Laura Cha’s pay rises 51pc to US$420,825 at HKEX, making her one of Asia’s highest-paid exchange chiefs

- HKEX chairman’s salary still 30 per cent below that of Singapore Exchange chairman’s, Cha says

- 11 other non-executive directors also get 16 per cent pay rise

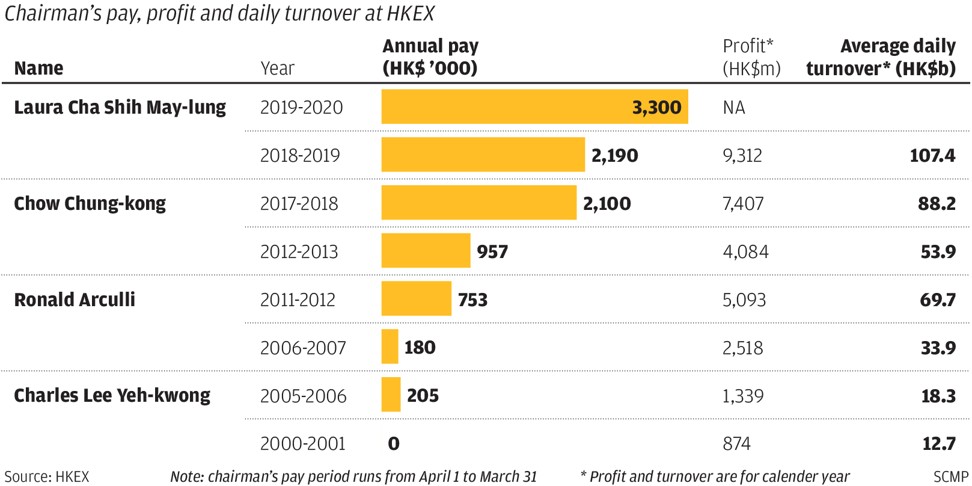

Laura Cha Shih May-lung, the first woman to head bourse operator Hong Kong Exchanges and Clearing Limited, will earn HK$3.3 million (US$420,825) in the financial year starting April 1, a 51 per cent increase over 2018, after shareholders approved new pay packages for non-executive directors in an annual general meeting on Wednesday.

Cha’s pay stood at HK$2.19 million last year, and her new pay is 57 per cent higher than Chow Chung-kong’s, her predecessor, who earned HK$2.1 million in his last year as chairman until April 2018.

Chow, who was chairman for six years, started out on HK$957,000 a year in 2012. His predecessor Ronald Arculli, was paid HK$734,000 a year, but started out on HK$180,000 a year in 2006. Charles Lee Yeh-kwong, HKEX’s first chairman, received HK$205,000 a year when he stepped down in 2006, but was paid nothing in his first two years (2000-01) in the role.

Victor Cha Mou Zing, Cha’s husband, is a prominent Hong Kong businessman. Forbes Asia estimated Victor Cha and his family were worth US$2.8 billion in 2018.

HKEX’s 11 other non-executive directors also got a 16 per cent pay rise and their an annual pay will rise to HK$850,000 in the coming year, from HK$730,000 last year. The remuneration was approved by shareholders at the annual general meeting of the HKEX, whose shares are listed on the city’s exchange.

The increase in pay packages comes following a review by consultancy McLagan Partners, which found pay for the chairman and directors at HKEX significantly lagged behind its regional and international peers, including the Singapore Exchange, Australian Securities Exchange and London Stock Exchange Group.

Cha pointed out the HKEX chairman’s salary was still 30 per cent below that of the Singapore Exchange chairman’s, who earns more than HK$4 million.

“I am glad shareholders have agreed … to increase the pay level of the non-executive directors and chairman, as the pay level is substantially lower than overseas markets,” she said after the AGM.

Kwa Chong Seng, the Singapore Exchange chairman, has an annual pay of S$825,000 (US$606,925), according to Reuters. The London Stock Exchange’s chairman, earns HK$4.1 million. The chairmen of ASX, however, earns HK$2.8 million, and that of the Nasdaq, HK$1.9 million.

“As HKEX consolidates its position as a world-class exchange, it will need to attract top-tier candidates to serve on its board,” the bourse operator said in a circular to shareholders.

The non-executive directors’ time commitment has also gone up with the bourse operator implementing many expansion plans in recent years, the circular said. Forty-six board and committee meetings were held in 2018, for a total of 78 hours, compared with 38 meetings with 62 hours in 2017.

Watch: How Hong Kong stocks opened in the Year of the Pig

HKEX has 13 directors – six of them, including Cha, are appointed by the government while the others are elected by shareholders. These 12 are non-executive directors.

The only executive director is HKEX chief executive Charles Li Xiaojia, and his pay is decided by the bourse operator’s board of directors. In 2018, his pay rose by 11 per cent to HK$28.97 million, including HK$9 million in salary, a cash bonus of HK$18.5 million and other benefits. In 2017, he received HK$25.53 million.

HKEX has embarked on an aggressive three-year strategic plan to turn itself into a leading exchange in Asia, and to expand its connect schemes with mainland China.

Since HKEX became a listed company in 2000, its market value had soared more than 30-fold to HK$344 billion as of this week. The capitalisation of the Hong Kong stock market itself also ballooned by nearly sevenfold since 2000 to US$5.7 trillion this year, surpassing Japan as the world’s third-largest equity market, and the No. 2 market in Asia.

Listing reforms aimed at attracting technology and biotechnology companies to go public in Hong Kong introduced last year have so far yielded mixed results, while it must keep an eye on Shanghai’s upcoming new board for technology flotations.