Fat chance of staff cuts after PetroChina headcount doubles

Profit growth has masked bloated headcounts at some state enterprises, and there's little prospect of change despite leaner economic times

Making Jiang Jiemin, the former chairman of PetroChina, the head of the State-owned Assets Supervision and Administration Commission (Sasac) is a big sell for state enterprises.

The oil giant spearheaded the so-called jian yuan zengxiao - downsize-for-efficiency - campaign launched by the then premier Zhu Rongji back in 2000. His formula for building an efficient and competitive state enterprise was to trim staff numbers, cut expenses and then list the business.

In its 2000 prospectus, the company made much of its leaner 441,000-strong workforce; a plan to cut 50,000 more; and a share reward scheme for its management, or a pledge to be a genuine business.

Guess what? In its 2012 annual report, PetroChina reported having 866,666 people on its payroll, including 548,355 employees and 318,311 seasonal workers. Exxon Mobil, the world's largest oil company, has just 76,900 regular employees.

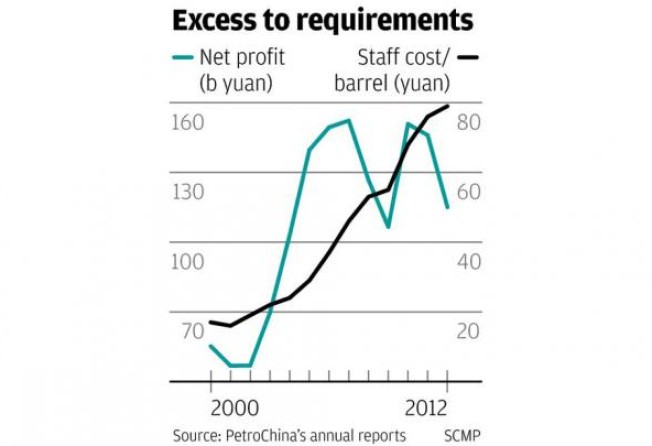

How did it happen? For over a decade, management justified the higher headcount with higher output and sales, with its production rising by 58 per cent over the years. That can hardly justify a doubling in staff and certainly not a 133 per cent increase in the number of people at its headquarters.

A recent episode at rival Sinopec is perhaps more telling. In January, Sinopec chairman Fu Chengyu ordered the "cancellation" of new employment contracts for 816 fresh graduates. They were signed up by regional subsidiaries in their "annual hire" but most of them turned out to be the sons and daughters of people already on the payroll. The company said it would do a round of centrally co-ordinated open recruitment instead.

That never happened. The so-called central hire is no more than a desperate move by the new chairman to control rocketing costs.

As for PetroChina, the annual hire went ahead as usual. After all, it is the most profitable oil company in the country.

"You should realise that the company is a growing one. In comparing to its hundreds of billions yuan of revenue, a one billion yuan [rise in the] salary bill is peanuts," Jiang said when challenged by the media in 2010. About 80 per cent of the staff growth happened during his leadership between 2007 and last month.

In other words, growth can easily mask excessive fat. Indeed, PetroChina's staff size did not take off until 2004 - a year after the start of a decade-long rally in oil prices, Zhu's retirement and the creation of Sasac to protect the interests of SOEs.

Thanks to the trebling of the oil price in the past decade, PetroChina has been able to absorb a seven-fold increase in its per-barrel staff expenses and a doubling of sale and administration costs per barrel, without much impact on profit and therefore shareholder complaint. This is despite the fact that all the increases were way above inflation.

Even the drop in net profit margin from 22 per cent to 5 per cent didn't seem to bother the management or the government. After all, what is the point of having profitable state enterprises if they don't create jobs?

The big question is: now what? What are they going to do to survive a slowing economy with the excessive fat?

Sinopec's Fu provides the cue again. He told a staff meeting in January that "staff size has to be controlled and productivity has to increase". The cue is not in his words but the fact that he's the only top SOE manager that has talked and acted on staff cost controls so far.

Most SOEs experienced a significant drop in profit, if not massive losses, last year. Among them was PetroChina, which had had its worst fall in profit since its 2000 listing. Yet, none of them mentioned controlling staff costs.

SOE managers are parrots. Obviously, control of costs, in particular staff, has yet to become an order from the top.

But, who would have the courage to demand SOEs do another round of "downsizing for efficiency" when the economy is slowing, and the wealth gap and social discontent are at record highs?

Who has the guts to risk a headline that says companies are "paying overseas shareholders at the expense of mainland workers"?

The answer is: nobody. If there were someone with the courage, Jiang would not have been chosen to lead state enterprises through the coming difficult time, given his alarming track record.