CBRE issues contrarian call to buy office, hotel and retail real estate in Asia Pacific in 2023

- These three sectors offer significant upside opportunities as the commercial real estate market outlook in Asia Pacific turns relatively positive

- Hong Kong SAR and Mainland China are the bright spots in the region, with a post-Covid return to business-as-usual driving recovery and growth

[The content of this article has been produced by our advertising partner.]

CBRE forecasts overall 2023 GDP growth at 3.6 per cent for the region. “Hong Kong SAR and Mainland China are leading the growth from the economic and real estate leasing, occupier, and investment points of view,” states Dr Henry Chin, CBRE’s Global Head of Investor Thought Leadership & Asia Pacific Head of Research. “Hong Kong SAR has become attractive again as people do see the city’s value, and the recent lifting of travel restrictions – including the reopening of the border with Mainland China – is also positive news.”

Sectors that have suffered during the pandemic, such as office, hotel and retail, will bounce back quite well, while growth in industrial & logistics is expected to soften. Rentals will remain solid, and occupier demand is on the way to recovery.

Capital markets, on the other hand, will continue to be impacted by interest rate hikes. However, after a quiet first quarter of the year, deals are expected to come through as inflation and interest rates in the region stabilise, with the total volume for investment activities expected to remain similar to the 2022 level.

Based on the findings in their report, CBRE makes the contrarian real estate investment suggestion for investors to buy office, hotel and retail, and sell logistics.

Return to office drives commercial rental growth

According to Ada Choi, CBRE’s Asia Pacific Head of Occupier Research and Head of Data Intelligence and Management, the return-to-office trend in Asia Pacific is in full swing, driving a healthy demand for companies to lease good quality buildings, with the momentum across the region led by Hong Kong SAR and Mainland China. “The fundamentals are pretty solid, particularly for newer and high-quality Environmental, Social and Governance (ESG) compliant buildings in central business districts where occupiers want to be located. Hong Kong is one market that we particularly like because we will probably see the market turn around the corner.”

However, the definition of a Central business district is changing, at least in Hong Kong, notes Choi. “Our studies show that people are looking for destinations with a good transportation infrastructure like Kowloon Station.”

The retail sector sees strong expansionary demand

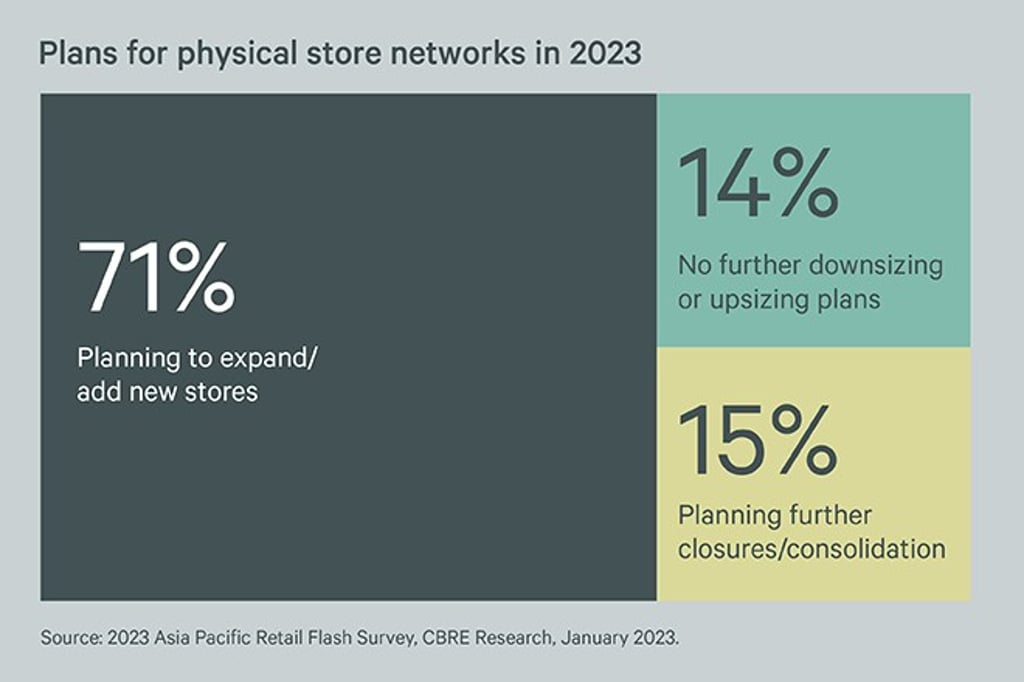

With over 70 per cent of retailers planning to open more stores in their existing markets, leasing activity is returning. “Most of the markets are seeing positive territory in retail rental growth. The return of tourists and workers to their offices is leading retailers to take up more space, especially in prime shopping malls in city centres. This will translate into better investment pieces for those interested in the retail sector. In our view, the top three markets are Hong Kong SAR, Mainland China, and Singapore,” says Dr Chin.

The reopening of Mainland China will boost the hotel sector

Mainland Chinese tourists’ return and the prolonging of revenge tourism are expected to boost the hotel sector across the region, with modest growth forecasted in 2023 and a return to pre-pandemic levels in early 2024. Dr Chin expects the rebound in the Asia Pacific region to outpace that in the rest of the world. “We anticipate stronger growth in Mainland China, Hong Kong SAR, Japan and Korea, which is another positive for the sector in these markets.”

Leasing demand and rental growth for industrial & logistics to slow

The growth in the logistics sector, which has previously benefited from the rise of e-commerce during Covid, is now normalising. “Some e-commerce companies say they are still growing but will not take as much space as before, or they have slowed down in acquiring new space because they want to improve their operational efficiencies first,” Choi explains.

But while the fundamentals are still good, they are softening compared to the previous five to ten years. Thus, CBRE made the contrarian suggestion to sell. “With pricing compressed to a lower level and rising interest rates slowing down fundamentals, we think it’s a good time to sell logistics to cash in and redeploy capital to other sectors,” says Dr Chin.

Q2 2023 is the narrow window of opportunity for investors

For investors keen to adopt a contrarian strategy, particularly to acquire good quality assets in trophy buildings and gateway cities, Dr Chin thinks the window of opportunity could be about three months. “If you look at past financial crises, the best quality buildings are only available on the market for a month or two before investors snap them up. It will be the same this time. We are expecting to see a price correction in Q2 this year before the market turns to the upside in the second half of 2023.”