China to erect fewer farms, generate less solar power in 2017

China’s 2017 installations and generation will shrink for the first time in five years, causing global capacity to grow by a mere 1.3 per cent, a far cry from last year’s 35 per cent surge

China, home to the world’s largest installations of solar farms, will install fewer panels in 2017, taking a breather for the first time in five years, amid arrears in government subsidies and bottleneck problems with the country’s power grids, analysts said.

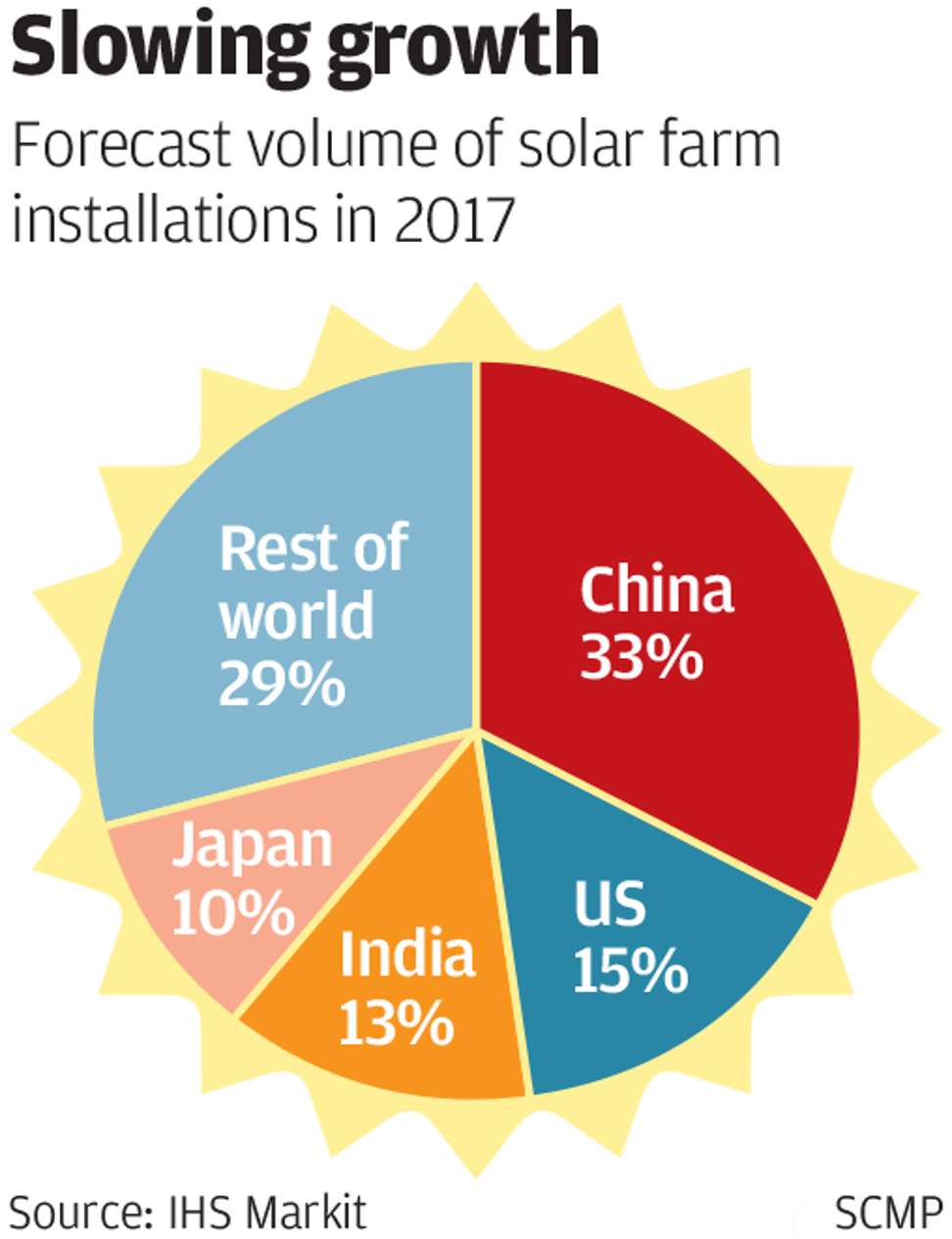

Chinese solar farms will add between 26 and 28 gigawatts (GW) of power generating capacity this year, with their share of the global market shrinking to 33 per cent from 44 per cent in 2016, according to forecasts by IHS Markit. Worldwide installations would grow by a mere 1.3 per cent to between 79 and 85GW this year, a far cry from last year’s 35 per cent surge, owing mostly to reduced volume from China, IHS said.

“Global demand in the second half, like in last year, will be highly affected by Chinese policy,” IHS principal analyst Edurne Zoco said at the annual SNEC solar power industry conference in Shanghai.

Chinese companies erected 34.5GW of solar farms last year, of which two-thirds, or 22GW, were done in the first half as developers rushed to complete their projects ahead of a June 30 government deadline to reduce subsidies on clean energy. A further cut to tariffs is on schedule for projects that are not completed by June 30 this year.

Owing to problems in transporting electricity from remote areas around China, the emphasis recently has been on the less sunny central and southern regions close to consumers as well as on rooftops of industrial buildings in urban areas.

But these industrial projects have only been able to sell 60 per cent of their output to building occupants, compared with 80 per cent expected earlier amid slower industrial power demand growth, according to Asia Europe Clean Energy (Solar) Advisory’s founder Frank Haugwitz.

The subsidies have been funded by a renewable energy levy on the electricity bills of non-residential and agricultural end-users, which has risen to 1.9 fen (0.3 US cent) per kilowatt-hour (kWh).

Meanwhile, the Chinese government has fallen into arrears on subsidy payments to some solar operators after the fund set aside for these payments ran into deficit.

“About 45GW, or 60 per cent of operational wind and solar farms, are entitled to receive the subsidies, but more than 30GW are still waiting to be approved for the disbursement,” Haugwitz said. “New sources of funding need to be identified soon.”

Already, to control the deficit and encourage greater technology innovation and production cost reductions, new projects are increasingly allocated based on open bidding on power prices.

Beijing has also announced a plan to shift some of the financial burden on subsidising clean-energy development to fossil-fuel power generators through a carbon emission quota trading mechanism. The scheme is expected to be launched in the next few years.

Meanwhile, Zoco expects China, India and Japan and the United States, the top four markets, to account for nearly 70 per cent of global solar farm installations this year. This comes even as China, the US and Japan could see their combined volume growth fall by 9GW, or 16 per cent, to 47GW.

However, growth in India and Latin America will partly offset that decline.

The global slowdown will pose a significant challenge for solar panel and component suppliers already grappling with an oversupply due to aggressive capacity expansion in the past two years when demand was strong.

Zoco projected their combined production capacity would grow 5 per cent, down from 17 per cent last year and 21 per cent in 2015.