The road ahead for cryptocurrencies: an industry strategist explains why inflation could drive the next market rally

- AAX’s Ben Caselin delves into the reasons why investors are looking to bitcoin and other cryptocurrencies as investible assets

- He sees continued growth and dominance for bitcoin, but also recognises that innovations are drawing attention to alternative cryptocurrencies

[Sponsored article]

The cryptocurrency market has made global headlines in financial media this year, thanks in part to wild swings in the price of bitcoin. But the relative calm in that space in recent weeks offers an opportunity to take stock of fundamentals not only for bitcoin, but also the universe of alternative coins, or altcoins.

According to a senior researcher at a leading crypto-exchange, what lies ahead could be a bullish setup for a range of crypto assets including the time-tested bitcoin, as well as innovative smart contract platforms, stablecoins, meme coins and other tokens.

Ben Caselin, head of research and strategy at Singapore-based crypto-exchange AAX, explains that monetary policy decisions amid the Covid-19 pandemic are set to drive a wave of inflation – and the resulting loss of purchasing power in traditional fiat currencies.

If inflationary pressures don’t prove to be transitory – as is expected by many analysts – investors will increasingly look towards cryptocurrencies as a store of value.

In April, bitcoin surged to an all-time high above US$64,000, but has since dropped to about half that value. Yet it remains attractive as a hedge against inflation, because it has a limited supply that allows only 21 million coins to be mined.

“Bitcoin very specifically offers a fixed predictable monetary policy, hard-coded – we know how much will be mined each year,” Caselin notes. “We know that the supply is finite. If anything, it will shrink if people lose their keys [issued to access purchased bitcoins].”

Caselin also has an upbeat outlook on innovation taking place elsewhere in the cryptocurrency space, but cautions that investors need to tread carefully, given the huge number of offerings and uncertainty over which platforms will become dominant.

“Currently, there are more than 10,000 individual coins and other tokens trading on global crypto-exchanges, but over the coming decade we expect these numbers to decline significantly to a point where only four to five crypto projects will actually prove to be durable,” Caselin says.

Striking the right balance in crypto trading

AAX, which was developed in collaboration with London Stock Exchange Group’s LSEG Technology, supports roughly 50 crypto assets, which range from household names such as bitcoin and ethereum to more esoteric altcoins.

In deciding which crypto assets trade on the AAX platform, administrators deploy a “benevolent strategy” to identify projects that they believe have the best chance of success, while others are selected under a “tolerant strategy” to reflect user demand.

“We have to strike a balance between what we believe is a correct direction and more sustainable, and what users are actually coming for due to hype,” Caselin explains. “Some users are just coming to trade that [one asset], and if you don’t offer it, they’ll go somewhere else.”

Although Dogecoin, Shiba Inu and Baby Doge were popular altcoins among traders recently, AAX still chose to leave thousands of similar offerings off its platform because of their questionable value, according to Caselin.

He says AAX tries to find the right balance when it comes to what is popular, while also providing educational information to act as a guide for investors.

In addition, AAX is supporting what it considers “high quality” blockchain projects such as Solana, a fast-growing smart contract platform focused on rapid transactions.

“We’ve noticed that during periods of downturn – when bitcoin is down, everything is down – Solana was able to actually grow and see price appreciation,” Caselin says, adding that these trading patterns indicate demand for this platform’s native token based on credible fundamentals.

The cryptocurrency space is still evolving

While price volatility has left some investors wary of the cryptocurrency space, there are signs that the sector is maturing as it gains mainstream acceptance.

Bitcoin is becoming increasingly resilient in the face of negative news or restrictive government policies, Caselin says, noting the muted response in terms of price decline following the recent announcement that Beijing would ban banks from handling cryptocurrency settlement.

“It went down [by] a few percent and then it just recovered, and that’s very different from a few years ago,” he notes. Bitcoin’s market capitalisation topped US$1 trillion as recently as April, but has since slid back to around US$600 billion.

Another explanation is that crypto assets generally stabilise over time. Caselin noticed a pattern in which Dogecoin “has matured [compared] to how it was two years ago”. Meanwhile, Shiba Inu, a meme coin that launched in August last year, has experienced wild speculative trading activity akin to bitcoin’s early days.

Looking ahead, Caselin expects that bitcoin will benefit as institutions allocate some of their holdings to the asset as a hedge against a potential monetary crisis.

“[With] bitcoin, for some it’s a conviction, for some it’s a threat – but even if it’s a threat, you might have to hold it, simply as a hedge against its potential success,” he says.

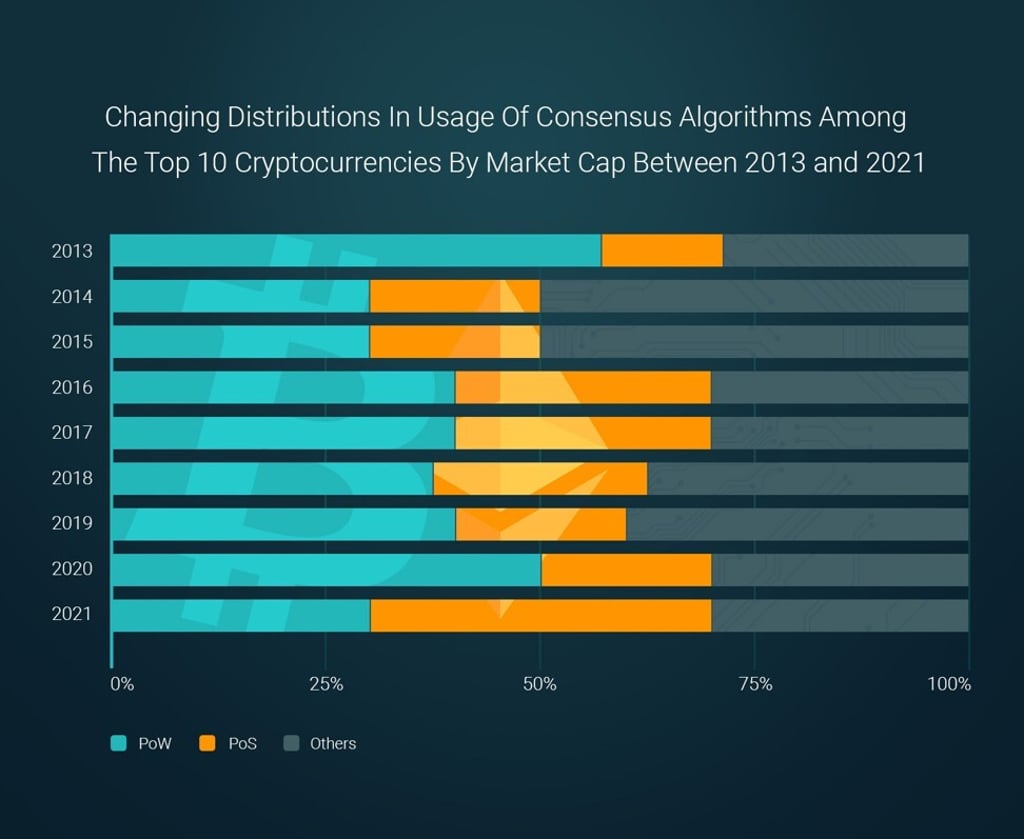

Still, Caselin acknowledges there has been debate within the industry about the future of bitcoin, which uses the proof-of-work (PoW) consensus protocol, and whether the tide will turn to favour assets that use an alternative consensus protocol such as proof-of-stake (PoS), the algorithm that underpins ethereum and other altcoins.

PoW relies on large amounts of energy for the computations used to mine coins, which keeps operations anchored in the real world while also driving competition in the market. PoS provides mining power based on how many coins are held by a miner, and while it is seen as easier and more eco-friendly, it is also wholly digital and considered to be less secure. Caselin also notes that PoS also has an inherent tendency to centralise, whereas the opposite is true for PoW.

Although the bitcoin network is still growing, there are some in the sector who believe it could be displaced as the dominant cryptocurrency platform in the future, as new innovations based on PoS continue to emerge.

Still, Caselin remains confident in bitcoin as a reserve asset, seeing it as a safe choice for years to come given its fundamentals. But for investors who may be wary of becoming overly concentrated in a single asset, he suggests they diversify their portfolios across a range of core themes in the crypto markets.

The information provided in this article is for educational and informational purposes only, and is not intended to be and does not constitute financial advice, investment advice, trading advice, an invitation to invest, or any other advice. All content provided by our sponsors is purely their opinion, and SCMP does not warrant or represent that they are factually correct, and will not be responsible for and will disclaim all liability to the extent permitted by law should you decide to take any action. Please conduct your own due diligence and consult your own independent adviser if deemed necessary.