How the rise of ‘super app’ platforms has transformed small business operations

● Today’s software solutions can deliver full-suite of cloud-based offerings on one platform to cover all business needs

● Accounting software now exceeds core functions and through app integrations offers complete visibility of financial numbers

[Sponsored Article]

Platforms or “super apps” are nothing new to consumers. In the business to consumer (B2C) space, super apps such as WeChat in China and Grab in Southeast Asia have transformed our lives as we know it.

They empower us with the ability to arrange transport, send payments, order food and buy goods all through one app – from anywhere at any time.

Similarly, smartphones can be considered platforms. These smart devices give us access to a vast app ecosystem, from which we can download apps for various aspects of our daily lives.

Each person’s combination of smartphone apps will be different from everyone else’s – making each mobile “platform” unique.

Consumer technology has been evolving at an accelerated pace – and in many developing countries by leaps and bounds. But it is only now that businesses are gaining access to the beautiful world of platforms.

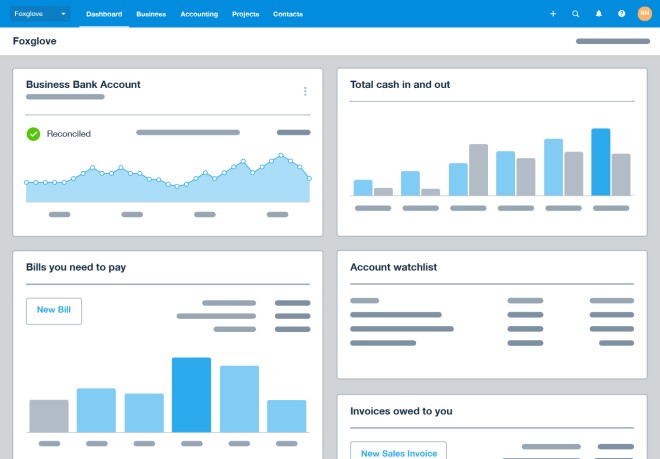

A good cloud accounting platform, for example, helps companies to scale with ease – even with limited resources. It can also transform business operations by allowing integration with other cloud software.

How platforms can help businesses

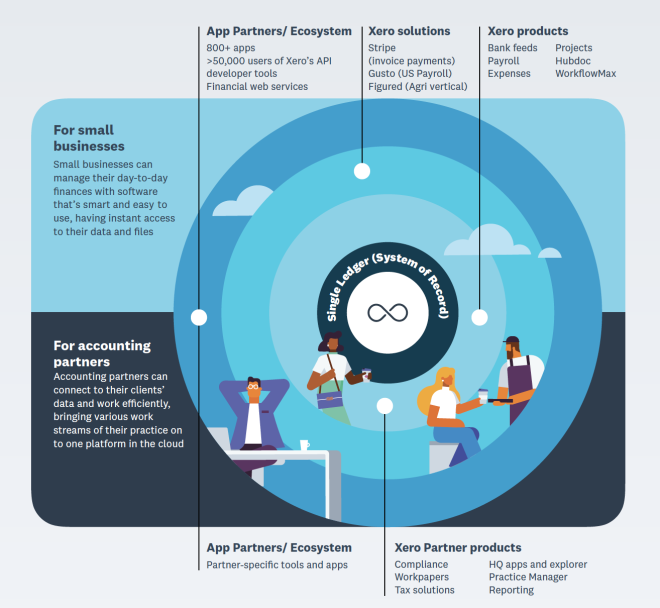

Platformisation – the adding of tools and value to your operations platform – transforms cloud accounting software into something far beyond a simple bookkeeping solution.

It incorporates business features such as inventory management, human resources and payroll management. The integration of bank feeds and payment providers also helps to make it easier to carry out loan applications and payment transactions.

These add-ons create a customised operations platform offering full visibility of the performance of a business, with numbers flowing directly from various sources into a single platform. They enable speed and transparency within the organisation and have a positive impact on other business aspects.

In addition, moving to a cloud-based accounting platform will give small businesses and start-ups secure 24/7 access to extensive company data.

How do you assemble a B2B cloud platform?

Think of every element below as a link in a chain: the first one acts as an anchor to which other functions can be attached to form a comprehensive business-to-business (B2B) cloud platform serving all your operations needs.

Accounting software

Deemed the anchor in this platformisation process, this is the most critical choice small business owners will make. When selecting a cloud accounting provider, it is essential to assess the power of its platforms i.e. the number, quality and type of partners that can integrate with it.

App partners

One app can offer a multitude of consumer and business services on its own, equivalent to the workload of at least one headcount.

One example would be Xero’s ecosystem of over 800 app partners that can cater to various business needs and functions. Its ecosystem already has integrations for payments, payroll and HR tools, and data reporting. It also offers apps for alternative financing (such as Validus Capital, MoolahSense, InvoiceInterchange), e-commerce transactions (such as Shopify, A2X, BigCommerce), and inventory management.

This means that any business can shift to cloud-based services for all (if not most) of its administrative tasks, not just accounting.

No business owner wants to track every transaction manually. Accounting platforms that connect to reliable banking institutions, reconcile bank transactions in bulk and handle multiple currencies can help to save countless man-hours and avoid costly human errors.

On the flip side, small businesses can leverage accounting platforms’ API to offer their own services to current and future users. This is especially useful for SMEs in fintech, such as the financial services and e-commerce companies with Xero app integration, or Software as a Service (SaaS) start-ups with connected service offerings.

Accountants and bookkeepers

The success of any accounting platform depends on the professionals who will use it the most: accountants and bookkeepers. They determine if a platform abides by industry standards and country regulations and if they can use it without encountering any problems.

Yet platformisation also means they can offer and customise their own services through only one SaaS.

Business owners and start-up founders

Business owners are an integral part of the business platform. With all the mentioned platform players providing data that flows seamlessly into the accounting platform, business owners will always have access to all of their financials.

When business operations such as invoicing, payment and forecasting are done in a timely, professional manner it has a ripple effect leading to better cash flow management, as well as customer and vendor relationship management.

In a world where word of mouth is a key way to acquiring new business, this carries more weight than standard promotional material and endorsements.

Future tax-filing developments

National governments often change their regulations for tax preparation, categories and filing procedures so they can keep up with local or global developments – and get their slice of the “pie”.

Platformisation is the way forward

Businesses and start-ups need to take the cloud accounting selection process seriously.

The accounting platform they choose must build upon its core offerings with custom or partner apps to offer complete access to financial data and preferred services.

Since no platform is complete without its users, it must enable business owners and staff to build stronger connections with – and on – it, as well as add their own services to create a customised suite of business operations solutions.

Only then can companies capitalise on the full potential of platforms to deliver customer value and positive business outcomes.