How digital tools can help businesses overcome economic uncertainty

- Rising costs of imports and exports caused by trade war can impact revenues and margins of SMEs

- Digital processes can boost productivity and streamline business operations so leaders can focus on strategising for growth

[Sponsored Article]

The blow to international trade can be felt across industries, especially as reduced demand from China and from the US manufacturing industry for raw materials has weakened exports.

No doubt large corporations with multinational operations are directly affected by global economic uncertainties.

Yet in reality, we also see a lot of small and medium-sized enterprises (SMEs) feeling the full brunt of the trade wars, particularly those who have yet to embrace digitisation, as they will be slower to adapt to industry changes and to optimise their operations.

Impact of trade wars on SMEs

However, with lower consumer confidence and intensifying competition, it is difficult for SMEs to raise the prices of their goods. To do so would make them less competitive against big companies that are able to enjoy economies of scale to introduce product discounts while still making a profit.

With higher reserves of cash and enough collateral to take out loans, these larger enterprises also tend to have the financial cushion to maintain operations during an economic slowdown.

In the same survey, 15 per cent of SMEs projected negative turnover growth for 2018, and 44 per cent suffered from finance-related challenges, particularly delayed payments from customers.

Together with increased unsold inventories, this resulted in an “endemic shortage of working capital and a decrease in liquidity” for SMEs.

While all SMEs are affected by the unsavoury effects of a trade war and economic slowdown, the ones most at risk of suffering the brunt of its effects are those who have not yet digitised.

How SMEs can survive – and thrive

The digital transformation of businesses has the potential to increase productivity, streamline operations, increase security, reduce costs and mitigate economic uncertainty.

By automating internal processes, streamlining workflows, implementing smart management systems and using analytics to make data-driven decisions, business leaders can redirect their energies into business improvements and focus on making more strategic decisions that drive long-term growth.

Although the digitisation of processes entails initial costs, its return on investment (ROI) comes in the form of enhancing the overall productivity and functionality of a business. And this is what can mean the difference between success and failure during these uncertain times.

For SMEs to stay afloat amid economic turbulence and remain competitive, they need to employ digitals tools that help them minimise costs and optimise their businesses.

Here are some ways SMEs can leverage technology for their business success.

Move from paper to cloud

Traditionally, businesses log their financial records and other sensitive company information on paper ledgers. Not only is this method tedious, time- and space-consuming and subject to human error, it is also a data security risk with no back-up measures.

By upgrading to cloud-based software, small businesses can store and organise vast amounts of data in one place. Cloud software can provide them with complete data protection, secure file access at any time and any place, back-up and recovery systems, and easy file sharing systems.

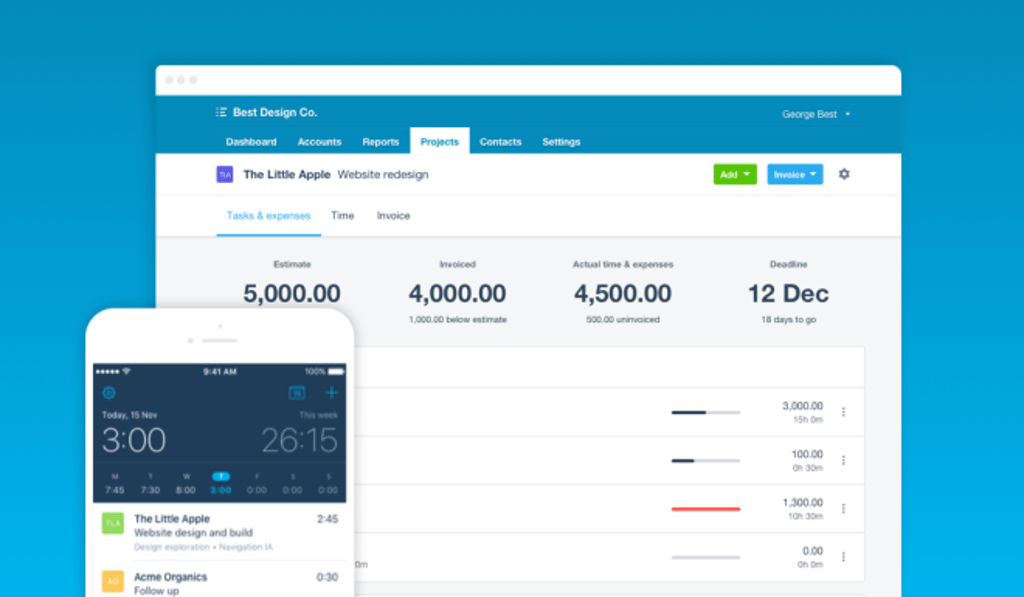

At the same time, cloud software enables automation of manual tasks such as data entry, invoicing, and bank reconciliation. It also allows integration with bank feeds and other apps through application programming interfaces (APIs).

This can help businesses increase productivity and lower costs by reducing the amount of time it takes to perform routine tasks.

Small businesses subscribed to Xero, a global business platform, saved 307 hours from March 2017 to May 2018 thanks to more than 750 million invoice and bill code recommendations, and more than 250 million bank reconciliation recommendations delivered by the platform’s machine learning capabilities. These systems help automate tasks and identify and correct errors in accounts.

Automate manual HR functions

Well-trained staff who work well together and have an in-depth knowledge of the business will be especially important during economic uncertainties, as they are better positioned to improve the products and services to drive sales. Successful retention will also cut the cost of employee turnover and hiring.

Use inventory management software

Data analytics can be used to understand inventory and sales trends and predict future demand for each product. This allows a business to adjust its orders accordingly, avoiding excess or insufficient inventory.

Manage a firm’s relationship with customers

A sales team needs to be able to manage and follow large numbers of leads – and fast. This entails storing vast amounts of data and implementing a system that will help you find, generate, get in touch with and follow up on leads.

Customer relationship management (CRM) is a tool for managing an organisation’s relationship with existing and potential customers. It serves to meet the needs of the sales team and can take on all the logistical tasks of engaging with customers.

Speed up payments with digital solutions

● a 20 per cent reduction in Days Sales Outstanding

● a 25 per cent reduction in past-due receivables

● a 15 to 25 per cent reduction in bad-debt reserves

Make use of e-commerce

Without the large capital required to set up a brick-and-mortar store, e-commerce can help level the playing field between SMEs and large corporations.

Additionally, by analysing the data stored in the platform, SMEs can understand their customers better and implement strategies that can generate more revenue. These include predicting product demand in individual markets, identifying new markets, implementing dynamic pricing and personalising online marketing campaigns.

What can digital transformation mean for SMEs?

These are just some of the many digital solutions available to SMEs in the market. They are a testament to the way digitisation has deeply transformed how businesses operate, making them significantly more efficient, productive, and collaborative.

Digitising operations will inevitably incur costs, but it may be more costly for a business to miss out on the tangible benefits that tech transformation can deliver.

Learn more on the Xero website