02:07

George Floyd’s death reignites protests in Paris over black Frenchman’s 2016 death in police custody

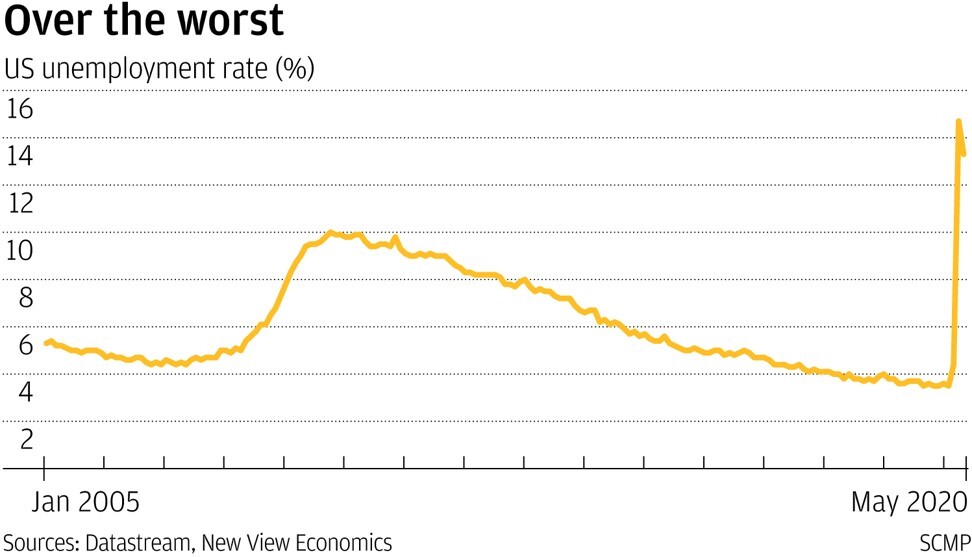

It’s been a brutal last few months, but at least last week’s US employment report showed a surprise 2.5 million jobs added to payrolls in May, evidence that the world might have turned the corner on the coronavirus crisis. Recovery could be on the way.

The outlook is still pretty bleak and the pain is not over yet for many of us, but the odds are the world economy reached rock bottom in April and the journey back towards more normal times has begun. The big question is what sort of world we return to post-coronavirus.

Global equity markets are certainly bullish about recovery, but what’s the shape of things to come for ordinary people in the street, for employment, wages, real incomes, consumer demand? Ultimately how will it all pan out for global growth? If the world is heading towards a more lopsided sharing of the spoils and a greater inequality of wealth, then the outlook for recovery – and humanity – could be in deep trouble.

You would think that after all the sacrifices we have made that we would be heading towards a kinder place where governments and companies have a more sympathetic approach and where caring capitalism prevails. Sadly, social tensions are already boiling over, the culmination of anger over years of austerity cutbacks since the 2008 financial crisis, the rise of global protectionism and the exploitation of employees in the workplace with the emergence of the gig economy and zero-hours contracts.

Growing hostility to the coronavirus lockdowns and the rise of the Black Lives Matter movement personifies the frustration felt by many for real change in society. Until those needs are addressed, the outlook for recovery is even more challenging.

02:07

George Floyd’s death reignites protests in Paris over black Frenchman’s 2016 death in police custody

For consumer-driven economies like the United States, where consumer demand typically accounts for nearly 70 per cent of gross domestic product, confidence is the be-all and end-all of growth going forward.

The worry is whether companies are going to use coronavirus furloughs, production shutdowns and factory closures as an excuse for radical overhauls, culling workforces in a bid to boost productivity and profits when the return to work starts for real.

While there may be a need to slash costs and restructure in response to the downturn in global demand, it could not come at a worse time. It could mean lower employment growth, reduced wages, weaker consumer spending power and a more compromised outlook for global growth.

There is speculation that corporate cutbacks could go much further with companies taking advantage of the crisis to push for more radical changes such as more lay-offs, increased outsourcing, reduced employee benefits and more workers placed on zero-hours contracts.

While the shift away from labour to capital may be good news for stock market valuations, it will do little for industrial relations, easing social tensions or making the job any easier for global policymakers desperately trying to stoke a sustainable recovery.

It would be fine if the world corporate sector intends to lead a productivity-driven, capital-intensive dash to growth, but most business sentiment indicators around the world show investment intentions are down in the dumps right now.

02:01

Indian factories struggle to reopen after coronavirus lockdowns because of a lack of workers

The key question is whether governments turn a blind eye or step in to discourage more drastic corporate cutbacks. At the moment, governments and central banks are bending over backwards to improve corporate cash flows, providing cheap and easy money, improved state aid and generous tax breaks to get global production going again.

Company boardrooms might have a freer hand in the United States and Britain, but maybe less so in the European Union where statutory rules and regulations are more protective of workers’ rights.

China, where the combined weight of monetary easing and fiscal reflation is already starting to show early signs of progress, should be the exception in getting its workforce back into action at full speed. China’s recovery should also have more staying power if Beijing sticks to its plan to shift the economic emphasis from externally-driven to domestic-led growth.

Consumers, companies, investors and governments all have a part to play on the road to recovery. Things may look bleak at the moment, but humanity can pull through in the post-coronavirus world if the world sticks together. Sacrifices have been made and companies and governments both have a duty of care to protect their workers and boost job creation as much as possible.

David Brown is chief executive of New View Economics