HK$10 billion annuity plan will guarantee monthly payout for Hong Kong retirees

HK$1 million lump sum investment will generate HK$5,300-HK$5,800 a month, depending on gender; HK$50,000 will get HK$265-290

Hong Kong is to launch a HK$10 billion (US$1.3 billion) public annuity scheme under which retirees will be able to invest a lump sum in exchange for a guaranteed monthly income until death, the government announced on Monday.

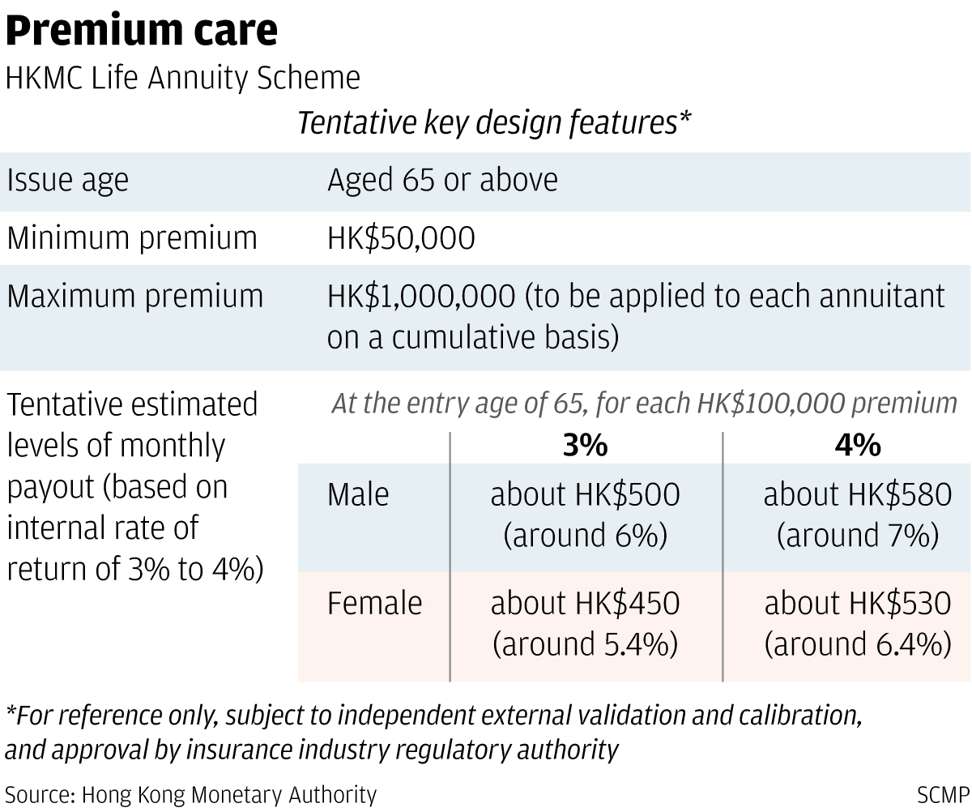

People aged 65 and above will be allowed to invest between HK$50,000 and HK$1 million under the scheme, to be launched in the middle of next year by the government-owned Hong Kong Mortgage Corporation (HKMC), according to Norman Chan Tak-lam, chief executive of the Hong Kong Monetary Authority.

“At HK$1 million, a male at age 65 will get a guaranteed monthly return of about HK$5,800 per month until death. This represents a return of about 4 per cent,” Chan said on Monday in a briefing to the media.

Retired women are expected to live longer so their monthly payment will be slightly less – about HK$5,300 if they pay the maximum HK$1 million.

Men who pay the minimum HK$50,000 will receive HK$290 per month while women will get HK$265.

“The low minimum threshold is aimed at allowing more low-income retirees to join the scheme. It is not designed just for the wealthy retirees,” Chan said.

With a total size of HK$10 billion, the scheme could accept 10,000 retirees who each put in HK$1 million or up to 200,000 retiree who pay in the minimum HK$50,000 each.

“Due to the rapidly ageing population of Hong Kong, enhancing the quality of living of the elderly after their retirement is one of the key policy focuses of the government,” financial secretary Paul Chan Mo-po, said at the briefing. He announced the plan in broad terms as part of his budget in February, but the details only emerged on Monday.

The annuity “will provide an additional financial planning option to the elderly, to help them turn cash lump sums into life-long streams of fixed monthly income, so that they can better enjoy the rest of their lives,” Chan said.

Due to the rapidly ageing population of Hong Kong, enhancing the quality of living of the elderly after their retirement is one of the key policy focuses of the government

The products will be sold through banks, while the investment will be handled by the HKMA which would invest the money through the Exchange Fund, Hong Kong’s local reserves fund.

HKMC will offer a guaranteed return, so if the markets turn bad it will use its own reserves to make sure investors receive the monthly payment they have been promised.

Those who live longer will benefit the most from the scheme because the HKMC will continue to pay until the person’s death.

Under the current structure, an investor would get back all the money he or she had initially invested within 15 years. If they live longer than that, they earn extra money. If the investor dies within 15 years, what remains of his or her initial investment would be left to the family.

Investors can also opt to leave the scheme and take the remaining money out if they need the money urgently.

“This option would help the investors to feel more comfortable buying the annuity,” said HKMC chief executive Raymond Li Ling-cheung.

Henry Shin, chief executive of Convoy Financial Services, said many elderly people would prefer to keep their money in their own pocket.

“They would be reluctant to pay such a large sum of money to buy the products. They would also worry about the fee issue,” Shih said.