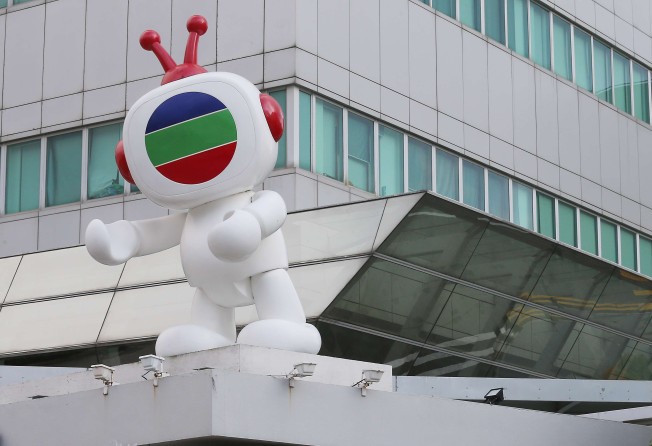

TVB shares rise to 11-month high on takeover offer by China’s TLG

Little-known TLG has made an 11th-hour takeover offer to thwart the HK$4.2 billion plan by TVB’s controlling shareholders to tighten their grip on Hong Kong’s main free-to-air terrestrial broadcaster

Shares in Hong Kong’s main free-to-air terrestrial television broadcaster TVB rose to an 11-month high, triggered by an announcement that the company had received an unsolicited “conditional cash partial takeover offer” on Wednesday night.

The 11th-hour offer by little-known TLG Movie and Entertainment Group, is to buy a 29.9 per cent stake of Television Broadcasts, in a move that could disrupt the two-week-old share buy-back plan aimed at strengthening the existing shareholders’ hands on the network.

“The market has reacted with mild enthusiasm as there are still a lot of uncertainties surrounding the buyer’s financial conditions and whether this deal will come true in the end, ” said Ronald Wan, chief executive for Hong Kong-based Partners Capital International.

TVB shares rose as much as 5.9 per cent to an intraday high of HK$31.40 before settling 3.2 per cent ahead at HK$30.60, the highest level since March last year. As many as 1.64 million shares changed hands, almost triple their daily average in the past year.

Hong Kong-incorporated TLG is part of Beijing-based Top Legend Group, which calls itself an investor in real estate, entertainment and media.

TLG was interested in TVB’s intellectual property and had been in contact with the 49-year-old broadcaster since 2007 to acquire its trove of films, sitcoms and archival footage, the company’s founder and chief executive Alex Chow (周藝強) said in a telephone interview with the South China Morning Post.

In response, TVB spokesman S.Y. Tam said: “As our statement [on Wednesday] said, the offeror is not known to us. We therefore would be interested to know who are the senior management in TVB that Mr Chow has been in touch in the past 10 years.”

TLG’s unsolicited takeover, however, throws a spanner in the HK$4.21 billion proposal announced in late January for TVB to repurchase 138 million of its shares at HK$30.50 each, which would be funded by the broadcaster’s internal cash resources.

The buy-back would raise the 29.9 per cent stake held by its biggest group of shareholders – called Young Lion Holdings and its concerted parties – to 43.66 per cent, which will trigger a mandatory general offer.

Young Lion, with 26 per cent of TVB, is controlled by the broadcaster’s chairman Charles Chan Kwok-keung, while unknown stakes are owned by Chinese media mogul Li Ruigang and HTC Corp chairwoman Wang Hsiueh-hong.

Li, founder of China Media Capital, bought an undisclosed stake in Young Lion in April 2015 and was named TVB’s vice-chairman last year.

Mona Fong Yat-wah, general manager of TVB and the second wife of the broadcaster’s founder, the late Sir Run Run Shaw, owns 3.9 per cent of the network and may act as a concerted party of Young Lion.

TVB issued US$500 million (HK$3.9 billion) worth of 3.625 per cent notes in October 2016. The funds raised were supposed to finance the broadcaster’s development, Chow said.

“I don’t think it benefits TVB’s minority shareholders for the company to use the funds from the note issue to repurchase its shares,” he said. “It will be very difficult for us to get into TVB if the controlling shareholders raise their stake to 43 per cent, so we have to make the offer now.”

In offering its takeover, TLG said it wanted TVB’s shareholders to vote down the January 24 buy-back offer as well as a so-called whitewash waiver, which is a corporate law concept originating in Hong Kong and Singapore aimed at thwarting hostile takeovers. The offer was also contingent on the “approval or no objection from the Communications Authority of Hong Kong”, TLG said in a February 8 statement to the stock exchange.

The Communications Authority would monitor the situation and await TVB’s evaluation of the proposal, the regulator’s chairman Ambrose Ho Pui-him said on Thursday.

“We will ask TVB about the status of the change in shareholders,” Ho said. “They need to seek the approval of the authority if TVB proceeds with the change.”

TVB’s shares soared 12.8 per cent on January 24 to a three-month high of HK$30, just before it announced its repurchase plan. The buy-back was priced at a premium of 14.7 per cent from the stock’s previous close.

The broadcaster’s 2015 net profit fell 6 per cent to HK$1.33 billion. The network issued a profit warning in December for its 2016 financial results, citing Hong Kong’s lingering economic malaise, the costs associated with covering the Rio 2016 Olympic Games and start-up losses at its television set-top service.

Additional reporting by Zen Soo and Viola Zhou in Hong Kong