Chinese cancer drug firm Akesobio’s US$330 million IPO – Hong Kong’s largest this year – is oversubscribed 639 times by city’s investors

- Akesobio’s HK$2.58 billion IPO sees HK$166.5 billion in investors’ funds locked up

- Hard to know if popularity is driven by short-term speculation, analyst says

The Hong Kong tranche of cancer drugs developer Akesobio’s HK$2.58 billion (US$330 million) initial public offering has been oversubscribed 639 times, making it the most popular biotechnology listing among the city’s retail investors by funds frozen, according to a source close to the deal.

The IPO is also Hong Kong’s largest so far this year, and is also its biggest in the broader health care sector after Pharmaron Beijing’s HK$5.3 billion flotation last November, according to Refinitiv.

The Zhongshan-based company’s offer of 15.95 million shares in the city, a tenth of its global shares offering, saw HK$166.5 billion in investors’ funds locked up when the offer closed on Friday.

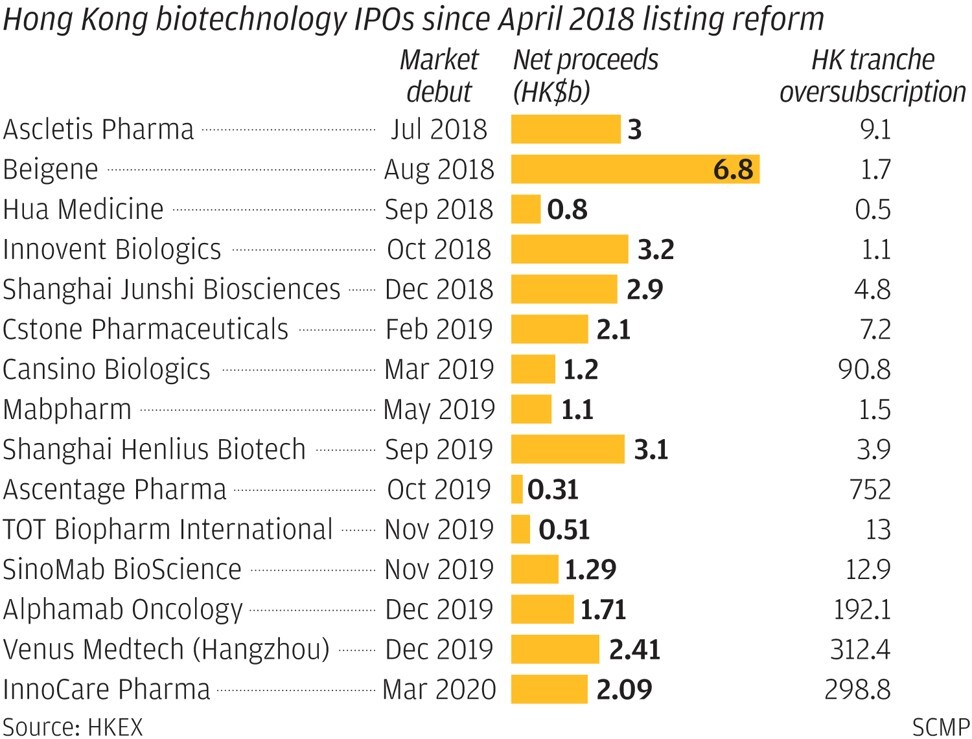

The funds frozen by Akesobio’s listing represent the largest such amount collected since Hong Kong started allowing unprofitable biotechnology companies to list two years ago. It beat the HK$75 billion drawn by medical device maker Venus Medtech’s IPO last December. Ascentage Pharma’s IPO, which raised only HK$312 million last October, however, recorded a higher subscription multiple, of 752 times.

IPOs by Alphamab Oncology and InnoCare Pharma, two Chinese cancer drug developers, in recent months have also been popular, and were oversubscribed 192 and 299 times, respectively, by Hong Kong investors.

“It is hard to know if Akesobio’s popularity is driven by short-term speculation. Some may be betting on the commercial prospect of its drug development pipeline,” said Carol Dou, senior health care analyst at Singapore-based investment bank UOB-Kay Hian. “Drug developers should be evaluated by their overall capabilities. While research and development success is a big part of it, regulatory approval, pricing and marketing are also important. So it takes time for management to prove their capabilities.”

Hepatitis drug developer Ascletis Pharma’s new drug, while approved in China, has faced tough competition from multinational rivals, while diabetes drug developer Hua Medicine late last year reported that its clinical trial results failed to impress investors, Dou added.

Hua and Asceletis, among the first three to go public under Hong Kong’s new biotechnology listing regime, are trading about 63 per cent and 79 per cent below their IPO prices, respectively.

Akesobio’s lead drug candidates, which target cervical, lung, liver, nasopharyngeal and blood cancers, are in late stage clinical trials. The company aims to complete the trials and apply for approval to market them between the second half of this year and 2022.

Less than 50 per cent of drugs making it to Phase 2 go on to become a commercial success, while for oncology drugs, only 50 per cent to 60 per cent succeed even in Phase 3, according to Bao Jun, chief business officer at Beijing Shenogen Pharma Group.

Akesobio was founded in 2012 by Xia Yu, its chief executive, who has previously held senior roles in US drug developers Crown Bioscience and PDL BioPharma, according to its listing prospectus. Its shares are expected to be priced on Thursday at HK$16.18, the high-end of its offer range, the source said. The shares’ trading debut is scheduled for Friday.