Thousands of Hongkongers face home financing crunch as flat delivery increases and banks tighten loan scrutiny amid economic slump

- More than 11,000 units in 17 residential projects are due for handover in the second half this year, almost double the volume in the preceding six months

- Several lenders have also raised their lending rates twice in the past six months, according to Eric Tso of mReferral Mortgage Brokerage

Thousands of Hong Kong homebuyers are facing the risk of being shut out of bank financing for flats bought two years ago on a staggered payment plan, as banks have started to tighten lending criteria amid an economic slump.

More than 11,000 units in 17 residential projects are due to take delivery in the second half this year, almost double the volume in the preceding six months, according to government statistics and data compiled by Midland Realty.

They will come up against possibly stricter assessments by lenders, especially since the city’s worst economic crisis in decades – fuelled by protests and coronavirus pandemic – has eroded the purchasing power of many residents in several troubled industries, such as aviation, food and beverage and tourism.

“Some may further tighten the assessment of repayment ability for applicants in view of the third wave of Covid-19 pandemic,” said Eric Tso, chief vice-president at mReferral Mortgage Brokerage Services. “Several lenders have also raised their lending rates twice in the past six months.”

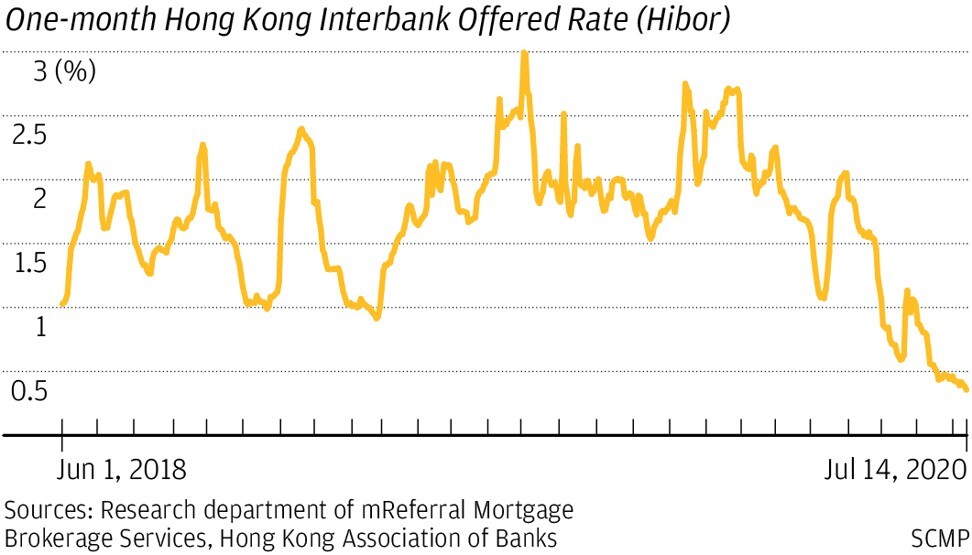

The rate on mortgages linked to the Hong Kong Interbank Offered Rates (Hibor) has risen by 20 basis points to 1.5 percentage points above Hibor this year, he added. Some lenders have even raised the bar to 1.6 percentage points above the benchmark.

That number of affected homebuyers could be between 30 and 40 per cent, according to Sammy Po, chief executive of Midland Realty’s residential department. Many have also opted for delayed financing, he added, since the government eased mortgage financing rules in October last year.

The rules were relaxed to allow homebuyers to obtain up to 90 per cent of financing versus the previous 60 per cent for completed flats costing up to HK$8 million. The cap is 80 per cent for units costing HK$10 million and below.

The third wave of Covid-19 is threatening to undo various stimulus measures unveiled by the embattled government and the banking industry to support the economy. The city has continued to struggle with the fallout, with cracks in various economic sectors and unemployment at the highest in 15 years.

Among projects due for delivery later this year are Nan Fung Development’s LP6 in Lohas Park, Wheelock Properties’s Malibu in Lohas Park and Sun Hung Kai Properties’s Cullinan West Phase Three in Sham Shui Po. More than 200 buyers at LP6 alone have chosen the staggered home financing plan, according to the data from the Sales of First-hand Residential Properties Authority.

The ratio of new mortgage loans pegged to the Hibor stood at 91 per cent in May, according to latest data from the Hong Kong Monetary Authority. The ratio of new mortgage loans priced with reference to best lending rates was only 5.7 per cent. The proportion was 40:58 in late 2018.

The financing rush came to light last month, when buyers of The Horizon, an upscale residential development near the Science Park in Tai Po, had to scramble for loans as the project completion date was brought forward by five months from November.

“We have been approached by about a dozen buyers who were rushing to get bank financing to complete the transaction this month,” said Adrian Wong, regional sales director at Centaline Property Agency’s Tai Po branch.

Flat sales at The Horizon were launched in 2018 by Billion Development and Project Management, which declined to comment on the situation.

“Buyers who opted for stage payment need to seek mortgage loans several months ahead of schedule,” Wong said. “Some of our clients have encountered difficulties in getting bank loans now. They have asked us to reflect their views to the developer.”

Lenders contacted by the Post said loan applications depend on individual cases.

Bank of China (Hong Kong) said assesses and approves loan applications in accordance with its loan policy and guidelines. Hang Seng Bank accepts mortgage applications for all types of property and aims to provide comprehensive mortgage solutions to customers, it said.

In response to the third wave of Covid-19, Standard Chartered said: “We remain focused in supporting our clients to ensure there is minimal impact to our services. We are monitoring the situation closely and will take necessary measures to reduce the risks to our colleagues and clients.”