Digital tools make it easier to master financial ins and outs of your business

- Up to 82 per cent of business failures can be attributed to poor cash flow management, study shows

- Firms that digitise accounting and use complementary apps can conduct financial forecasting to plan ahead

[Sponsored Article]

While checking how much money comes in and goes out might sound like a simple and straightforward affair, it can be easily neglected amid the day-to-day running of the business and fall behind because of how administrative and time-consuming it can become.

Company owners who are not adept at accounting may also find it challenging to organise the transactions they need to record, such as sales, supplier payments, and non-recurring costs.

Here we’ll discuss how to do cash flow analysis and improve cash flow management using digital tools. But first, let’s examine the risks that poor cash flow management poses to your business.

Over expenditure: When a business neglects cash flow management, it can find itself spending beyond its means. It can be tempting to hire more staff, invest in a bigger marketing budget to engage a famous influencer, or deck out your office with pool tables and free lunches.

Without oversight on your financial position, you may end up spending beyond your means without justifiable returns.

Long periods of cash shortages: You don’t want too much time to pass between cash inflows and outflows. Ideally, your business should have enough cash to pay your bills when they become due, even if you have yet to collect payments for that month.

Businesses that require large amounts of initial investment, are bootstrapped or have high operational costs need to be especially wary about extended cash shortages. Knowing that it will take time before your earnings catch up to your outflow, you need to make sure you have enough ammunition to keep going until you become profitable.

The same holds true for highly cyclical businesses, such as beach resorts and restaurants within university belts. Poor cash management will lead to the failure to plan for lean seasons, resulting in cash shortages over a period of months.

Regardless, businesses that fail to keep track of their cash flow can experience long periods of cash shortages. This can happen when customers pay their invoices late.

Data from Xero, a cloud-based accounting software platform, shows that Hong Kong and Singapore small to medium-sized enterprises (SMEs) have late payments amounting to a total of HK$13.339 billion (US$1.7 billion) and S$4.146 billion (US$3.05 billion) respectively. In Hong Kong, the sectors most affected by late payments and unpaid invoices are wholesale trade, transport, postal & warehousing, and public administration & safety. In Singapore, the most affected sectors include accommodation & food services, transport, postal & warehousing, and electricity, gas, water & waste services. It is evident that the issue of late payment is not unique to a particular industry and if addressed, can free up a significant amount of capital for SMEs.

Such a financial state is unsustainable, especially if you’ve exceeded your projected timeline for turning profitable, and sales are stagnating. You may be able to turn the business around with an influx of venture capital or private equity funding, but you can bet investors will think twice about working with a business owner who doesn’t have control of his finances.

Management of cash inflow and outflow is key

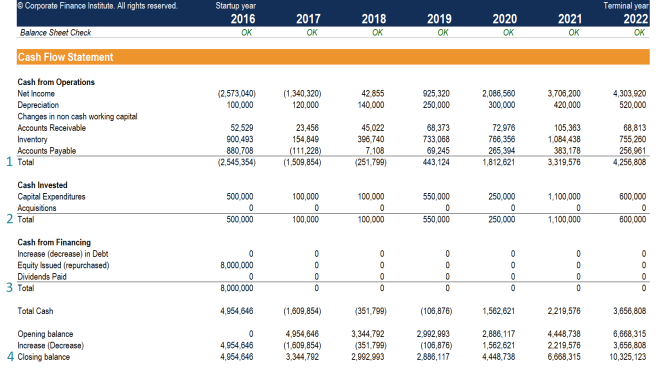

To avoid the dire situations discussed above, a business owner must know how to conduct proper cash flow management. All the money coming in and going out should be recorded in a cash flow statement. If you make a sale on credit, it doesn’t go into your cash flow statement until you receive the payment. In other words, invoices and receivables do not count in your cash inflow – only the actual cash received does.

A cash flow statement records the following activities:

Operating activities: these include sales, payroll, bills, payments to suppliers, asset depreciation, and taxes not related to financing or investment.

Investment activities: these include the sale and purchase of assets not related to the business’ day-to-day operations – for example, property.

Financing activities: these include paying a business loan, selling and buying company stock, and distributing dividends.

You’ll want to see that your cash balance this month is greater than the cash balance last month. A positive net cash flow indicates that your cash has grown over that period. On the other hand, negative cash flow means you’re losing money faster than you’re making it. A related concept is free cash flow, which is the money you have left after you’ve settled your expenses.

How technology simplifies financial analysis and forecasting

With the Hong Kong Monetary Authority’s launch of the Open Banking framework last July, companies such as Xero have introduced Open API to facilitate integration with complementary apps. As such, you can now integrate your bank feed, allowing you to view transactions directly in your cloud accounting platform in real-time. That basically means it can automatically record a payment made by your customer as an inflow in your cash flow statement among others.

While battling many unknowns, it is always good to put in place some level of stability and predictability by owning parts of the business that you can control – cash flow being one of them. Think of it as half the battle won as you set up your business for success.

Learn more on the Xero website