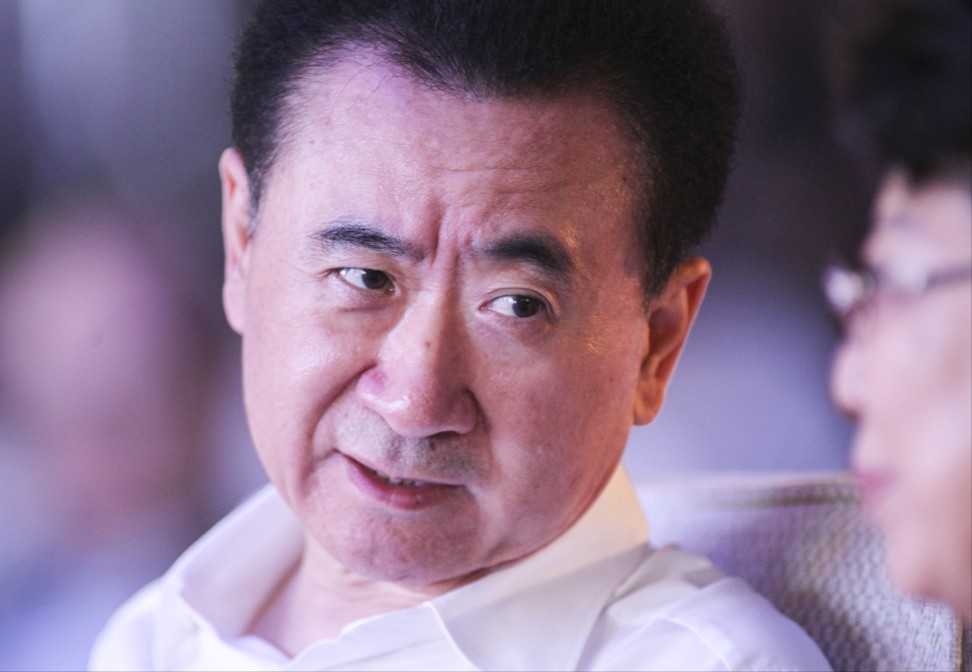

Wang Jianlin sells most of Wanda hotel and tourism portfolio to rival magnate for US$9.3 billion

Proceeds from the disposal will be used to repay loans, according to a report in Caixin.

Wanda Group, one of China’s most aggressive overseas asset buyers of recent years, has announced the disposal of the majority of magnate Wang Jianlin’s hotel and tourism portfolio to a rival, in the country’s biggest single property transaction, as it raises funds to repay loans.

Wanda will sell 76 hotels under its eponymous brand, along with 91 per cent equity in 13 theme parks and projects classified as culture and tourism to Sun Hongbin’s Sunac China for 63 billion yuan (US$9.3 billion), according to an announcement on the seller’s website. The sale includes the US$6 billion Harbin Wanda City, the resort featuring the world’s biggest indoor ski slope that opened two weeks ago.

Wanda said it’s disposing of assets to “fully exercise the competitive industrial advantage” with its buyer, but analysts say the company may be buckling under the scrutiny of China’s banking regulator to pare back on debt.

Together with Anbang Group, Fosun Group and the HNA Group, Wanda was named last month by the China Banking Regulatory Commission for special attention in loans exposure, as the country’s four biggest overseas asset buyers face the equivalent of US$11.5 billion in bonds and loans by the end of 2018, according to Bloomberg’s data.

“Wanda may be feeling the financial pressure, or it won’t need to sell off so many assets,” said Liu Feifan, a property analyst at Guotai Junan International. “Wanda may badly need funding to support its expansion, but can’t count on rental income.”

Wang, one of China’s wealthiest men, also had been planning to transfer the listing status of his flagship company Dalian Wanda Commercial Properties from Hong Kong, where it trades at 4.9 times estimated 2017 earnings, to the Shanghai exchange, where the median ratio is at 15.9 times. He spent HK$34.5 billion (US$4.4 billion) to buy back all of the Hong Kong company’s shares last year for the relisting, but had not made any progress on the transfer.

All the proceeds from the disposal of Wanda’s hotels and resorts will be used to repay bank loans, Chinese media Caixin reported on Monday, citing Wang.

With businesses ranging from property to entertainment to financial services, Wanda Group posted a 17.9 per cent revenue growth in the first half of 2017 to 134.8 billion yuan.

Property revenue, including residential sales and rental from shopping malls and hotels, rose 14.2 per cent year-on-year to reach 73.5 billion yuan in the first half.

The segment of its business that’s classified as culture, including theme parks, its ownership of the AMC chain of cinemas, sports clubs and tourism, rose 5.9 per cent to 30.8 billion yuan.

It’s a dramatic shift in focus for a man who only last year said Walt Disney Co.’s theme parks, including the one in Shanghai that recorded 11 million visitors in its first year of operation, was no match for his home grown theme parks. Wanda has launched six theme parks so far. Its Changbaishan ski resort and its Wuhan movie park are excluded from the latest disposal. The group operates more than 100 luxury hotels across the country, its flagship being the Sofitel at its head office building in Beijing.

Shares of Wanda Hotel Development Co. more than doubled to HK$1.48 on the Hong Kong exchange before closing at HK$0.85.

Sunac China, the seventh-largest Chinese developer founded by Shanxi tycoon Sun, is one of the country’s most acquisitive property developers, with a preference to buy its way into land banks and projects. The company paid 6.3 billion yuan this year for a 25 per cent stake in Jinke Property, and injected 15 billion yuan to bail out fellow Shanxi entrepreneur Jia Yueting’s cash-starved internet and streaming video business LeEco.

Trading in Sunac’s shares was halted on Monday. The stock fell 6.9 per cent to HK$14.80 on Friday, after surging to a year high of HK$16.88 four days earlier.