Neobanks vs. Traditional banks: What’s the difference?

[Sponsored article]

As banks worldwide continue their slow pace of innovation, numerous startups and FinTechs have come around to modernise banking.

The so-called “neobanks” are digital-only challengers that provide technology-driven alternatives to services traditionally offered by banks like current accounts, loans, credit cards or trade finance.

They’re not necessarily fully licenced banks themselves, but may hold alternative licences or work with licenced partners to offer their services. Take for example Monese from the UK, Simple from the United States, or Neat from Hong Kong.

With this global phenomenon in full swing (not to mention Hong Kong’s looming 8 virtual banks), what can these new players offer that traditional banks cannot?

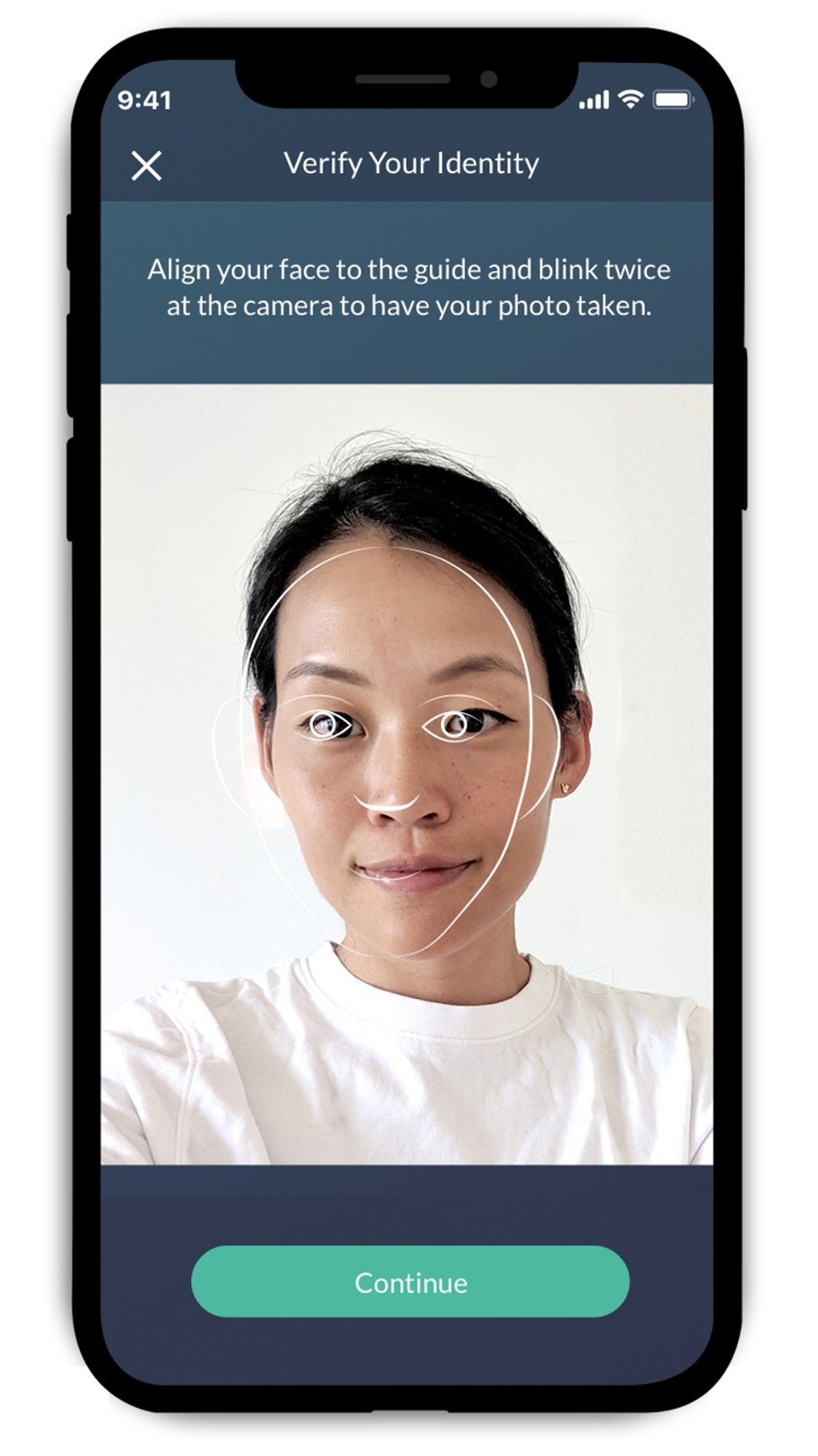

Fully-digital onboarding and account opening

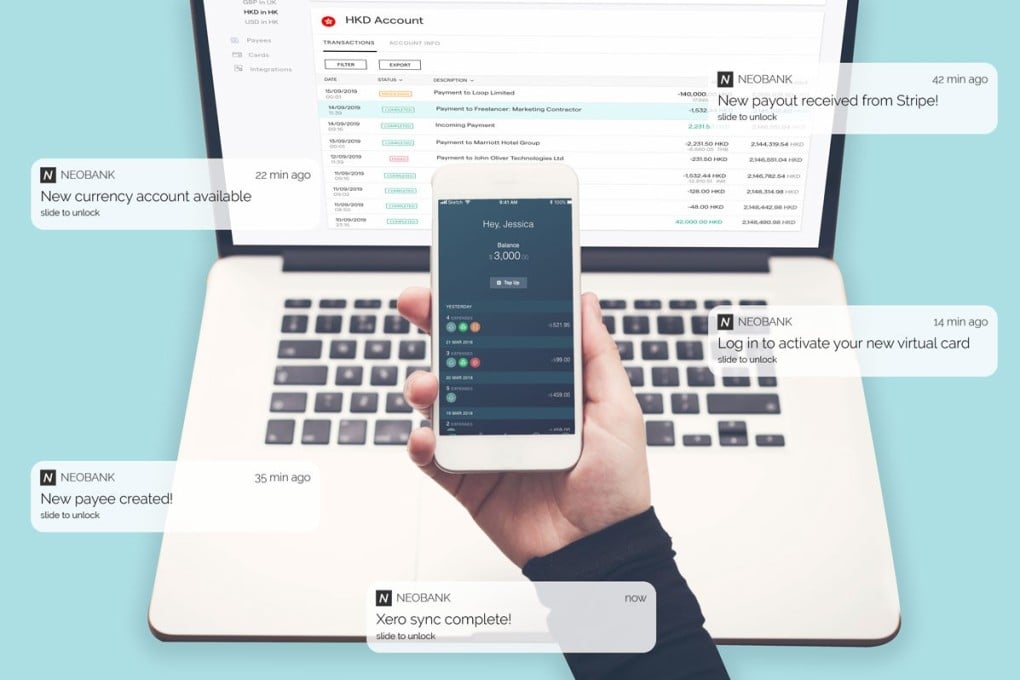

The ability to open an account via your smartphone or laptop is a key characteristic of neobanks worldwide.

While most commercial banks have some sort of e-banking option, few have developed a way for new customers to open accounts without having to go to a branch.

When you open a bank account with a bank, the process typically looks like this: you go to a branch with all your documents (proof of address, identification documents, employment contracts, etc.), meet with an associate, who will then send your application off for review. Then it’s a waiting game for anywhere from 2 weeks to several months.

Neobanks, on the other hand, have been able to build new digital processes that cut down on wait times and friction.

For example, Neat is a FinTech that provides multi-currency businesses accounts, known for its 15-minute online application. Approved accounts are opened within a week. Their digital-onboarding process integrates with the Hong Kong Companies Registry directly, so they can get any necessary documents straight from the source – in other words, the applicants don’t have to gather official paperwork themselves or meet with anyone to deliver it in person. In fact, Neat won an award from the Hong Kong government for its fully-digital Know Your Customer process in 2017.

Lower fees due to reduced overhead costs

Neobanks offer not only transparent pricing but lower fees than incumbent banks – one of the ways they do so is by eliminating branches.

Chime, for example, is a neobank in the US that offers debit cards and fee-free overdrafts.

Specialised features and value added services

Depending on the licences they have, neobanks often start out by offering a very specialised service – such as loans, credit cards/prepaid cards, or virtual accounts. They often target a specific niche, such as expats, students, or SMEs, to build a product that’s specifically catered for that audience.

Consider Coconut in the UK, which focuses on serving freelancers. They’ve developed specific features in accounting, VAT & invoicing that cater to the day-to-day needs of freelancers. For example, a freelancer who needs to request payment from a client can use Coconut to send invoices directly from the app.

Neobanks are changing the banking experience

With digital challengers popping up all over the world, and innovating on outdated banking systems, they’re changing the way consumers understand what the banking experience can be.