XTransfer pushes new trade payment model at 2025 summit

- Founder and CEO Bill Deng outlines growth strategy, whitepaper proposals and fintech innovations as Chinese exporters expand globally and move up the value chain

[The content of this article has been produced by our advertising partner.]

XTransfer, China’s leading B2B cross-border payment platform, hosted its annual TradeVision Summit 2025 on August 26 in Guangzhou, which gathered over 3,000 global traders, bankers and policymakers for a day of debates on global trade resilience and innovation.

Themed “Globalise with Local Accounts, Explore New Trade Markets”, the summit focused on XTransfer’s expansion into emerging markets and its plans for the future of trade settlement infrastructure.

A grand stage for foreign trade

Hosted at the Guangzhou Baiyun International Conference Centre, the event was also backed by heavyweight financial partners including ICBC, Bank of China, Deutsche Bank and OCBC Bank.

“The China-US trade disputes have evolved into global trade disputes, yet our [Chinese] SMEs have shown great resilience and innovation by actively exploring non-European and non-US markets,” Bill Deng, the company's founder and CEO, told the packed hall in his keynote address.

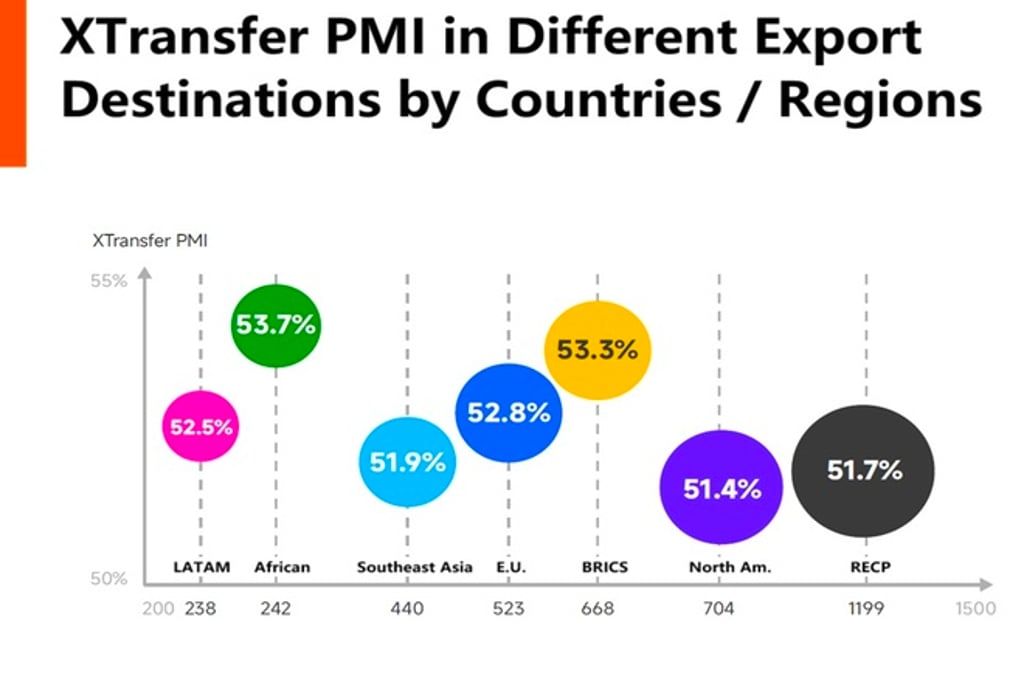

To coincide with the flagship annual event, the company released its July 2025 XTransfer Purchasing Managers’ Index (PMI) for SME exports, which came in at 52.4 per cent, above the 50 per cent threshold that separates expansion from contraction.

Deng identified local collection accounts as the most practical solution to exporters’ biggest problem, which is getting paid on time.

“The hardest part for many SMEs… is collecting the payment,” he said. “In markets with foreign exchange restrictions, buyers often can’t pay in US dollars.”

“With local currency accounts now available in Nigeria, Ghana, Brazil and South Africa, as well as in nearly 80 per cent of emerging markets, buyers can pay in their own currency while sellers receive funds quickly, securely and at lower cost.”

Now supporting more than 30 currencies, these accounts cut out middlemen and reduce FX losses and according to Deng, their rollout has been a key driver behind XTransfer’s rapid expansion from a China-focused platform to one that now serves SMEs worldwide.

XTransfer’s expansion is based on a strategy that builds licensed, compliant infrastructure in developed markets while addressing structural gaps in emerging ones.

“In developed markets such as the UK and Singapore, we focus on payment licenses, data localisation and strict compliance,” Deng explained.

“In emerging markets, where infrastructure is weak, we provide solutions where previously only underground banks filled the gap. The difference is that we do it safely and with regulatory approval.”

He added that governments in Africa, Southeast Asia and Latin America increasingly see XTransfer’s model as beneficial.

“Our infrastructure not only improves efficiency but also strengthens anti-money laundering oversight. Over time, regulators realise that we add stability and transparency to their economies,” he said.

Building a new settlement standard

The summit also marked the release of XTransfer’s X-Net Whitepaper, which Deng described as “a blueprint for the future of B2B trade settlement”.

New industry standards for digital settlement infrastructure are proposed in the whitepaper, covering API integration, data-sharing and compliance protocols.

“After connecting with more than 100 institutions in developing markets, we’ve distilled the process into a set of clear API requirements covering every stage of a transaction, from account opening and payment flows to refunds and compliance checks,” he explained.

Deng added that this standardisation allows XTransfer to expand faster and with more consistency, while also giving partner banks confidence that the platform’s operations are secure and commercially viable.

On the other hand, the company also pledges that 90 per cent of the value created through the network will be shared with SMEs to ensure inclusivity.

“We want to build the world’s new global settlement infrastructure – one that connects banks, regulators and SMEs in a single network,” said Deng.

Stablecoins: the next frontier

Perhaps the most forward-looking part of Deng’s keynote came when he addressed the role of stablecoins in cross-border payments.

He envisions a future in which settling an international invoice would be “as easy as scanning a QR code on WeChat Pay”.

“Within three years, I believe more than half of global SME trade payments will involve stablecoins.”

“Dual wallets, holding both fiat and stablecoins, will become the norm. That will mean 24/7 settlement, no intermediaries, no hidden costs.”

Although XTransfer will not issue its own stablecoin, Deng said the company would integrate with major issuers.

The promise and pressure of AI

As CEO of a fintech company, Deng sees artificial intelligence as both an opportunity and challenge.

From risk control to customer onboarding, XTransfer has embedded AI tools, including large language models trained on trade data, into its systems.

“Our pass rate for compliance checks has risen from 96 per cent to 99.5 per cent, and most customers don’t even notice the checks are happening,” he said, yet admitting that there are challenges as well.

“AI talent is scarce and expensive. The key is applying AI to real-world cases, such as helping SMEs research markets, detect fraud and get paid.”

Far from shying away from rivals, competition has sharpened XTransfer’s edge.

“For four and a half years, we had no competition. But more recently with new competitors emerging, we have been encouraged to listen our clients better, move faster and deliver more value,” he said.

Long-term vision

When asked about his greatest challenge as CEO, Deng was candid.

“My job is to make the right big picture calls. If I get the strategic judgment wrong, the company suffers. And during rapid expansion, aligning all departments to move as one team is always hard.”

Nonetheless he remains committed to what he called “long-termism”. Short-term gains, he argued, are fleeting.

“Some choose short-term wins. But to build something truly large and that lasts, you must choose the long term, even if it’s painful.”

And it’s just the beginning

XTransfer is positioning itself not merely as a payment provider but as the architect of a new global trade payment infrastructure.

Not only are China’s exporters exploring new markets, but they are also moving up the value chain, with Chinese brands no longer confined to low-end segments.

A case in point, he said, is the global craze around LaBuBu, a Chinese toy brand that has become a cultural export.

For Deng, the journey is still in its early stages. “All the milestones we’ve hit, including reaching 700,000 customers, are just the beginning,” he said.

“The globalisation of SMEs is irreversible, and our mission is to give them the same financial tools once reserved only for multi-nationals.”

"In three years’ time, paying an overseas supplier will be as easy as sending a WeChat red packet. That’s the revolution we’re building for SMEs worldwide."