The role venture capital may play in a sustainable future

By Dr Jeffrey Chi, Founding Partner & Vice Chairman, Vickers Venture Partners

[Sponsored Article]

If there is one lesson that we should take from the Covid-19 pandemic, it is the fragility of humanity and our social and economic structures. As the virus continues to ravage the global population, we have been forced to make changes in our very way of life. The pandemic has forced us to change consumer behaviour and how we think about work. It has radically changed multiple industry sectors including healthcare, education and supply chain management. It has even shook socio-economic and political systems globally.

As we adapt to a new normal in the aftermath of this crisis. there is a larger crisis that looms over us. That crisis is one of climate change. At the Sustainability Forum of the MIT Better World Campaign, MIT Provost Martin Schmidt and Professor Asegun Henry delivered a moving call to action. They cited that we are likely to be close to a global tipping point where multiple earth systems march past the point of no return. They go on to add that most people do not realize how little time we have left, stressed the urgency for everyone to do more, particularly in the development and adoption of technologies that can make big differences.

One trend that may have gone unnoticed in 2020 was the growth of sustainable and impact investing. In the wake of the Covid-19 pandemic, investors now recognize the fragility of our economic systems, the necessity to plan for risk factors other than short term financial losses and the financial wisdom behind solving for humanity’s future. I’m encouraged to see the world come together in addressing the climate change crisis. Last September, President Xi announced China’s plan to have peak CO2 emissions by 2030 and achieve carbon neutrality by 2060. Central banks across the world have embraced the promotion of green and sustainable finance. Regulators are beginning to emphasise the importance of ESG practices, not just amongst the public market participants but also amongst other financial institutions including private market investors, lenders and insurance companies.

I’m further encouraged to see new technologies come to market in spaces such as fossil free polymers (biodegradable alternatives for single use plastic), more efficient and sustainable clean energy production, wider adoption of electric vehicles and cleaner fuels such as hydrogen. These technologies not only make a difference in our quest for carbon neutrality, but also promise superior financial returns for investors as these technologies become necessary for solving humanity’s continuity.

As a deep tech investment firm, our investment philosophy at Vickers Venture has been to fund that better world. By backing these fundamental technologies that solve these big problems. Not only do we make a difference that would alter the course of humanity for the better, we also address problems that represent huge market demands. This makes for very profitable investments that we make on behalf of our investors.

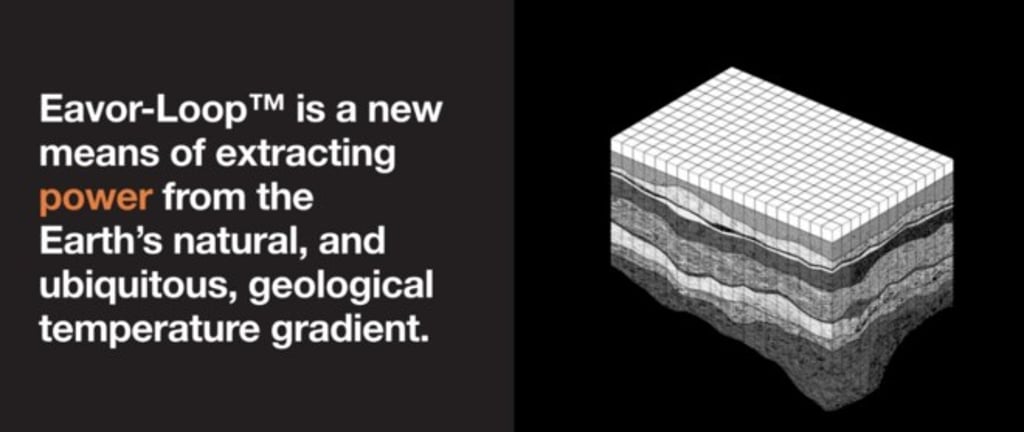

One of these investments is Eavor Technologies whose technologies produces clean, carbon-neutral, scalable baseload power from geothermal energy. Eavor’s innovations allows heat from the earth to be tapped, independent of geographical conditions in an environmentally friendly manner. Eavor recently welcomed BP, Chevron, Temasek and BDC to its list of shareholders. Another game changer is RWDC Industries, a leading player in the growing biopolymers industry.

Venture capital can indeed make the world better. As stewards of capital backing technologies, let’s take a broader look at returns. Apart from the financial returns that are obvious, we need also to start factoring in the environmental and social benefits that our investments may have on humanity.