Asian Family Office - Recent Trends and its Non-financial Role

Family office, if used properly, not only could achieve wealth preservation and growth, but could also preserve harmony and legacy of the family

[Sponsored Article]

By Professor Winnie PENG,

Director of the Tanoto Center for Asian Family Business and Entrepreneurship Studies,

HKUST Business School

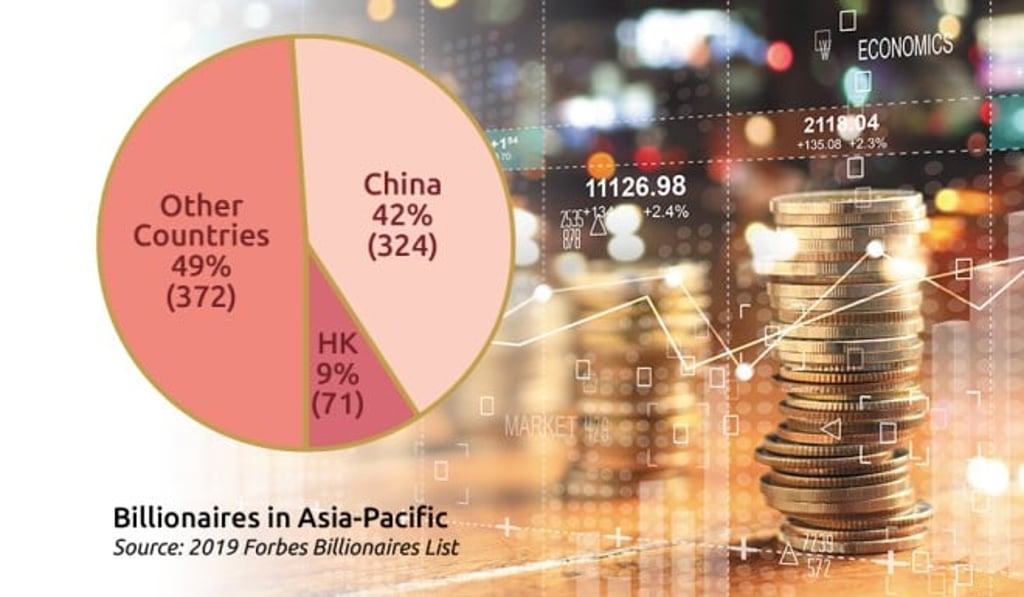

As the number of billionaires grows in Asia, the need for an efficient way to pass on family wealth and values, and to maintain harmony within the family, has been increasing. This has resulted in a dramatic increase in the number of Asian family offices. A report by the EY Family Office estimates that the number of family offices increased tenfold in 2017 compared to a decade ago. With the increasing number of family offices, they are creating greater impact and shaping the future of Asia. Understanding the following trends helps families and professionals better prepared for the future.

Trend 1: A growing number of family offices built on “New Wealth”

New wealth can be defined as wealth that has been accumulated recently, within one generation of time. It may refer to a large sum of money from a sell-off when the first generation of family business encounters a bottleneck, or when the second generations refuse to take over; it may have been obtained by monopolizing access to natural resources; or it could have been gained from emerging industries and high-tech sectors. Owners of such wealth are keen to have it properly managed, but private banks and asset management firms fail to provide adequate services to satisfy their need. This has resulted in the creation of family offices.

Trend 2: More diversified and direct investment portfolios

Traditional old-wealth families are more conservative when it comes to their investments. Fixed-income products and stocks are popular investments among the older generations. As younger generations get involved in the family business, family offices are starting to make more diversified and direct investments, such as private equity and venture investments. Recent statistics show that private equity accounts for one third, or at least one fourth, of investment portfolios owned by family offices.

Blue Pool Capital, the family office of Joseph TSAI – Co-Founder of the Alibaba Group – is an example. In August 2019, Tsai completed a US$2.35 billion deal to buy the Brooklyn Nets, making himself the second Chinese owner of an NBA franchise. Not only does this represent an expansion in his own field of investment, it is a model for investment diversification for other Asian family offices.

Trend 3: More collaborative: co-investment among family offices

In addition to undertaking new investments, family offices have embraced a new model of collaboration – co-investment. This enables families with backgrounds in different sectors to share resources, make use of each other’s strengths, and mitigate risk. This positive synergy leads to more stable investment returns.

Co-investment among family offices takes at least two forms. The first is when a single family office seeks to collaborate with other family offices or asset management companies. However, in my observation, single family offices tend to co-invest more with other single family offices than asset management companies as the visions and the motives of family offices can be more aligned. The second is when several families engage in investment projects under a multi-family office platform which, in addition to allowing shared access to resources, also leading to reduced operational costs.

Trend 4: Greater focus on investing in tech and emerging industries

As risk tolerance is usually higher in the younger generation than in the older generation, when it comes to new wealth, or old wealth managed by younger generation, their investment strategies shift towards more wealth growth than wealth preservation. In recent years, family offices tend to invest more in technological innovation and emerging industries. Many Internet tycoons in mainland China invest heavily towards technological innovation and startups. Some new wealth even taps into cryptocurrency and block chain investment which old wealth would never try. A few younger generations managing old wealth in Hong Kong have also attempted to enter into emerging industries, of course, not as aggressively as new wealth. For example, the family office of Nan Fung Group has a specific focus on bio-tech investments.

Trend 5: Greater focus on social responsibility and sustainable development

Younger generations in the family are voicing their willingness to help address social and environmental issues, on top of meeting the bottom line. Having adopted the principles of sustainable finance, they focus on investment in companies with higher ESG (Environment, Social Responsibility, Corporate Governance) scores and impact investing. According to a 2018 UBS report on sustainable investing, nearly half (45%) of the one third (38%) of family offices that undertook sustainable investing had plans to increase ESG investing within the next 12 months.

Meanwhile, in Hong Kong, sustainable finance is becoming increasingly popular among private investors who seek financial investments that offer social or environmental benefits. This trend will accelerate Asia’s transition towards a sustainable finance hub.

Trend 6: Asian family offices are moving towards specialization and professionalism

Unlike matured family offices in the West, Asian family offices are often managed by family members. This approach has limitations when it comes to execution. Due to the rapid development of technology and organizational management, family offices need to source more professionals. The long-term development of a family office lies in trusting and retaining such talents. As highlighted in a report by PWMA and KPMG in 2019, the talent gap in Hong Kong’s private wealth management industry is growing. Within a year in 2018 alone, some 2800 professionals were needed in the wealth management market with the most demand from family offices.

Trend 7: Growing recognition of a family office’s non-financial role

From a historical point of view, the concept of family offices originates from the West. In ancient China, eunuchs and eminent families did use “majordomos” who were asked to take care of everything about the family matters. Putting this in a modern context, a family office would, theoretically, also take charge of everything, including financial and non-financial matters for the family.

A family office, if used properly, can become a powerful tool to implement a family succession plan. Along with taking care of financial matters to help pass on family wealth, family offices can take on non-financial roles such as family governance and family philanthropy, to support a harmonious coexistence within the family and its succession. With the aging first generation and the growing number of family members, more and more Asian family offices start to realize the importance of their non-financial roles.

Family governance can be one key role for family offices

Many family businesses in Mainland China are managed by first-generation entrepreneurs whose family consists of a spouse and one child. The composition of their family is simple. So there is no urgent need for family governance. This explains why most family offices in mainland China are set up for the sole purpose of wealth management. By contrast, family businesses in Hong Kong, which are often in their second or third generation, have complicated familial relationships. For example, some family members are shareholders or paid staff of their family-owned business, while some are not. Some are blood family members, while some like daughter in-laws or son in-laws are not. With different family members and different interests but with no appropriate family governance system in place, a family could be faced with different dilemmas, tussles, and even a breakup. Therefore, family offices need to strengthen their “soft skill” by supporting family members to establish a comprehensive system for family governance.

As far as implementation is concerned, family offices can help set up a family council with members across generations elected. They can follow up all decisions made in the council and lay down a family constitution with rules for family members to follow. A family constitution can set for example, family values, responsibilities and remuneration policy for family members, define their rights or rules to sell family shares, etc. A family office can also assist to review and update the family constitution in time, including its policy and implementation status. Family gatherings and training for members can also be arranged by the family office.

Family philanthropy can be another key role for family offices

In addition to family governance, family philanthropy can play the role to keep the family together. Philanthropy can be divided into strategic philanthropy and traditional philanthropy. Although families can always start with traditional philanthropy, I suggest families to undertake strategic philanthropy when they are able to for two reasons:

First, strategic philanthropy can better help to unite the family compared to a traditional charity. Traditional philanthropy often means monetary donations or “cheque writing”. For a traditional charity, philanthropy ends when the first-generation founder of a family business donates to name a building, a bridge or a road, with no involvement of the younger generation. For strategic philanthropy, all family members can take part in the discussion and decision on the solutions addressing a social issue, and will thus develop a deep understanding about the meaning of philanthropy with first-hand experience. These philanthropic projects can facilitate frequent communication and exchange among family members, which allow them to better understand one another, creating a stronger family bond to be passed on.

Second, strategic philanthropy is a better tool than a family business to preserve harmony among family members and preserve family legacy. In addition to subjecting all family members to potential conflicts of interest and disputes, a family business does not always allow participation for all members. In a traditional Chinese family business, those considered non-blood relatives are often excluded. A philanthropy project, on the other hand, invites all family members to participate in an undertaking, allowing the entire family to work towards the same goal of social benefits instead of fighting or competing for personal gains.

It is noteworthy that people may criticize some new wealth for spending too much. However, these new wealth owners could be big philanthropists as well. In comparison, old wealth was accumulated through the hard work of several generations, and therefore the owners could more likely think twice before they spend or donate. With the emerging new wealth, we are likely to see more family offices in supporting their need to set up a charitable foundation.

It is unnecessary for family offices to undertake family governance and family philanthropy simultaneously despite the growing attention they receive. Execution of philanthropy is not going to be impeded over factors such as the size of family wealth or the stage of business development. The earlier the family starts to engage in philanthropy, the sooner it can be united and be beneficial to the passing on of the family value and legacy. It is plausible for a family in its first generation (like family businesses in the Chinese mainland) with a few members to start planning for family governance, but there is no urgent need to make it a top priority.