CBRE survey reveals growing preference for office attendance, highlighting the value of group productivity

Despite a cautious economic outlook, 44% of surveyed companies are planning to expand their commercial real estate portfolio in the next three years.

[The content of this article has been produced by our advertising partner.]

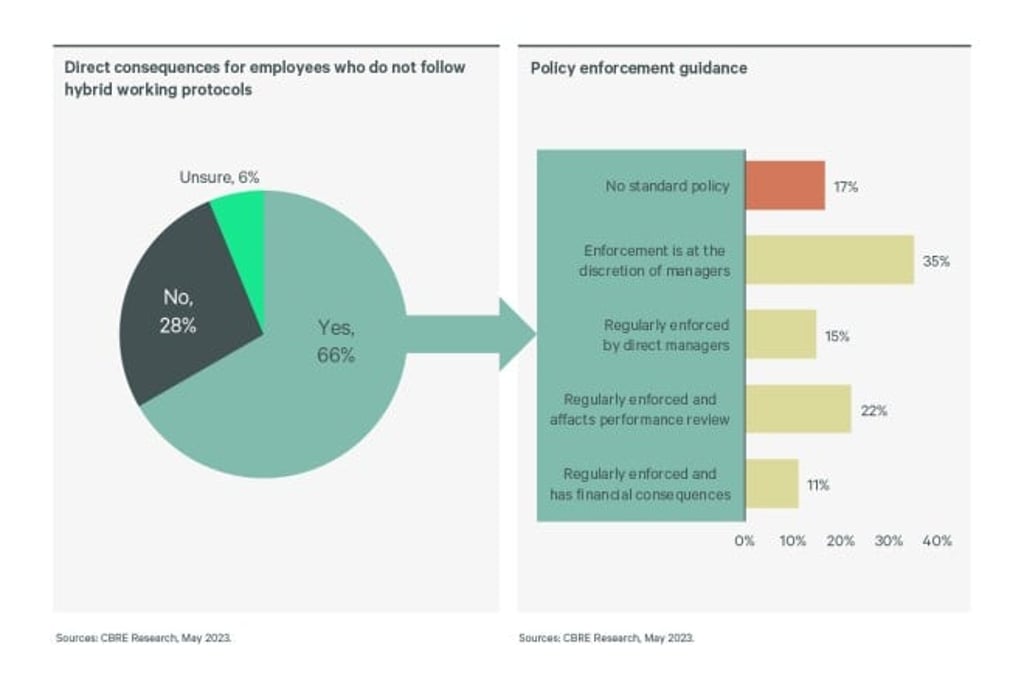

As a result, employers are now implementing stricter policies on hybrid working, favouring physical attendance for its perceived benefits in terms of productivity and collaboration.

Despite a cautious outlook on short-term economic growth, 44% of the surveyed companies are planning to expand their commercial real estate portfolio in the next three years.

Tighter policy on hybrid working

Unlike the broader acceptance of hybrid working in the US, Europe, or Australia, North Asia is experiencing a noticeable trend of returning to the office. This regional divergence could be attributed to cultural or organisational factors. Nevertheless, the global transition to hybrid working continues to unfold, with each region adopting its own approaches and timelines.

“Businesses in major cities in mainland China, and Hong Kong, Japan, and South Korea, are actively encouraging or mandating their staff to work from the office,” says Luke Moffat, Head of Advisory & Transaction Services for Asia Pacific at CBRE. “This shift reflects a growing sense of normalcy and a recognition of the benefits that in-person interaction can bring to businesses in the region.”

Despite the ongoing tug-of-war, Ada Choi, Head of Occupier Research and Head of Data Intelligence and Management, Asia Pacific at CBRE, emphasises the importance of hybrid working as a perk to attract top talent in professions where talent shortages are common, such as the tech industry. In contrast, the banking and professional service sectors have largely transitioned back to working in the office after a period of hybrid work over the past two years, she notes.

The importance of giving employees choice

Finding the right balance between work-from-home arrangements and office work is crucial. As Moffat points out, employers recognise the value of investing in office space upgrades or reconfigurations to attract employees back to the office. Having people in the office is important for team bonding, collaboration, and for less experienced colleagues to learn from senior team members, he says.

"Being physically present allows for more dynamic interactions and spontaneous discussions, which enhances efficiency and innovation. It also enables valuable mentorship and skill development, which may be more challenging to achieve remotely."

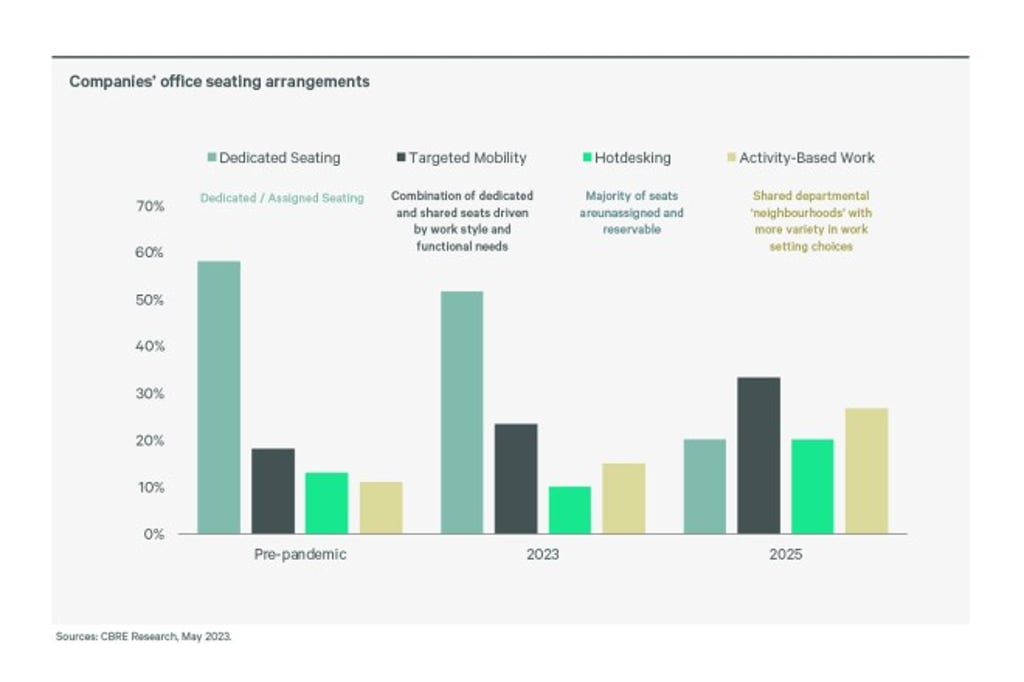

"It’s important to provide workers with a sense of choice in order to effectively motivate them to work in the office," he emphasises. Within the office environment, a flexible seating arrangement caters to various work styles, including concentration, collaboration, and presentation. It also offers the option to work while standing or seated, providing flexibility and adaptability to individual preferences.

According to the survey results, the demand for upgrading or reconfiguring office spaces into multi-functional, versatile, and adaptive environments is expected to increase to 80% by 2025 from 48% this year. This trend explains why nearly half of the respondents expressed a desire for a more refined workspace.

As well as office designs that cater more to the needs of employees, amenities such as transportation access and availability of food and beverage facilities within the building are just as important for creating an appealing workplace, according to the survey.

Optimise office space in dynamic market conditions

44% of respondents expressed their intention to expand their office footprint within the next three years. However, the majority of respondents maintained a cautious "wait and see" sentiment when it came to their short-term leasing strategies.

Notably, in certain cities, the dynamics of the office market have shifted in favour of tenants, giving them the opportunity to be more selective in their leasing decisions.

According to Choi, occupiers have the opportunity to optimise their office space by expanding in markets where the supply pipeline is strong. This strategy allows them to secure favourable rental rates and identify potential efficiencies.

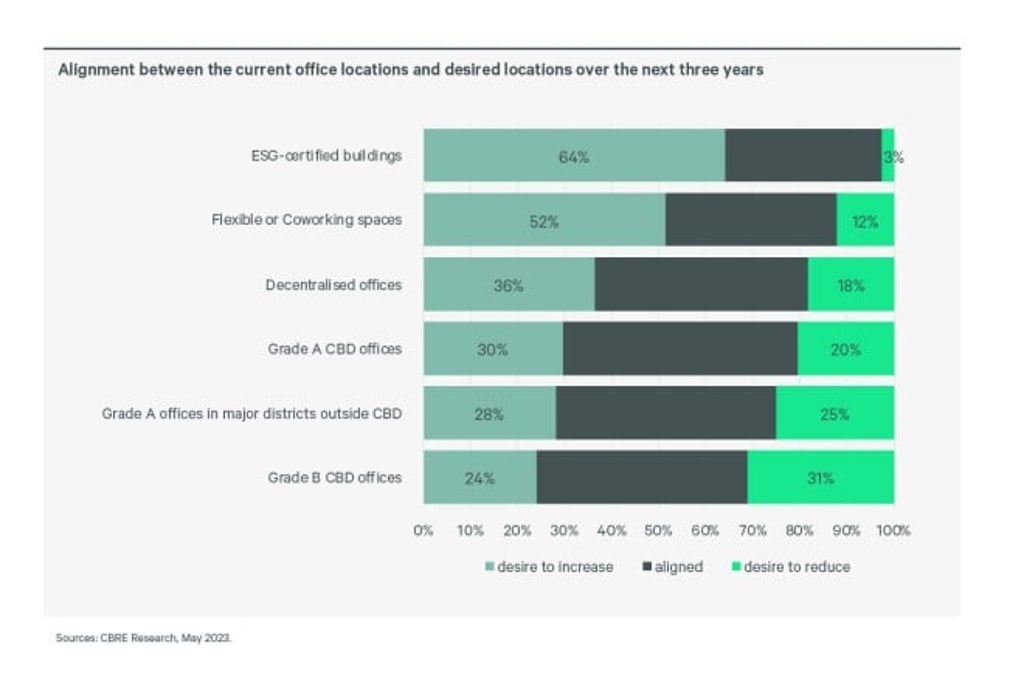

Flight to green buildings

Against this backdrop, developers are recognising the need to construct certified green and healthy buildings to attract tenants. As businesses prioritise decarbonisation and employee well-being, there is a growing demand for such spaces.

Green and healthy building certifications assure tenants that strict environmental standards are being met, while also promoting energy efficiency, water conservation, and waste reduction. The emphasis on creating a healthy working environment acknowledges the positive impact it has on productivity and employee satisfaction.

The survey results confirm that there is a growing preference for sustainable building features among tenants. With 48% expressing a desire for these features, it is clear that the "flight-to-green" trend is becoming the new norm in the commercial real estate industry.

Furthermore, 64% of respondents expressed a desire to expand into buildings that are certified for their environmental, social and governance (ESG) practices.

“In addition to well-known green building standards like LEED, the increasing popularity of healthy building certifications such as WELL and Fitwel can be attributed to their emphasis on important features like indoor air quality, outdoor spaces, natural lighting and greenery,” says Moffat.

Challenges associated with green leases

Green leases can play a crucial role in supporting landlords and tenants who are committed to reporting Scope 3 emissions, which refer to indirect emissions that occur in a company's value chain, including emissions from leased properties.

By incorporating sustainability requirements, energy benchmarking, collaboration with tenants, and monitoring and verification of sustainability measures as part of the agreement, green leases can help ensure that both parties actively contribute to sustainable practices and environmental stewardship, says Choi.

Data sharing plays a critical role in facilitating accurate reporting, collaboration, benchmarking, and measurement for both landlords and tenants in the execution of green clauses within a lease. According to the survey, a significant 47% of respondents expressed their desire to include provisions for data sharing in green leases.

Choi acknowledges that promoting green leases to encourage tenant participation is a positive step. She believes that while landlords are generally willing to share the data and benefits of green leases, they are hesitant to make these requirements mandatory. This is because they don't want to risk driving away potential tenants, especially in markets where tenants have the freedom to be selective.

“While the adoption of green leases may still have some gaps, real estate companies such as CBRE can play a crucial role in bridging this divide and encouraging tenants to embrace sustainable practices.”