Life Sciences real estate transactions reached US$11b globally in the first half of 2021. What are the opportunities in Asia Pacific?

By Greg Hyland, Head of Capital Markets, Asia Pacific at CBRE, and Dr Henry Chin, Global Head of Investor Thought Leadership and Head of Research, Asia Pacific at CBRE

[Sponsored Article]

Many lessons can be drawn from the deep and far-reaching effects of the Covid-19 pandemic to date. But one key lesson that countries will no doubt take away is the need to be able to manufacture or at least stockpile large quantities of medical supplies for use in an emergency.

While supply conditions have improved from the past year, countries are keenly aware of the complications that can arise from logistics disruptions in the global supply chain, affecting access to vaccines, face masks and other personal protective equipment. For instance, a study by the Organisation for Economic Cooperation and Development (OECD) this year found that the top vaccine exporters were significantly concentrated in developed economies like Europe and the United States.

Seeking to improve supply chain resiliency, manufacturers are turning to Asia and seeking real estate to test, produce and store vaccines, medicines and related products. This has made life sciences-related real estate in Asia a hot spot in a still uncertain global property market.

A bright spot

In stark contrast to the overall Asia Pacific leasing market, which saw a 25% decline in 2020, leasing activity for life sciences real estate in the region recorded year-on-year growth of 17.4% as the events of the past year boosted demand. According to data from Real Capital Analytics (RCA), US$11 billion has been spent globally on life science related properties in the first half of 2021 alone.

CBRE’s 2021 Asia Pacific Investor Intentions Survey this year has uncovered growing interest in healthcare, with 26% of respondents indicating an interest in the sector, up from 18% in the previous year. 1 While hospitals and medical centres have traditionally been main proxies for the healthcare sector, more investors are exploring opportunities to acquire business parks catering to pharmaceutical tenants and R&D laboratories.

Many of these buyers are being lured by life sciences companies’ resilient performance amid the pandemic; large number of well-funded potential tenants; and a high degree of ‘stickiness’ towards real estate where leases far exceed those in traditional investment sectors such as office or retail.

Even pre-pandemic, the sector has been on a steady uptrend. Our recent report, titled “A New Era of Life Sciences Growth”2, identified several reasons that have helped to fuel occupier demand for life sciences real estate in the region. These include burgeoning demand for pharmaceuticals from a greying population; government policies to support the industry; a steady flow of mergers and acquisitions; a rising number of listings; and the expansion of R&D capacity.

How investors can make inroads

Life sciences real estate is at an early stage of development as an investible asset class and investors often possess limited knowledge about the sector. But demand is growing, evidenced by the uptick in life sciences-related investment transactions that we have brokered these past two years.

There are several potential entry routes for investors, which can involve corporate offices, logistics facilities (including cold storage), R&D laboratories and manufacturing facilities:

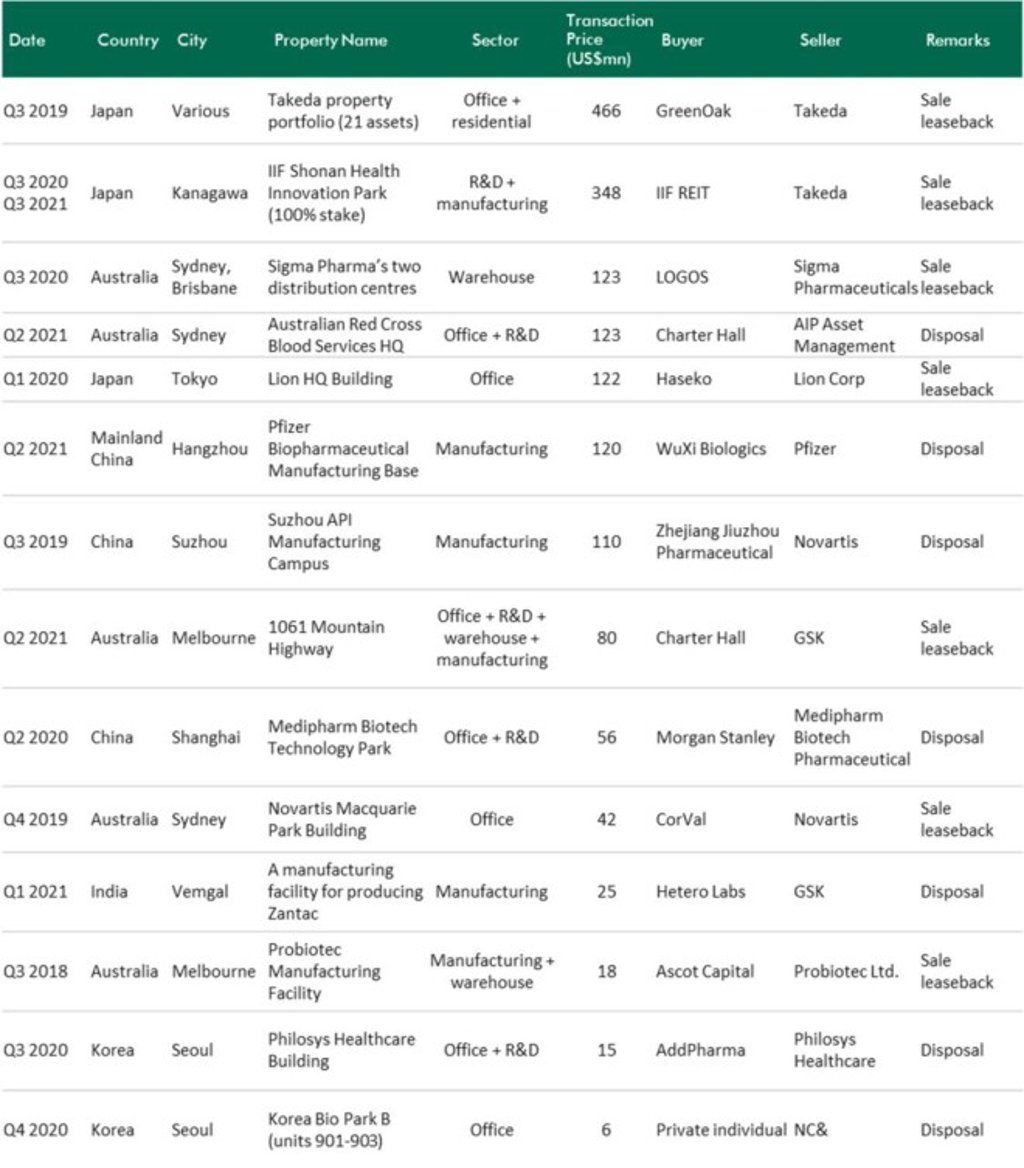

• Sale Leasebacks & Disposals: Investors seeking income-producing assets can target sale leasebacks or disposals by life sciences companies looking to improve their balance sheets or offload non-essential assets following M&A. CBRE expects numerous assets to come onto the market in Australia, Japan and Korea as pharmaceutical companies recycle capital to focus on their core R&D business.

• Asset Conversion: Value-added investors can consider converting older industrial properties into BSL-1/BSL-2 laboratories3 or cold storage. This strategy is best suited to markets like Hong Kong SAR and Japan, both of which have limited land specifically allocated to the life sciences industry. But investors should also be aware of various factors that can affect conversion suitability like zoning restrictions, roof spaces, ceiling height, floor loading, floorplate and power related issues.

• Public-Private Partnerships: Government bodies play a prominent role in promoting the development of the life sciences industry. Investors can engage in public-private partnerships to capture development opportunities in newly planned science parks or land tenders. We expect to see emerging hubs in various markets, such as Shanghai, Beijing, Singapore, Melbourne and Bangalore.

• Asset development: There are opportunities for investors and developers to construct build-to-suit facilities with pharmaceutical companies. In Japan, Mitsui Fudosan has developed two laboratories for rent, while in Australia, Stockland acquired land in Sydney’s Macquarie Park from Johnson & Johnson and developed a new headquarters building for them.

• Equity (fund investment and/or joint ventures) and debt: Primarily investing in pharmaceutical or logistics companies offering temperature-controlled supply chain solutions for the life sciences industry. While transactions involving debt financing are rare in Asia Pacific compared to the U.S., this area of the capital stack offers considerable potential, particularly in Australia, due to the typically long lease terms for life sciences real estate.

Nascent asset class with strong potential

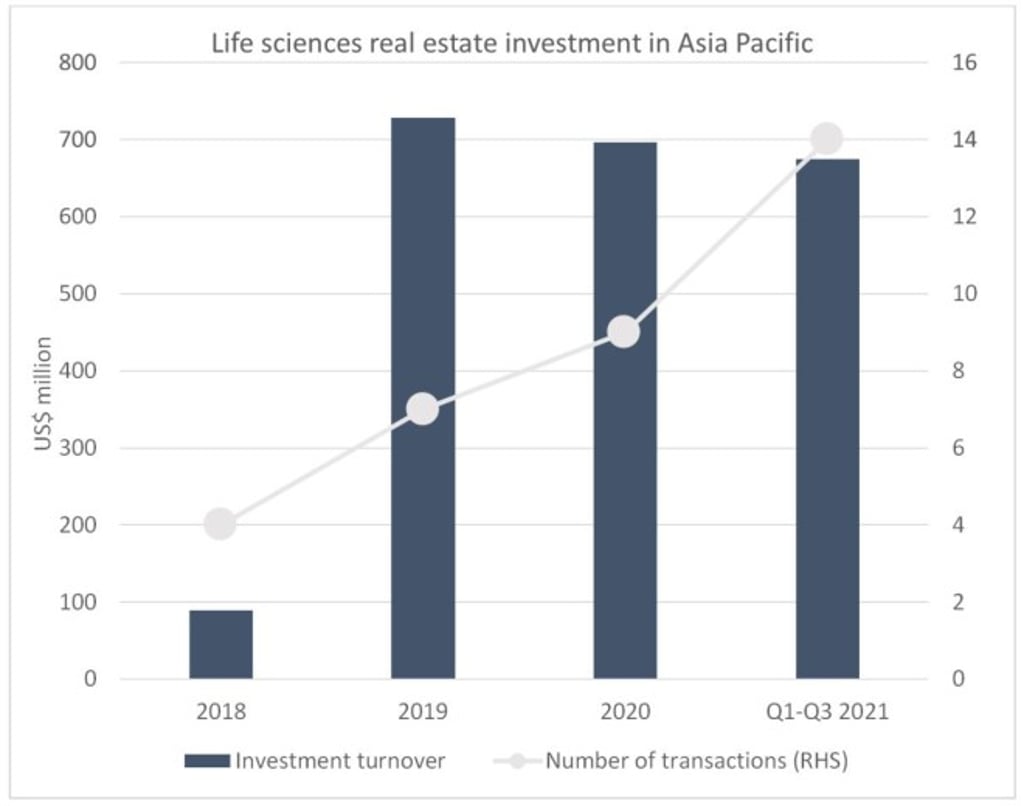

In 2020, life sciences-related transactions accounted for just under 4% of global commercial real estate volume, higher than the long-term average of 1.4%, according to RCA, with the U.S. accounting for the bulk of deals. In Asia Pacific, US$675 million worth of life sciences real estate changed hands in the first three quarters of 2021, though up from a low base of less than USD 100 million in 2018, still represents a fraction of the overall total (Figure 1).

Possible reasons for muted interest in this asset class to date can be attributed to such properties being tightly held by universities, government bodies and end-users; and a small investible universe available for sale. Private ownership is limited in Australia and Japan which has also lead to smaller turnover in the region.

However, all this may yet change as governments begin to set their sights on recovery in a post-Covid 19 world.

While the specialised nature of this sector may have initially kept many at bay, we believe that investors’ focus on tenant credit, long leases and stable cash flows are beginning to awaken them to the recession-proof nature of life sciences real estate as they pursue diversification strategies.

Figure 1: Life sciences real estate investments in Asia Pacific on the rise.

Figure 2: Recent major life sciences real estate transactions in Asia Pacific

1 https://apacresearch.cbre.com/research-and-reports/Asia-Pacific-Investor-Intentions-Survey--2021

2 https://apacresearch.cbre.com/en/research-and-reports/asia-pacific-life-sciences-major-report

3 Note: Biosafety Level 1 (BSL-1) laboratories feature settings in which personnel handle low-risk microbes that pose little to no threat of infection to healthy adults. Biosafety Level 2 (BSL-2) laboratories feature settings in which personnel work with agents associated with human diseases (i.e. pathogenic or infections organisms) that pose a moderate health hazard.