Dalian Wanda’s backdoor listing deal with Beijing Soft Rock called off

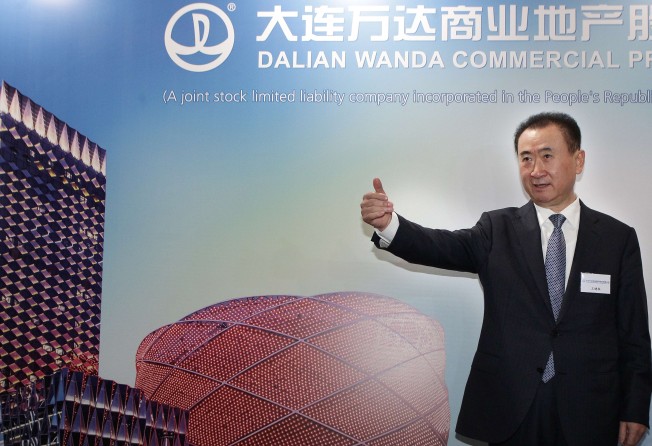

Tycoon Wang Jianlin’s ambitions to relocate his real estate empire from Hong Kong to mainland China isn’t going as smooth as expected as a mainland-listed company on Monday announced the termination of a deal with his Dalian Wanda Group.

Beijing Soft Rock Investment Group said in a statement to the Shenzhen bourse that it had been in negotiations with Dalian Wanda Group to issue company shares in exchange for all the shares in Dalian Wanda Commercial Properties.

“After repeated discussion, relevant parties were not able to reach agreement on the timetable of the major asset restructuring,” said the company, whose Shenzhen-listed shares have been suspended since September 26.

Dalian Wanda Group said in a statement that it only made initial contact with Soft Rock and that there hadn’t been any formal negotiations or agreements.

A source from Dalian Wanda Group, who requested anonymity, said the company still has many choices and Soft Rock was just one of the potential targets.

Wanda Commercial, the property arm of Wang’s Dalian Wanda Group, was delisted from Hong Kong on September 20 via a HK$34.5 billion buyout as Wang sought a backdoor listing for its property business on the mainland in order to achieve a better valuation.

The undervaluation of Wanda’s shares in Hong Kong made him “feel sorry” for shareholders and investors, Wang, China’s richest man, said in an earlier interview.

Wanda Commercial is aiming to go public on a mainland exchange by either August 31, 2018, or within two years of the Hong Kong delisting, or Wang has promised to buy back its shares with up to 12 per cent annual return for investors who funded the privatisation.

Besides Soft Rock, Shanghai-listed China Sports Industry Group is rumoured to be another potential “shell” for Wanda.

Shell companies refer to poorly-run listed companies that are willing to transfer control to other investors and cash out from their business.

Shares of China Sports Industry have been suspended from trading since November 14.

The state-owned company said its largest shareholder, General Administration of Sport, plans to sell all the shares it holds.

Last month, Financial Times reported that UBS, one of the two lead financial advisers in Wanda Commercial’s privatisation deal, withdrew from the advisory post after it became uncomfortable with the structure of the transaction.