Addressing the Fintech Talent Gap

Fintech provides unlimited opportunities for growth, and thus the demand for such talent across the world surges. To hear directly from industry players can promote discussion among policy makers, education institutions and industry stakeholders in setting out optimal strategies to retain, attract and nurture new talent.

[Sponsored Article]

There is broad consensus that fintech solutions will play an ever greater role in the movement and management of money. That is evident from the fast increasing use of e-wallets, cashless payment systems, and the spike in interest in new virtual banking licenses.

However, in the short term at least, one obstacle in particular may limit the natural growth of the sector. As things stand, there are simply not enough trained professionals in Hong Kong with the skills and proficiencies needed to meet burgeoning demand. And the lack of suitable talent may put a brake on developments just when employers should be gearing up for change and looking to capitalize on any first-mover advantages they can find.

With that in mind, HKUST Business School is undertaking a comprehensive research project, funded by the Research Grants Council’s Theme-based Research Scheme, on what's happening and why, with a view to putting forward practical recommendations for the various stakeholders on how best to proceed.

“This project looks to facilitate the industry, educators and policymakers to support Hong Kong in transforming into a global fintech hub,” said Professor Kar Yan Tam, the project leader and dean of HKUST Business School.

Altogether, more than 80 organizations contributed to the research, which began last August, with insights also obtained from online surveys and interviews with 28 influential executives. The aim was to hear from traditional and digital banks and insurers, as well as start-ups, regulators and “enablers” to pinpoint the industry’s driving forces and major areas of concern.

“We found that partnership building is one of the top business priorities,” said Christy Yeung, HKUST Business School’s senior manager for the Fintech Research Project. “That is between mature players and new entrants, also between fintech and lifestyle ecosystems, with the objective of building a seamless customer or user experience.”

Other notable priorities include “co-opetition” [working with competitors to improve products], more constructive engagement with regulators, creating the trust needed for customer acquisition, and opening up to more cross-disciplinary collaboration.

What also emerged were worries about a significant talent shortage in most of the technical and data skills.

“This poses a challenge,” Yeung said. “The largest gaps in ‘people capability’ are in the middle management and junior levels - and they make up the majority of the workforce. In technical readiness, many organizations perceive themselves as behind the curve.”

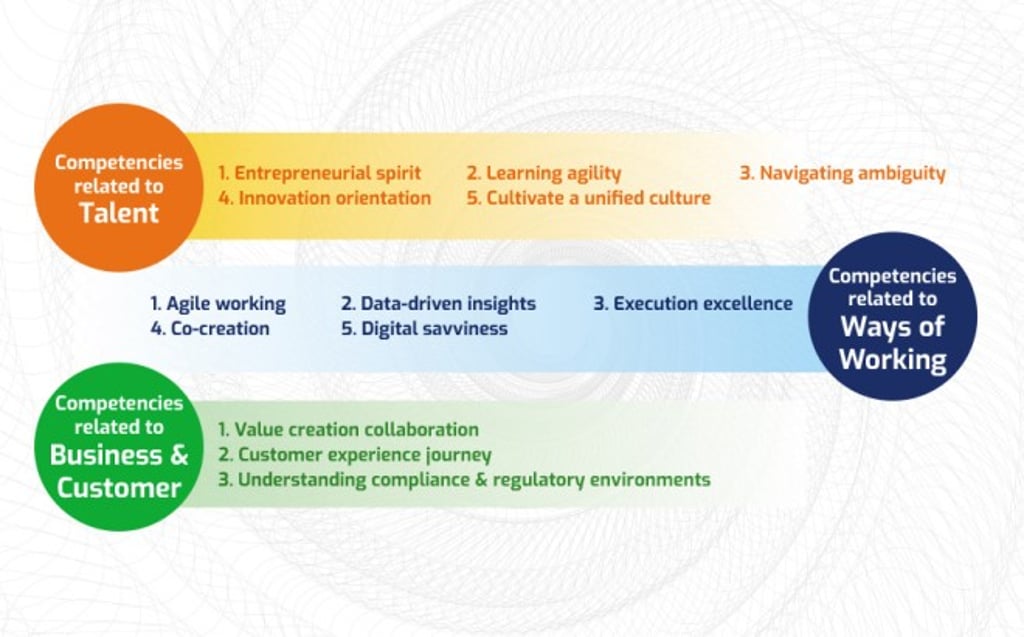

Reference to the competencies can now be used to guide hiring, training and planning. It can help banks and other institutions adapt to new ways of working and changing consumer needs.

“We wanted something scalable, to start with a foundation for the industry that allows things to move forward,” Tang said. “We looked at behaviors that are coachable, visible and measurable and aimed to strike a balance. For example, competencies like learning and agility are about mindset too, and they reflect the way the world is evolving.”

The subsequent panel discussion, overseen by Peter Yan, chief executive officer of Cyberport Hong Kong, brought out further ideas and perspectives.

For instance, Nelson Chow, chief fintech officer for the Hong Kong Monetary Authority (HKMA), confirmed that the talent gap within the industry is very real for everything from data scientists to cybersecurity specialists, but there may be light at the end of the tunnel.

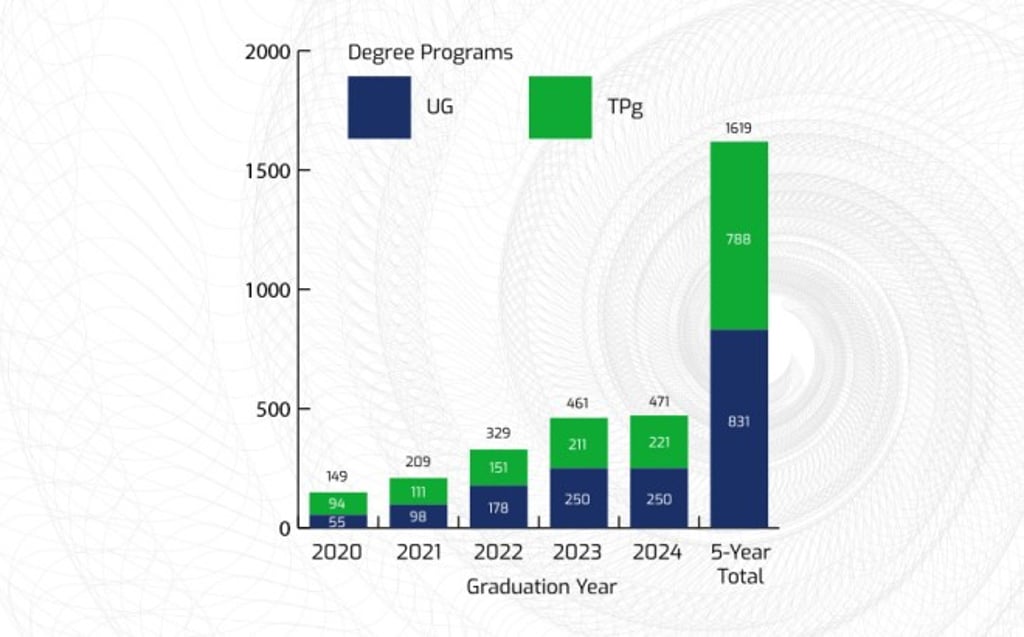

“More universities are offering [relevant] undergraduate and postgraduate courses,” Chow said. “Also, Hong Kong has a huge talent pool on the ‘fin’ side. What if we can train 10 per cent of them to be more ‘tech’ capable?”

Professor Tam agreed that retraining practitioners was one way forward. The competency model could help develop programs teaching the necessary technical and soft skills.