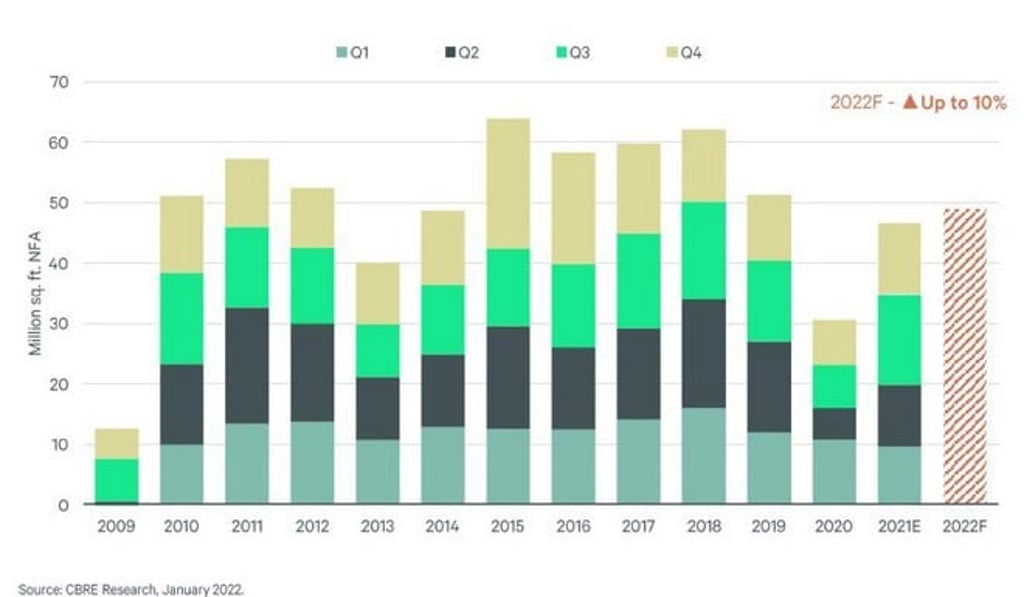

Asia Pacific office demand enjoyed a solid recovery in 2021, and leasing activity is forecasted to increase by up to 10% this year (Figure 1). However, this will not bring the net absorption back to pre-Covid levels due to the fact that mainland China already recorded a historical high in 2021, and activity in several mature markets is expected to be constrained by limited supply.

We expect 2022 to feature faster decision-making, flight-to-quality relocation and workplace reconfiguration as companies gain confidence in the return to the office and the adoption of hybrid working.

The tech sector overtook finance as the main driver of office demand in 2021. This year, expansion by advanced technology, social networking and software development companies will be most prominent. Meanwhile, we continue to see life sciences companies’ share of leasing demand grow. Within the financial services sector, wealth management, fintech and insurance companies are expected to drive the demand.

Greater demand for cold storage space

2022 is expected to be another strong year for the Asia Pacific industrial real estate sector. Logistics space demand will continue to be dominated by e-commerce, but the strongest growth is coming from the grocery shopping, food manufacturing and pharmaceutical sectors. This will fuel competition for high-quality cold storage space, which is still under-developed in most parts of the region.

In addition to robust expansionary demand, we anticipate a rise in flight-to-quality requirements as more occupiers seek modern logistics facilities to enhance operational efficiency and install automation and other logistics technology.

Retail consumption patterns to return to normal

While the emergence of the Omicron variant late last year has added fresh uncertainty to the retail market outlook, we expect consumption patterns to return to normal this year, with a shift to more experiential and service-based trades such as F&B and entertainment.

Prime locations will be the key focus for retailers seeking to expand, as they take advantage of tenant-favoured markets to secure lower rents and better locations. However, the pandemic will continue to weigh on retailer sentiment in the near term, with many adopting a cautious approach before committing to major expansionary moves.

Investment to hit a historic high

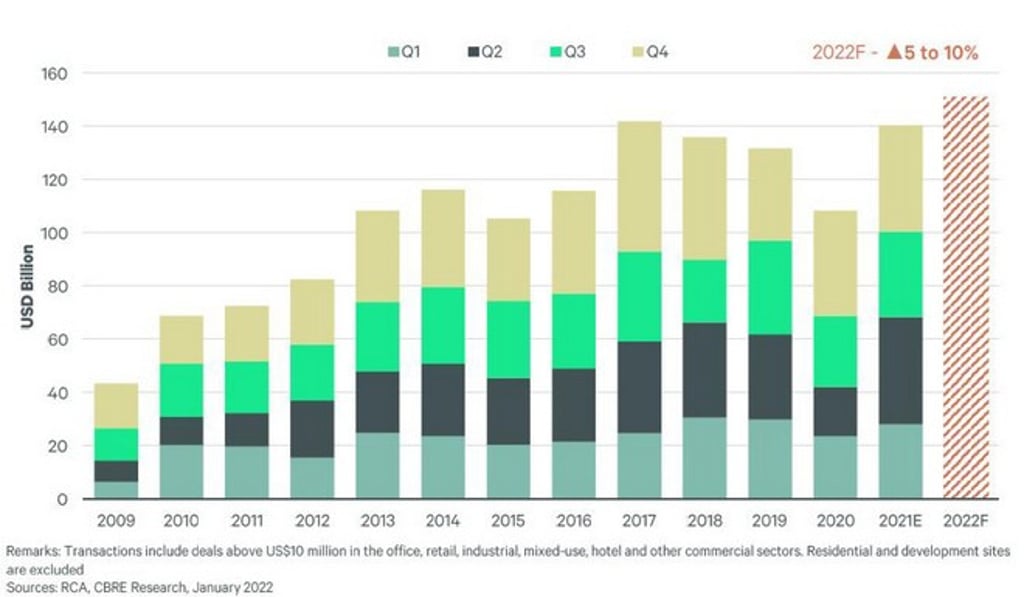

2022 is projected to be a record-breaking year for Asia Pacific investment volume as market sentiment will remain upbeat, with investors still having ample capital for deployment. CBRE forecasts total investment turnover to increase by 5% to 10% to around US$150 billion in 2022, which would mark an annual historical high for the region (Figure 2).

With Asia Pacific commercial real estate market capital values set to hold firm in 2022, we have identified three key investment strategies for investors to consider, as well as three contrarian strategies, which are explored further in CBRE’s report.

Core Investment Strategies:

- Focus on greenfield and brownfield logistics opportunities in emerging locations and prime locations

- Selectively choose turning office markets while the longest downward cycle is coming to the end

- Consider opportunities in the living sector such as multifamily markets

Contrarian Investment Strategies:

- Don’t overlook hotels

- Revisit core retail

- Explore secondary retail in prime districts

Overall, we believe the outlook is bright for the Asia Pacific real estate market this year, with significant growth opportunities across all sectors. Real estate investors and occupiers who use the year ahead to take proactive steps to navigate ongoing uncertainty and capitalise on these opportunities will be well-positioned for long-term success.

Read CBRE’s 2022 Asia Pacific Real Estate Market Outlook here.

CBRE’s Online Data Dashboard provides dynamic delivery data for all sectors. Access the Data Dashboard here.