US Federal Reserve rate cut could boost Hong Kong-listed bank shares, weigh on weaker property developers, experts say

- Local banks not likely to cut, making the top ones’ shares more attractive, experts say

- Hang Seng has been trading range-bound for more than a month, but may need bigger-than-expected cut to really rally

Investors have been waiting for this week.

Finally, after weeks of hints by officials and endless market speculation, investors will learn whether the US Federal Reserve will cut its benchmark rate by a quarter of a percentage point, as expected.

If it does that, Hong Kong-listed bank stocks could get a temporary lift, while weaker property stocks, especially those ones whose focus isn’t residential, could be weighed down, experts say.

Those sectors with big debt, like airlines, could see their shares rise. Gold-linked stocks could go up, as investors see the yellow metal as a more attractive asset in a lower-rate environment.

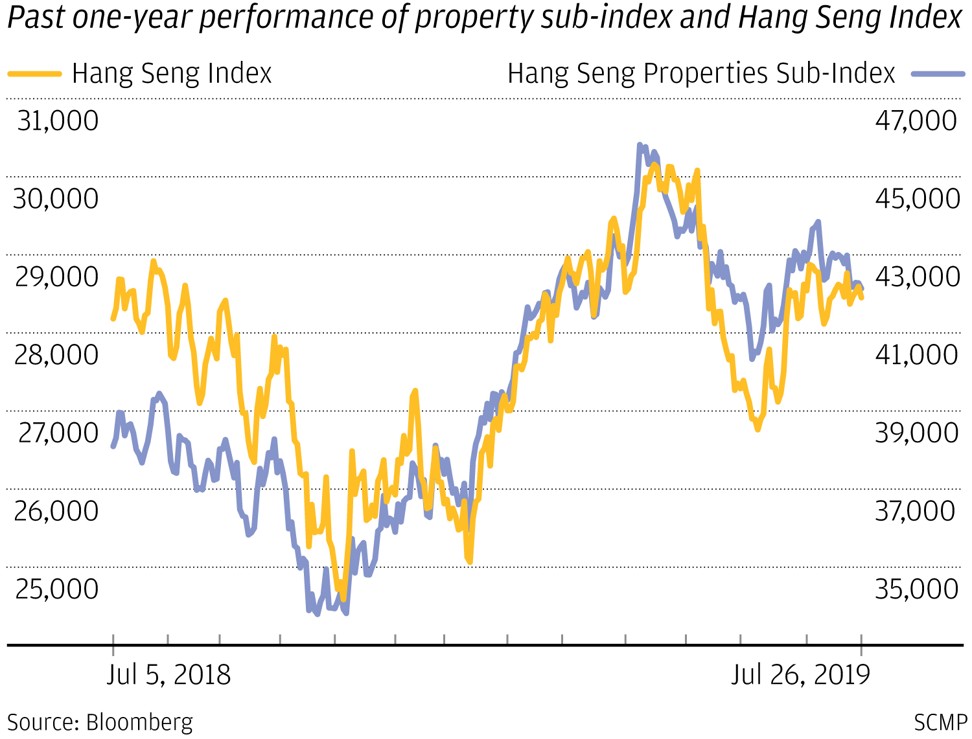

Meanwhile, Hong Kong’s Hang Seng Index could get a sugar rush – it’d be the first rate cut in the US since 2008 – especially if the Fed surprises with a bigger cut. That could break the benchmark’s tight range-bound trading for more than a month on thin turnover, partly due to investors waiting on the sidelines for the Fed to act.

Such a bigger-than-expected surprise rate cut could push the Hang Seng benchmark up to 29,000, where it has not been since May, when trade talks broke down and sent benchmarks around the globe tumbling, said Alvin Cheung, associate director at Prudential Brokerage.

Investors should watch for two key things once the Fed acts on Wednesday Washington time.

First, whether Hong Kong banks decide to keep their prime rate unchanged, as expected, denying developers extra property buying sparked by lower interest rates and as a result dampening interest in their shares.

And second, how the market reacts after the Hong Kong Monetary Authority – the city’s de facto central bank – moves in lockstep with the US Fed’s rate decision, as it is required to do to maintain the Hong Kong dollar peg to the greenback.

Kenny Tang Sing-hing, chief executive of Royston Securities, says banks will benefit if they do not cut their rates because they have already been struggling with squeezed profits in what is known as narrowing net interest margin, or what it earns on loansversus pays out on deposits.

Iris Pang, ING Bank’s economist for Greater China, agrees.

“I don’t expect there will be any change in the prime rate. The business environment for banks is very competitive,” she said, adding that she does not believe a bank that cuts its rate would generate enough from additional loans to cover its losses from lower interest margins.

Hong Kong-listed bank shares favoured by analysts tracked by Bloomberg include Hang Seng Bank and Bank of China Hong Kong, which have a comparatively higher return on equity – a measure of a company’s performance – than HSBC.

Prudential’s Cheung acknowledged that investors in property stocks might initially be disappointed if Hong Kong banks keep their prime rate unchanged.

“But if the Federal Reserve came out with a bigger rate cut, at 50 (basis points, or a half percentage point), then such an aggressive cut might signal a higher chance for (Hong Kong) banks to also move their prime rate at the next rate cut meeting,” said Cheung, a move that could benefit property shares.

Shares that might better hold up are those with less commercial exposure, experts said, such as Sun Hung Kai Properties, New World Development and MTR, which are more focused on residential property. That is because commercial property developers have been hit by the slowdown in Hong Kong retail sales this year, which is partly due to the ongoing trade war and more recently the huge protests sparked by a proposal to allow extraditions to the mainland.

“The weak retail sales environment, whose outlook remains doubtful due to the recent protests in parts of the New Territories, means that (commercial) developers might have less bargaining power when they negotiate with their tenants on lease renewal,” weighing on their rental income, said Prudential’s Cheung.

Looking to property stocks that might do better than others, Cheung noted that Sun Hung Kai Properties, New World Development and Henderson Land have attractive low price-to-book ratios, a gauge that compares a company’s share price to its book value per share. The lower the ratio, the lower the price an investor is paying for the company’s net asset value. Sun Hung Kai’s ratio is 0.69, New World Development’s is 0.55, and Henderson Land’s is 0.66.

Linus Yip, chief strategist at First Shanghai Securities, said property stocks overall got an earlier boost this month after Federal Reserve chairman Jerome Powell signalled a rate cut was coming.

“If the current weak sentiment in the property market doesn’t change, I cannot see much room for their share prices to rise,” said Yip, adding he expects the Hang Seng property sub-index to continue trading at the 40,000-46,000 range, the same as seen in the second quarter.