Insurtech helps insurers build resilience and tap new markets

[Sponsored Article]

The Greater Bay Area (GBA) and the Belt and Road Initiative (BRI) will provide insurers opportunities to expand their business regionally and globally. Meanwhile, more tech-savvy customers will continue to demand a higher level of product innovation and improved customer engagement that the insurance industry has not seen previously.

These are some of the observations shared by leading industry players, regulators and virtual insurers at the Asian Insurance Forum (AIF), themed as "Spearheading Change for a Sustainable and Resilient Future", hosted by the Insurance Authority (IA) on December 8 as a hybrid event connecting with about 1,000 local and overseas online participants.

The event featured a total of three panel discussions — the first one on GBA moderated by Laurence Li, Chairman of the Financial Services Development Council; the second one on BRI moderated by Christopher Hui, Secretary for Financial Services and the Treasury; and the final one on Insurtech moderated by Dr George Lam, Chairman of Hong Kong Cyberport Management Company Limited.

Just as Carrie Lam, Chief Executive of the HKSAR Government, mentioned in her opening address, the GBA and the BRI will create abiding promise for the insurance industry as the IA continues to transform Hong Kong into a regional insurance hub and global risk-management centre. She revealed that the HKSAR Government is in an advanced stage of discussion with the Mainland authorities on the proposed establishment of after-sale service centres.

“That would mark a breakthrough in financial connectivity, and make it much easier for holders of policies issued in Hong Kong and Macao to acquire comprehensive customer support in the Mainland cities of the GBA,” Lam said. “that, of course, would hold true whether they are citizens of Hong Kong, Macao or the Mainland. Business people, whether established or just starting out, will be able to take advantage of the lower cost of living and of starting business ventures in the region, while continuing to access Hong Kong's sophisticated financial services, including insurance services.” she added.

Lam elaborated that the HKSAR Government passed legislation in July to expand the scope of insurable risks for captives, boosting the competitive edge of Hong Kong as a domicile for these business units set up by multinational corporations, including Mainland enterprises investing in Belt and Road projects. The IA is working out details to pursue this emerging opportunity early next year.

Citing some preliminary analysis, Dr Cheng pointed out that the more tech-savvy, younger middle-class are the main drivers for Insurtech, reaffirming the belief that digital platforms could reach into underserved segments and meet hidden demands. Improved financial inclusiveness and narrowed protection gap will in turn render the economy more resilient to external shocks and the insurance market more sustainable.

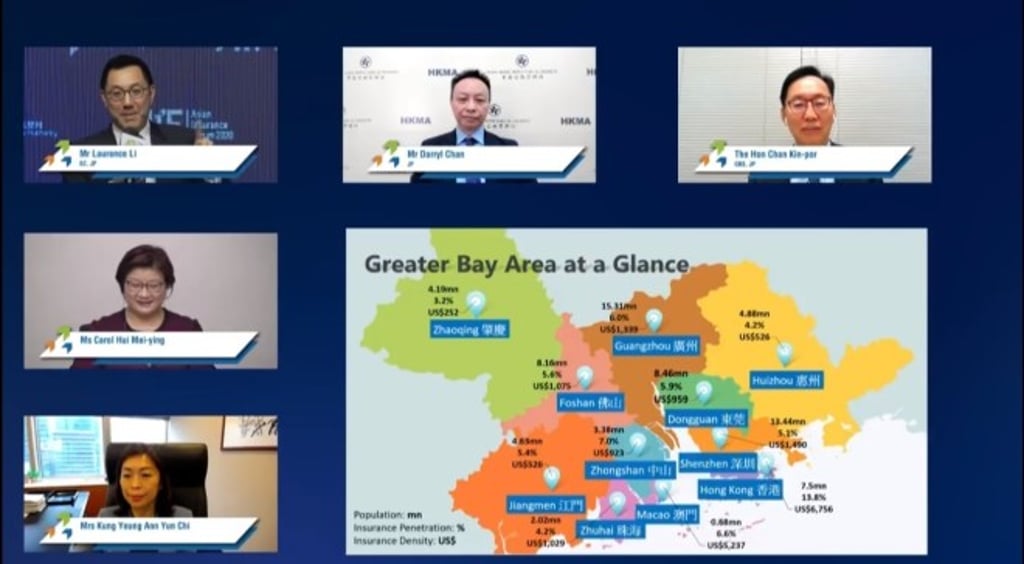

With 70 million residents, the GBA meets the necessary preconditions to establish itself as a leading international insurance centre, said Jonathan Dixon, Secretary General of the International Association of Insurance Supervisors (IAIS). “That is important because a dynamic insurance sector supports sustainable economic growth, promoting resilience to shocks and effective pricing of risk in the real economy. There is huge potential for the insurance industry to support sustainable, innovative and resilient economic growth in this region.”

He furthered that the IAIS is currently at the beginning of a five-year monitoring period for the global Insurance Capital Standard (ICS), and that the IAIS’ Holistic Framework for the assessment and mitigation of systemic risk provides an enhanced set of supervisory policy measures for macroprudential purposes. “We are very pleased that the IA has played such an active role in contributing to the IAIS’ work on both insurance group supervision, including the ICS, as well as our work on macroprudential supervision”, he concluded.

A sustainable future through financial connectivity in the GBA

Chan Kin-por, Member of Legislative Council representing the insurance industry, commented at the first panel discussion that with the substantial economic growth in the GBA cities in recent years, there is a greater demand for wealth and risk management products on the Mainland. He went on to assert that there is an enormous room for growth in the GBA and given the intense competitions from local players, Hong Kong insurers must ensure that their products remain as the preferred choice in the GBA.

Chan applauded specific initiatives announced in the Policy Address that include supporting the local insurance industry to set up after-sale service centres in the GBA, but urged the IA to engage in talks with Mainland authorities. Insurers should also keep themselves abreast of the latest GBA initiatives and submit timely feedback to the authorities through the Hong Kong Federation of Insurers (HKFI).

Darryl Chan, Executive Director (External) of the Hong Kong Monetary Authority (HKMA), felt that key growth drivers provided by the GBA development include domestic consumption, now being reshaped as the internal circulation, innovation and technology, and green and sustainable finance supporting the transformation of GBA cities into more liveable communities.

While financial institutions are poised to play a bigger role in supporting businesses for transformations in technological and environmental aspects, Chan considered their second most important role is to help manage wealth. He foresaw that “Since there’s a high concentration of high-net-worth individuals living in the GBA, there’s tremendous growth potential for wealth management solutions. There’s also huge potential for risk management solutions not only for retail clients but also for the corporate sector”.

While the penetration of insurance products is still concentrated at the lower end of the market and it will take time for potential users to understand and identify their needs for insurance, the most important of all to financial service providers is to build trust with customers, said Kung Yeung Ann Yun Chi, Deputy Chief Executive of Bank of China (Hong Kong) Limited.

She underscored that “To win the trust of GBA customers, we simply can’t rely on our success in the past. Financial institutions ought to make sure that they are able to meet the needs of GBA customers, know where their primary cities of residence are, and are able to communicate with them effectively”, and that “China has been particularly adapted to the use of Fintech. This is something the Hong Kong insurance industry really has to catch up with.”

Carol Hui Mei-ying, Executive Director (Long-term Business) at the IA, suggested that the Hong Kong insurance sector should help build a high-quality “living circle” for GBA citizens, including those from Hong Kong, to live flexibly across the GBA. Innovative ideas should be explored, such as collaborations with local partners such as hospitals or healthcare service providers.

“And since more people are encouraged to live and start business in the GBA, is there any innovative insurance solution that can be offered to people living and working across the border, so that they don’t have to worry about the differences in coverage or requirements?” she asked.

A resilient future through collaborative growth along the Belt and Road

Christopher Hui Ching-yu, Secretary for Financial Services and the Treasury, pledged in the second panel discussion that “The government is doing its best to promote and further the development of the insurance sector. In the past few months, for example, we have passed some legislation to support the development of the insurance industry”.

New measures include tax incentives for general reinsurance business of direct insurers, certain classes of general insurance business and insurance brokerage business. Hui also drew attention to resilience of the global insurance-linked securities (ILS) market through the COVID-19 pandemic, reaffirming its importance for diversity of the financial market in Hong Kong.

Construction and engineering projects have also been disrupted as a result of COVID-19, due to not only lockdowns and travel restrictions but also shortage in labour supply, reported Eric Hui, Chief Executive Officer of Zurich Insurance (Hong Kong) and Chairman of the HKFI. Against this scenario, however, standard business interruption insurance contracts may not cover losses caused by COVID-19. “But on the positive note, it means that in future insurers or capacity providers can be more creative in formulating solutions to cover the risks of communicable diseases.”

George Leung, CEO of SCOR Reinsurance Company (Asia) Limited, proposed to realise the idea of making Hong Kong a one-stop marketplace for integrated insurance solutions for businesses involved in Belt and Road projects. He envisaged that “the insured parties, such as state-owned enterprises (SOEs), can come to Hong Kong and get all their insurance needs met, including credit and political covers. To make it possible, I think we need very close collaborations among different parties.”

Simon Lam Sui-kong, Executive Director (General Business) of the IA, assured that the IA has been working hard to attract stakeholders to operate out of Hong Kong. Captives are essential in this regard as risk management platform for their parent companies. The IA is thus building a related ecosystem in Hong Kong with tax incentives, expanded scope of insurable risks, insurance-linked securities and the newly established Hong Kong Specialty Risks Consortium. “We have arranged 22 matching sessions, covering various projects and topics, to facilitate deals and attract stakeholders to place their business in Hong Kong,” he reported.

Following the second panel discussion, Paul Chan, Financial Secretary of the HKSAR Government, delivered the second keynote speech and brought into play the social dimension of insurance, “Insurance could play an effective role in risk pooling, providing people with the means to secure health protection and plan early for retirement. A shift in mindset from an emphasis on savings and investment return to a focus on protection is essential if we are to narrow the protection gap,” he observed, stressing that Insurtech is a potent enabler and accelerator and boosts creativity, enhances value, improves customer experience and deepens financial inclusion.

Spearheading change through innovation and positive disruption

Wayne Xu, President of ZhongAn Technologies International Group and CEO of ZA Insure, explained that his company uses a proactive digital approach to reach out to potential customers. During the pandemic, for example, it hosted online streaming and Zoom meetings to explain their products. “One interesting finding is that about 14 per cent of purchases are made outside of office hours. It means that customers are able to learn about our policies and go through the underwriting process anytime, anywhere, without face-to-face meetings with agents.”

Michael Chan, Co-Founder and Co-CEO of Bowtie Life Insurance Company Limited, emphasised the role of virtual insurers in narrowing the protection gap in Hong Kong by providing simple protective products such as term life and Voluntary Health Insurance Scheme policies. Technology provides a direct channel to improve access to these products and create user experience which is traditionally less possible.

Alvin Kwock, Co-Founder of OneDegree Hong Kong Limited, highlighted the demand from agents and brokers to embrace technology in doing businesses. He opined that “Although virtual insurers are not allowed to work with intermediaries, we have a strong feeling that intermediaries are also trying to up their game on the technological front. It would be great if the virtual insurers and the regulator can think about what can be done to empower them”.

Bernard Chan, Convenor of the Non-Official Members of the Executive Council, together with Clement Cheung, Chief Executive Officer of the IA, provided the concluding remarks on how industry stakeholders should work together for a more promising future.

To review AIF 2020, please visit - https://aif.ia.org.hk

About AIF

The Asian Insurance Forum (AIF), an annual flagship event of the Insurance Authority in Hong Kong, provides a high-level platform for the local and overseas delegates from different segments of the insurance industry to share insights on development prospects and opportunities in the region.