HNA unit is creating US$1.5 billion war chest as group’s primary vehicle for shopping

A unit of debt-laden Chinese conglomerate HNA Group is seeking to raise as much as US$1.5 billion by the end of this year in an investment fund that will serve as the group’s primary vehicle for global acquisitions, a document reviewed by Reuters showed.

The Overseas Aviation and Tourism Industry Fund will target travel, aviation and real estate assets around the world, according to the document.

HNA Aviation and Tourism Group is the division of the company that is behind the fund, the document showed.

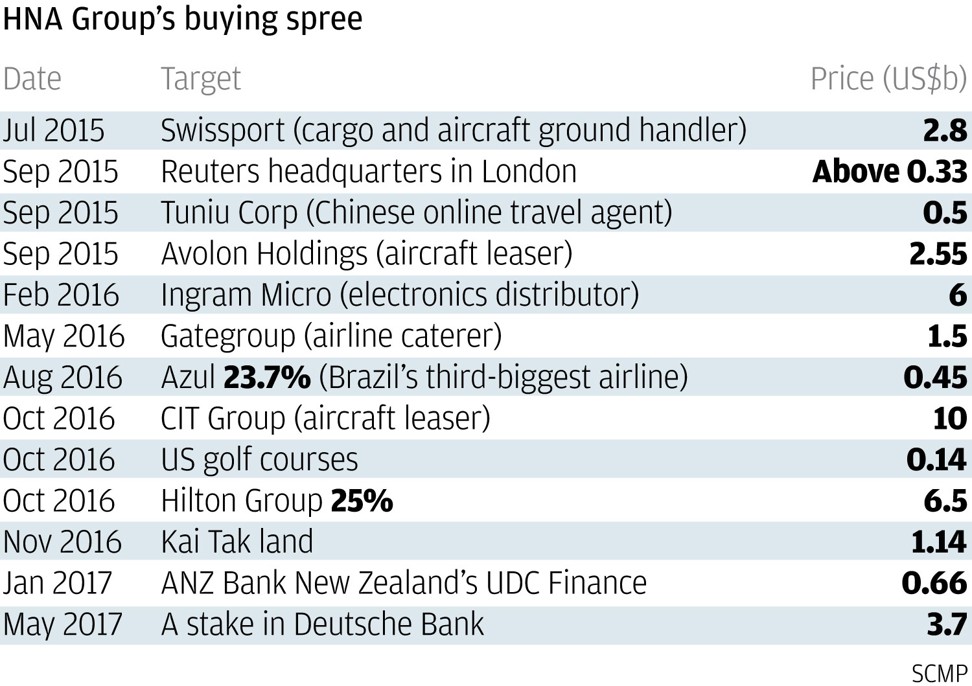

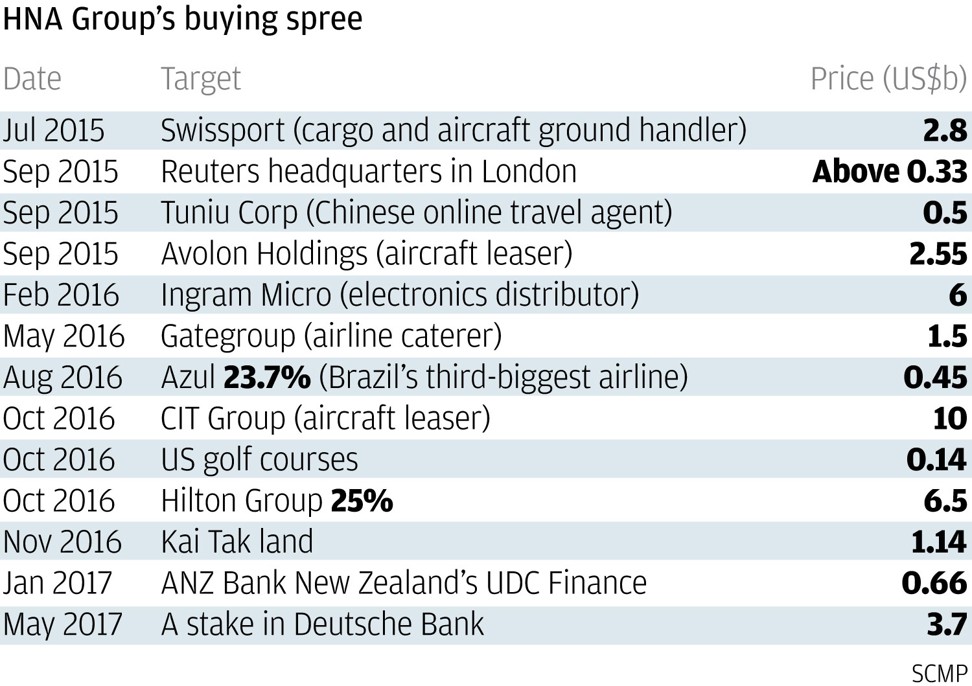

The fundraising comes as the Chinese conglomerate is unloading assets and partnering with other companies as part of a wider reorganisation, sparked by mounting debts levels after announcing more than US$50 billion worth of global M&A deals over 2016 and 2017.

The group has traditionally made direct acquisitions, and that strategy has resulted in higher debt.

HNA also has been pushed back by regulators in several countries, concerned about its murky ownership structure.

The company has started to raise external capital for the fund this month, according to the document.

HNA’s aviation and tourism division and or its affiliates will be the general partner of the fund, with a group-related limited partner initially committing about US$100 million to US$150 million, it showed.

HNA is also trying to attract limited partners to invest at various stages.

HNA is guaranteeing to investors a minimum return of 8 to 10 per cent, calling that a competitive advantage, the document showed.

HNA Group in Beijing declined to comment for the story.

The fundraising plan indicates that HNA is looking to move away from using its own balance sheet to do deals – thereby reducing its risk profile – and instead adopt a model where institutional investors make significant contributions, the document showed.

And the fund will be based in an offshore location.

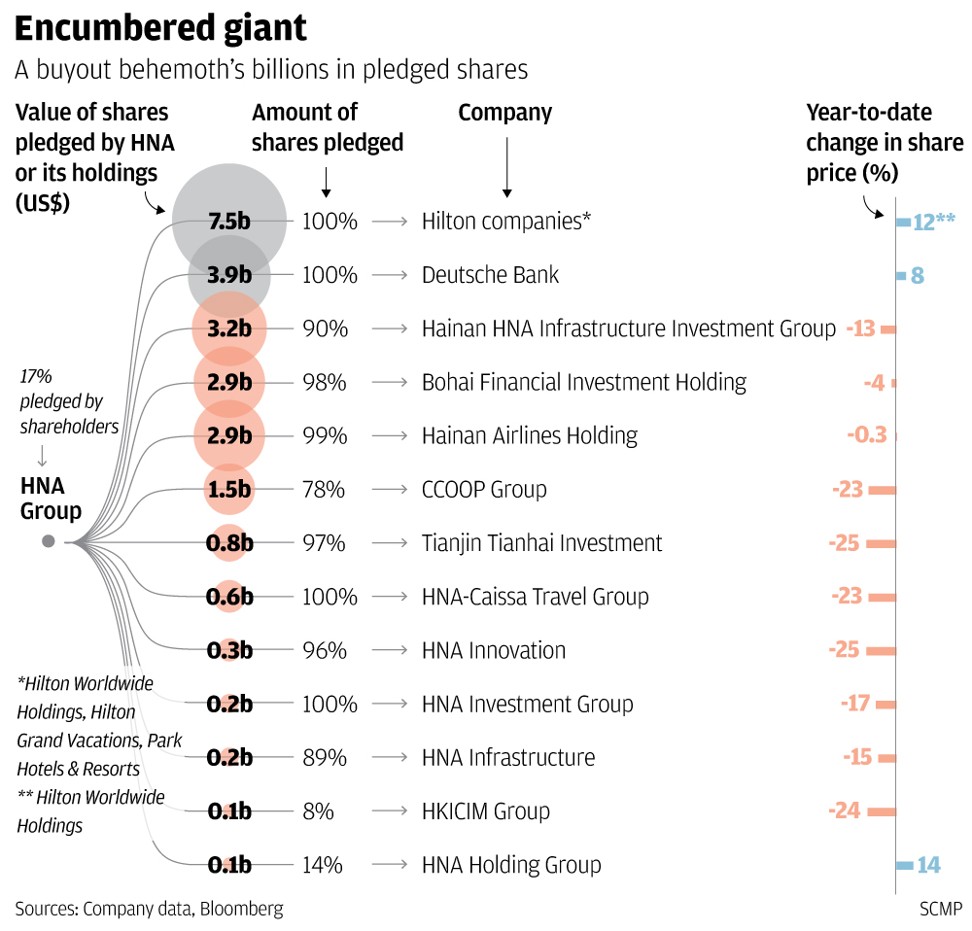

The Chinese aviation-to-financial services conglomerate’s restructuring includes selling overseas real estate and equity investments totalling more than US$10 billion in assets, such as stakes in Hilton Worldwide, Hilton Grand Vacations and Hilton Park Hotels & Resorts.

“This is in response to the Chinese government’s prohibition of future investments and concerns that their debt levels are untenable,” said Frank Turner, co-chair of law firm Osler’s Asia Pacific practice.

“They’re trying to protect their balance sheet,” he added.

Seven of the group’s 17 listed units in mainland China and Hong Kong remain suspended.

HNA also announced at the end of February that it signed a deal to raise two funds totalling 20 billion yuan (US$3.17 billion) to focus on investments linked to China’s Belt and Road initiative.

The funds deal was signed with China Asia Pacific Assets & Property Rights Exchange Ltd.

On Monday, HNA Group said it will remain a “major investor” in Deutsche Bank, after the conglomerate reduced its stake in the German lender to 7.9 per cent, from about 8.8 per cent.