Standard Chartered: Hong Kong’s role as a global financial centre grows ever stronger

[Sponsored Article]

The Greater Bay Area (GBA) and Belt and Road initiatives – two hugely significant multi-year development strategies launched by the Chinese government – are opening a world of opportunities for Chinese and overseas companies to expand both outside and into the country.

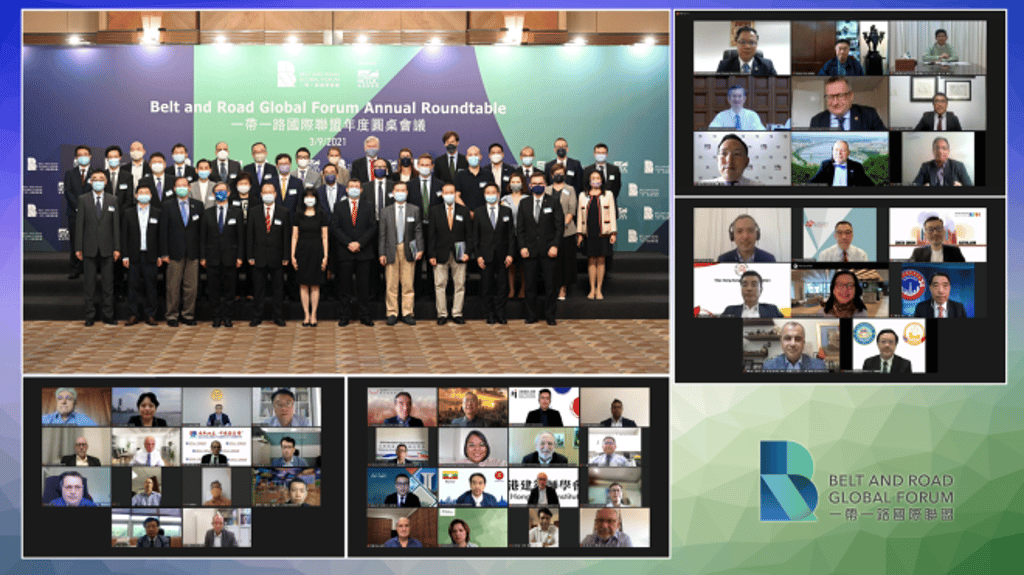

At two recent industry conferences, representatives of Standard Chartered shared their views on how Hong Kong could leverage its unique position to grasp strategic opportunities as the GBA and Belt and Road programmes continue to develop.

Opportunities in the GBA

Speaking at the Belt and Road Global Forum Annual Roundtable, Anthony Lin, Chief Executive Officer, Greater Bay Area at Standard Chartered, noted that the GBA and Belt and Road would further reinforce Hong Kong’s role as an international financial centre. He summarised four key opportunities that lie ahead for the financial industry.

“Thanks to the rapid economic growth seen in the past few decades, people in China are quickly accumulating wealth, and Hong Kong is the best place to serve these clients,” said Lin.

Indeed, the GDP of the bay area was close to USD 1.7 trillion in 2020 making it one of the wealthiest regions in China, with an affluent population of over 1 million in GBA cities. Demand for wealth-management services and global investment products is strong and will continue to rise.

As the widely anticipated Guangzhou-Hong Kong-Macao Cross-Boundary Wealth Management Connect Pilot Scheme is going to be launched very soon, GBA residents will be able to make cross-border transactions into eligible investment and wealth management products distributed by the banks participating in the Scheme. It is an important milestone in China's capital-account opening. Hong Kong, known for its status as Asia’s wealth management hub, is best positioned to benefit from the numerous opportunities presented by the Wealth Management Connect.

“Sustainable finance is another area where Hong Kong can play to its strengths,” he continued. “Environment, social, and governance (ESG) products have moved into the spotlight in recent years, not only among institutional investors but also retail participants who have started to recognise the importance of sustainable investing.”

According to the United Nations’ sustainable development goals (SDG) investment map, we would need over US$10 trillion of private-sector funding to support the transition to a more sustainable world. With access to the world’s largest and most reputed fund houses and their products, Hong Kong is leading in this arena.

Lin believes that renminbi (RMB) internationalisation will remain a vital opportunity for Hong Kong. “Currently, Hong Kong handles more than 70% of all RMB settlements. We also have the largest pool of RMB savings in the world, worth RMB 600 billion. This is going to work in our favour, as the RMB is further internationalised,” he added.

“And lastly, our highly active capital markets will continue to attract fast-growing and new economy companies to list in Hong Kong.”

Hub for capital raising and financing

Peter Burnett, Managing Director at Standard Chartered, echoed Anthony’s view that Hong Kong has a central role to play in the GBA and Belt and Road initiatives, particularly when it comes to capital raising and the financing of companies seeking to take advantage of China’s development tailwind.

Commenting at a panel discussion session during the sixth Belt and Road Summit recently held in Hong Kong, Burnett said, “The city does what it does best, which is connecting jurisdictions. It aggregates and allocates capital. This is a proven expertise that Hong Kong has possessed for many years.”

Since the launch of the Belt and Road and GBA initiatives, many Chinese companies have chosen to route through Hong Kong to raise funds for their projects. As such, there has been a lot more connectivity between Hong Kong, Mainland China and other parts of the world, with Chinese companies using Hong Kong as a platform for overseas financing.

He elaborated, “GBA is essentially a three-dimensional project, focusing on Hong Kong, Macao and South China. It is an extension of what many of us have been doing in the Pearl River Delta for the past 20-30 years – ever since China opened up and reformed its economy. A lot of GBA activity is based on relatively conventional financing, such as corporate credits and cash flow collaterals.”

Cross-jurisdiction financing

In contrast, the Belt and Road initiative is more complicated.

“The Belt and Road initiative is multi-dimensional. We must take into consideration diverse jurisdictions with varying laws and regulations. The financing challenges across markets, plus cultural and economic differences, are huge,” said Burnett.

Yet, he thinks that Hong Kong has the “knowledge, skills, and resources to rise to the challenge.”

He cited an example, “Standard Chartered led a financing operation in Dubai, which, at the time, was the world's largest concentrated solar power project. Several parties were involved, including the Dubai Electricity & Water Authority, a Saudi operator, Shanghai Electric, and the Silk Road Fund from China. We also had multiple engineering, procurement, and construction (EPC) contractors from across the world. It was an immensely complex project to bring together and finance. In Hong Kong we were responsible for connecting many of these parties and to support what was happening in Dubai. It was an example of how we can reach out and connect with jurisdictions overseas.”

Apart from credits, securitisation is another way to obtain the liquidity required to fund infrastructure projects under the Belt and Road initiative.

“Infrastructure projects typically involve non-recourse lending. When accumulated, it represents too much risk on a bank’s balance sheet, thus constraining its ability to lend money to other infrastructure projects. Securitisation allows banks to bundle infrastructure lending together, securitise these and sell them in the capital markets, hence offloading some of these risk assets from its balance sheet. For example, in Hong Kong, the Hong Kong Monetary Authority, through the Hong Kong Mortgage Corporation, has set up a securitisation vehicle that focuses on infrastructure loans,” explained Burnett.

Both Lin and Burnett are optimistic about the future of Hong Kong’s financial industry and are enthusiastic about the new opportunities offered by the GBA and Belt and Road initiatives. Hong Kong could act as a super-connector, facilitating more dynamic capital flows within the region.

“Given the proximity of GBA cities, I would like to see the GBA emerge as one big market. If this happens, then multiple dynamics will begin to change,” concluded Lin.