Positive outlook for prime London property markets

Rising house prices and rent increases in Q1 2018 are making buyers and sellers more optimistic about prime Central London residential markets, even as transactions remain low.

[Sponsored Article]

Central London's most desirable districts are still highly in demand among property buyers and renters. Prestigious addresses such as Chelsea, Kensington, Knightsbridge and Mayfair saw quarterly price increases for the first time in a year, according to research by Jones Lang LaSalle (JLL). The lettings market has also begun to stabilize after three years of falling rents.

London's residential landscape has changed considerably in the past few years, with an increase in stamp duty for higher value properties and uncertainty over the impact of Brexit, but the outlook is now more positive for buyers and sellers.

Those who owned prime London property before the changes are becoming more accepting of the new dynamics on the whole, but there has also been an increase in second-hand properties entering the market. These join the high volume of new build projects launching in the most sought-after prime locations, creating a more competitive marketplace through the rest of 2018.

Price gains in key prime markets

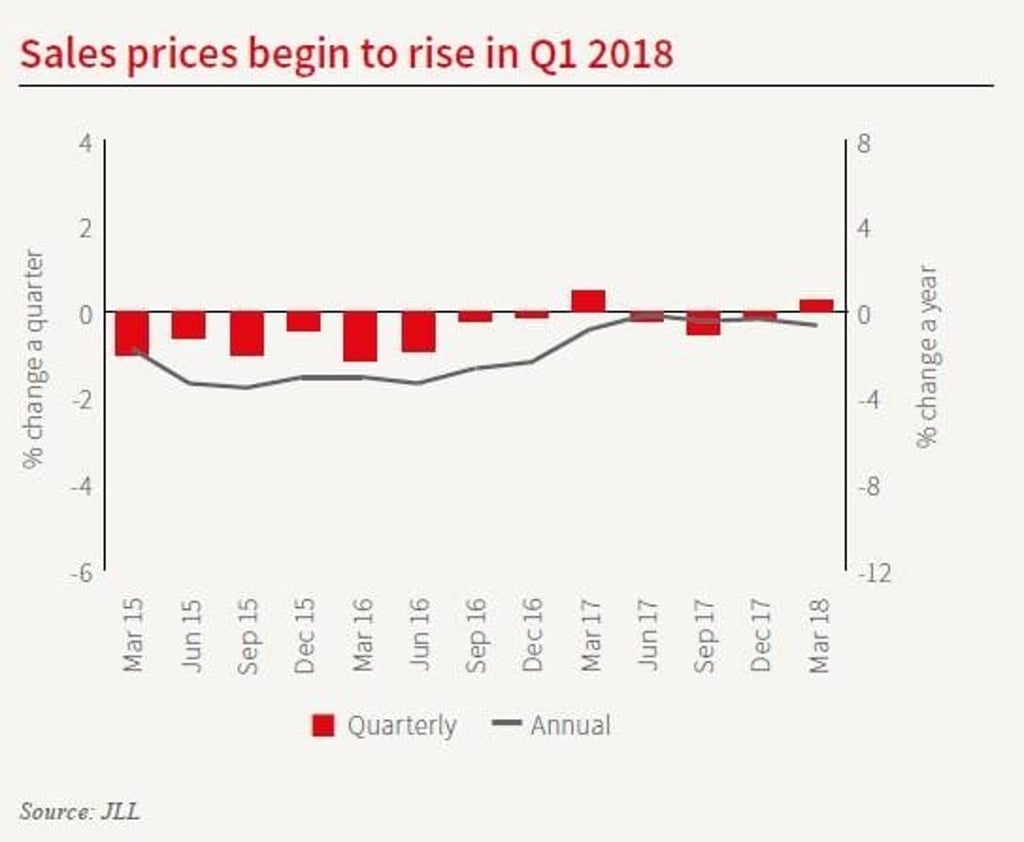

Property prices increased by a modest 0.3 percent across prime Central London as a whole in the first quarter of 2018, although more substantial growth was seen in the popular submarkets of Mayfair, Chelsea and South Kensington. The properties that saw the greatest gains in Q1 2018 were larger two to three-bedroom houses in the £2-5 million range (HKD 21-52 million).

Despite the resurgence in house prices, the first three months of 2018 saw the volume of property sales decreasing across prime London. This suggests that owners may be waiting for prices to recover more substantially before selling, now that the property cycle is showing clear signs of recovery.

Ongoing political and economic uncertainty in the UK may also be causing some buyers to bide their time and see how the next general election and Brexit terms will be decided. Many, however, remain optimistic that these outcomes will be favorable.

Prime lettings market more upbeat

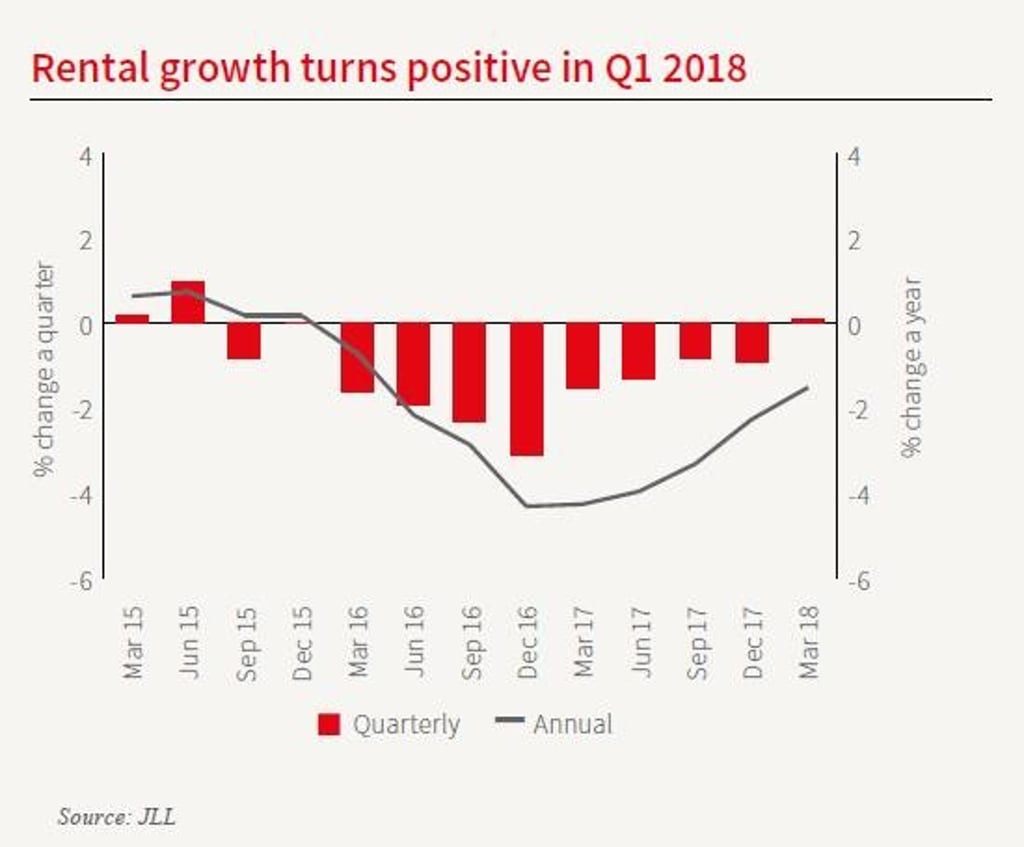

Similar to sales, the number of new rental agreements also declined in the last quarter, but JLL found that the annual volume of transactions has now stabilized between 9,500 and 10,000 for all prime London districts. More encouragingly, rental demand is growing in some prime neighborhoods after eight consecutive quarters of decline, causing buy-to-let investors to feel more positive.

There was more good news as rents increased in the key submarkets of Mayfair, Knightsbridge and South Kensington, for larger homes as well as single bedroom apartments. Rental demand is highest for lower and mid-priced properties, but renters are happy to pay slightly more for the perks of living in new build apartments.

Tenants are also less likely to be offered discounts and more likely to pay the full asking rent compared to last year. This is another sign that landlords are feeling more confident about the lettings market in 2018, especially as we enter the peak rental period when many families and students will be seeking accommodation.

Entering a new phase

With the residential markets beginning their upswing, JLL expects prime London house prices to grow by 8.7 percent and rents by 3 percent by 2022. While overseas property buyers will be keen to invest in London before the price hike, many current owners are waiting for selling conditions to improve, and this is likely to see only gradual growth in transactions through the rest of the year.

Director of Residential Research at JLL UK, Neil Chegwidden, explains: “The prime Central London sales market is still adjusting to the tax regime introduced more than three years ago. We believe the market is entering a new phase with some long-time owners reconsidering their options.

“While the vast majority will remain, we expect a moderate but steady number of owners will bring their properties to market over the next 12-18 months, marking the start of this new, more active and acceptance phase for the prime Central London sales market.”