Hong Kong’s wealthy enclaves are burnishing their safe-haven status as home prices tumble in protest flashpoints

- Inaccessibility to mass rallies and protests, and strong holding power, have so far helped preserve real estate prices of the city’s rich and famous

- The broader residential market has experienced a steep drop since the outbreak of anti-government protests and vandalism in June

Hong Kong’s wealthy residential enclaves, where some of the world’s most expensive homes are located, have also become safe havens in a tumbling property market as the city heads for a recession amid the worst political crisis in its history.

Average home prices in the neighbourhood inhabited by multibillionaires and tycoons have held steady, in some cases bucking the declining trend, compared with the working-class districts that had been the epicentres of the city’s five-month long anti-government protests, according to the data provided by real property agents and analysts.

Average prices at the Mid-Levels - an upscale neighbourhood near Central which counts Canto-pop queen Sammi Cheng and actress Shu Qi among its prominent residents - rose 0.1 per cent to HK$31,069 (US$3,970) per square foot in August, as the city’s protest rallies descended into violence.

At The Peak, the prestigious address at the highest point on Hong Kong Island, whose inhabitants include Macau casino heiress Pansy Ho, prices have held steady at HK$43,210 per sq ft, putting the typical mansion north of HK$150 million. In Happy Valley, where Hong Kong’s racecourse is located, prices actually rose 1 per cent in September from a year ago.

Home prices have been little changed among the exclusive addresses because these areas had been spared from the worst of the protesters’ wrath, said Maggie Hu, assistant professor of real estate and finance at the Chinese University of Hong Kong.

“Their main demand is for democratic reform, not really a revolt against the wealthy per se,” said Hu, adding that the exclusive districts are usually inaccessible to most protesters because they are not served by the subway network. “Hence we do not observe protests targeting affluent individuals or taking place in affluent neighbourhoods.”

The calm in the wealthy enclaves contrasts with the storm that is buffeting Hong Kong’s economy, and the broader property market.

What began on June 9 as an uneventful march by an estimated 1 million residents against a controversial extradition bill has turned into almost daily clashes between police and radical protesters. Even though the city’s Chief Executive Carrie Lam Cheng Yuet-ngor had withdrawn her unpopular bill, regular protest rallies have persisted, turning visitors away from the city, driving retail sales to a standstill and pushing the economy into a technical recession in the third quarter this year.

An index tracking the prices of lived-in homes fell 1.4 per cent in August, the third consecutive month of declines. The pullback in prices was the steepest monthly decline this year, as the property bull market stumbled after a decade-long run.

The contrasting impact on property prices underpins the widening wealth gap between the haves and have-nots in Hong Kong, where almost one in every five people lives below the official poverty line, the highest in seven years, according to government report in November 2018.

The city’s top 30 tycoons have a combined net worth of US$249.56 billion, according to Forbes, an amount equivalent to more than two-thirds of the local economy.

Two key reasons explain why the high-end residential districts are shielded from the city’s upheavals. Firstly, these exclusive neighbourhoods are usually beyond walking distance from the 93 stations dotting the city’s MTR subway network, which carries 5 million commuters everyday on average.

The limited ingress and egress points - Happy Valley, with a population of about 30,000 people, has three access roads, one of which is a steep climb uphill - of these communities deter protest organisers because they lack escape routes in the event of clashes with police.

“Accessibility is one reason as the protesters will find it difficult to retreat” (if cornered by police), said Koh Keng Shing, chief executive and founder of Landscope Christie’s International Real Estate. “Most protesters focus on targets like government buildings, rail stations and retail shops owned by mainland Chinese companies.”

Secondly, the city’s ultra-wealthy residents are unlikely to be under pressure to sell their assets in a falling market, according to property consultants. They can afford to wait until the current property market recovers from its slump, especially when the demand and supply imbalance is working in their favour, agents said.

“The difference in price drops can be attributed to the strong holding power of the super-rich and the limited supply of first-hand luxury residences,” said Sammy Po Siu-ming, chief executive of Midland Realty’s residential division. The scarcity of primary luxury residences means owners do not feel the urgency to sell for fear of being unable to reinvest in another, Po said.

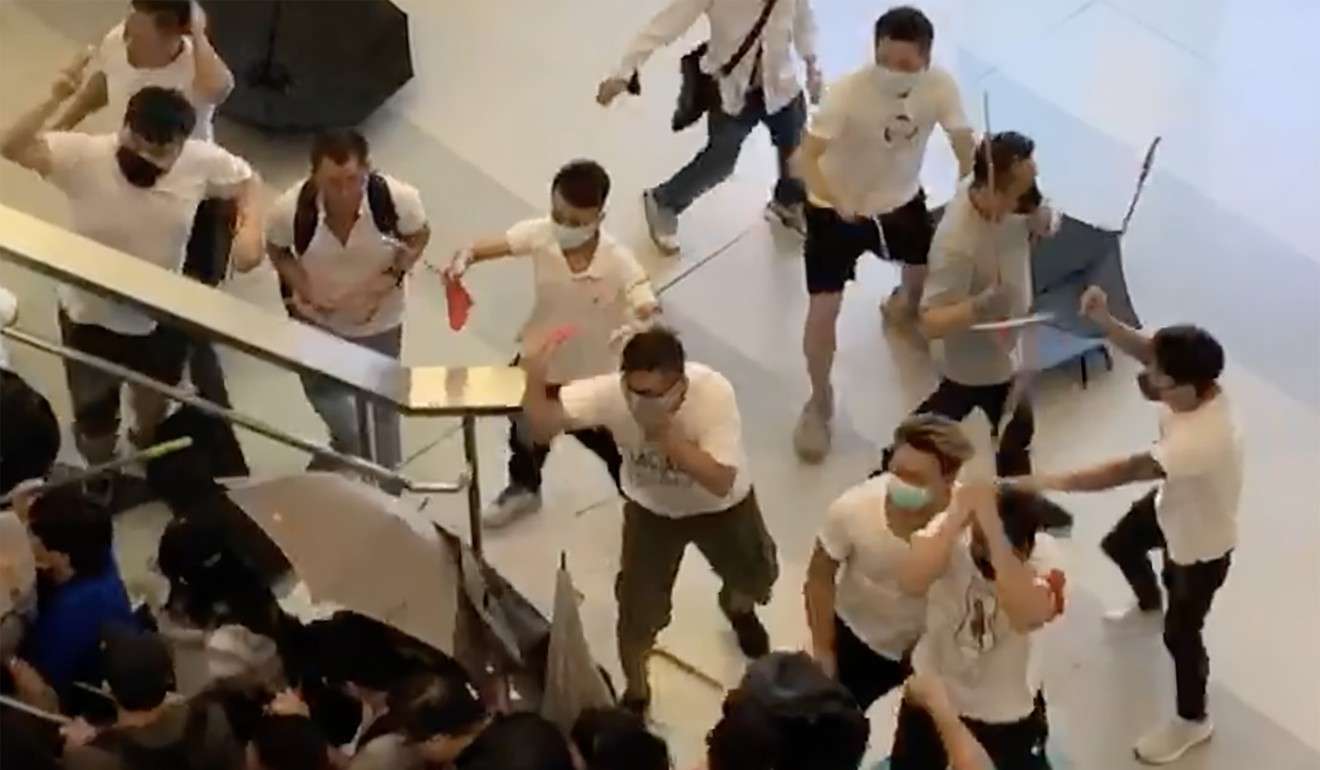

The fallout is most evident in the flashpoint neighbourhoods like Mong Kok and Yuen Long, where police clashed with protesters with batons, tear gas, rubber bullets and water cannons. The more radical among the protesters have taken to vandalism and arson, laying waste to shops and restaurants owned or associated with mainland Chinese owners.

In several subway stations like Prince Edward and even the upmarket shopping district of Causeway Bay, protesters have set fire to station entrances and vandalised station turnstiles and vending machines.

The average selling price of the Yoho Midtown complex developed by Sun Hung Kai Properties (SHKP) fell 15 per cent to HK$13,751 per square foot in the three months through August, according to Midland Realty. Yuen Long, located in the New Territories in the northern corner of Kowloon, was the scene of clashes on July 21 between a gang of men clad in white shirts and black-clad protesters.

Average prices of lived-in homes in Luk Yeung Sun Chuen and Discovery Park, both in trouble-hit Tsuen Wan, fell by 9.4 per cent and 3.1 per cent respectively, between May and August, according to data from Midland Realty.

“The occurrence of neighbourhood protests has some negative influence on housing price,” said Hu of CUHK. “However, I believe its impact is only temporary and secondary.”

Weaker property prices is just one indicator showing the extent of damage to the Hong Kong economy. Retail sales fell 25.3 per cent in August from a year earlier in the biggest slide since at least October 2005, official data shows. Tourist arrivals dropped almost 40 per cent in the same month, the most since the outbreak of Sars (severe acute respiratory syndrome) in 2003.

While some upscale districts are holding up, analysts said the luxury residential sector may still suffer from the impact of social unrest in the months ahead. Transaction of luxury homes have dropped as people wait for lower entry cost, and reports have suggested that an increasing number of wealthy residents have planned or applied to migrate or relocate overseas.

Even so, buyers are watching out as new supply of such properties is considered rare. Some notable transactions have been recorded among high net worth individuals, according to David Ji, director and head of research and consultancy for Greater China at Knight Frank.

He cited several transactions at more than HK$85,000 per square foot as examples, including three houses at Mount Nicholson, two at 45 Tai Tam Road, and a villa at 90 Repulse Bay Road.

“The luxury property market has been relatively resilient and less impacted by the downbeat economic sentiment,” he said. “Our research into price correlations also revealed that the luxury prices are a lot less sensitive to economic conditions and are proving inelastic.”

A price correction would be regarded by some as an entry signal, he added, given that there has not been many opportunities in the past decade.

In terms of leasing out luxury homes, anecdotal evidence indicates landlords are not inclined to reduce their asking price, which could explain the lower than usual transactions in recent months.

Based on available stock and information from landlords, rentals are not being affected even if those leases are not taken up, according to Letizia Garcia Casalino, head of residential services at Colliers International Hong Kong. In current scenario, it’s not unusual for luxury homes to remain on the market for up to six months versus an average of two months in 2018.

“It means landlords are not reducing their asking prices,” Casalino said. “In some cases, there were some slight adjustments, but nothing that would materially shift the market.”

Recent headline news do not augur well for the market owners and investors alike, according to Koh at Landscope. Given that Hong Kong continues to contend with the US-China trade war and the likelihood that political upheavals will persist, he reckons high-end homes will see an easing of prices going into the year end.

“We do not expect an uptick for the rest of the year, and probably will see further easing in price and rentals as the never-ending protests continue to dominate”, he said. “The local economy is predicted to enter into negative zone despite some encouraging news on trade talks.”