SFC makes right move by acting as corporate regulator

Watchdog vows to keep a closer eye on the conduct of listed companies and their directors

The Securities and Futures Commission has made the right move in signalling it will keep a closer watch on the conduct of listed companies.

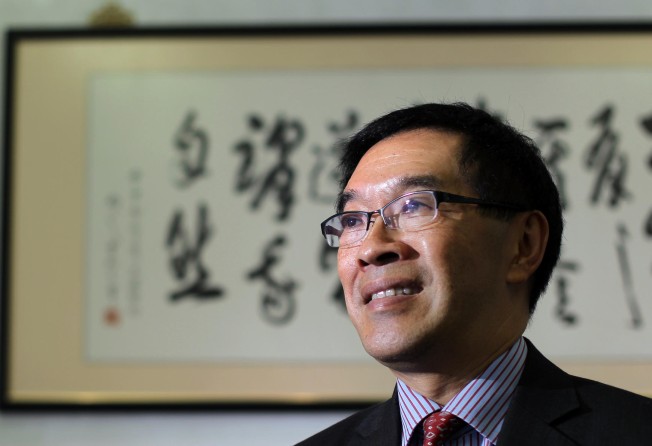

Chairman Carlson Tong Ka-shing said last week that the regulator had set up a team to actively review company announcements and reports with the aim of identifying problems early. In particular, companies with a history of losses or those announcing frequent restructurings will come under closer scrutiny.

Tong said the move was prompted by concerns over instances of serious corporate misconduct and the need for early detection of problems to limit damage to the market.

The SFC's more active stance is a welcome development, given the backdrop of uncertainty over regulatory roles in the city, with Hong Kong Exchanges and Clearing also a player here.

Since it was set up in 1989, the regulator has been tasked with cracking down on malpractice by brokers, fund managers or financial advisers licensed by it. It also devoted attention to developing the fund industry, while remaining vigilant against securities trading-related offences.

Brokers and fund mangers are well aware that they are answerable to the SFC if they breach any rules. Investors also know it will be keeping watch for any market manipulation. But a question mark arises over just who is the relevant regulator when it comes to the conduct of directors or management of listed companies.

The stock exchange is the frontline regulator of listed firms, but it is a watchdog with no teeth. If a company comes to the attention of the exchange for poor management, it may investigate that company and its directors. But it is not a statutory regulator, so it lacks the power to launch prosecutions or impose fines. Instead, the offenders may get a reprimand or be sent off for a corporate governance course. Not much to fear, then.

It becomes a different story with the SFC now stepping up its monitoring of corporate behaviour. The commission, as a statutory regulator, has the power to prosecute wrongdoers and impose fines. Recently, its favoured weapon has been section 213 of the Securities and Futures Ordinance, under which it can apply for a court order to force companies to pay back the victims of their crimes.

The SFC has shown a willingness to act. On Friday, it filed a court order to freeze HK$1.97 billion worth of Qunxing Paper's assets, alleging it provided misleading information to the public, and force the firm to buy back shares from investors. This came a day after it secured a court order requiring convicted insider Du Jun to pay back almost HK$24 million to investors who suffered losses from his insider dealing trades in 2007.

Wronged investors will be happier to get their money back rather than see the culprits given a slap on the wrist.