Which financial terms are Hongkongers searching for on Google? iBonds 2021 beats GME, Kuaishou, Xiaomi, Tesla and NFTs to top the annual list

- iBond 2021 topped Google Hong Kong’s ‘Year in Search 2021 Top Trending Finance News’ chart

- Bitcoin price, Kuaishou, and the share prices of GME, Xiaomi anmd Tesla also made the list, with non-fungible tokens (NFTs) rounding out the top 10

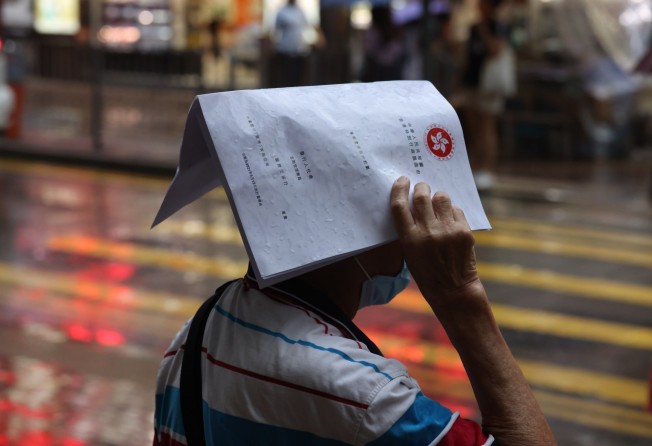

The Hong Kong government’s inflation-linked debt, known as iBonds, topped Google’s annual ranking of the most-searched financial terms, underscoring the appetite for sound investments during the Covid-19 pandemic.

“iBond 2021” ranked first on Google Hong Kong’s Year in Search 2021 Top Trending Finance News chart, while “bitcoin price”, “Kuaishou” and the share prices of GME (GameStop), Xiaomi and Tesla also made the top 10 list.

Financial investment was “top of mind” for the city’s netizens, while people also “searched for financial information related to the technology sector or fintech,” Google Hong Kong said. The list was based on search terms that had the highest spike this year when compared to the previous year, according to Google.

The annual ranking of the world’s dominant internet search engine, with 91.4 per cent of worldwide market share in November according to Statcounter’s data, offers a snapshot of what netizens care about in the internet-connected world.

The latest iBonds were overbought by 3.6 times when they went on sale in June, attracting HK$54.58 billion (US$7.03 billion) of investments from 717,000 people, according to data released by the Hong Kong Monetary Authority (HKMA), the city’s de facto central bank.

The iBonds are popular because they guarantee a minimum return of 2 per cent, with higher returns if consumer prices continue to rise. The iBonds will make an interest payment every six months based on the average rate of the consumer price index (CPI) over that half-year period. The minimum payment is double what the government offered four years ago.

The response was the strongest yet among all eight rounds of iBond offerings in the city, blowing past the HK$49.8 billion in principal attracted from applicants in 2012 and HK$39.6 billion in 2013. It was also higher than the HK$38.4 billion spent by about 460,000 investors in November last year.

“Bitcoin price” was the second-most searched term on Google in Hong Kong this year. The largest digital token – notorious for its volatility – soared to a record high of US$69,000 on November 10, but has plunged around 26 per cent since then.

“Kuaishou” followed in third place. The short video platform, which listed on the Hong Kong stock exchange in February, set a record as the most overbought initial public offering (IPO) in Hong Kong, as retail investors put in almost HK$1.3 trillion, oversubscribing the stock by 1,200 times of what was on offer.

Other trending results which made the top 10 on the list included the stock prices of GME, Xiaomi and Tesla. GME had a brief surge at the start of the year in the so-called “Nerds versus Wall Street” battle where stock punters used social media networks to trade against conventional wisdom by some of the world’s largest money managers.

The interest in Xiaomi and Tesla underscored the boom in China’s electric car industry, where three of every five new vehicles on Chinese roads are expected to be powered by battery packs by 2030, according to UBS.

Xiaomi, one of China’s largest smartphone makers, announced a US$10 billion investment over the next decade, with an initial budget of US$1.5 billion in late March, to assemble smart electric cars, becoming the latest of an estimated 500 brands to compete with Tesla in the world’s largest vehicle market. Tesla is the market leader in China, outselling its nearest rival nearly five to one as recently as in September.

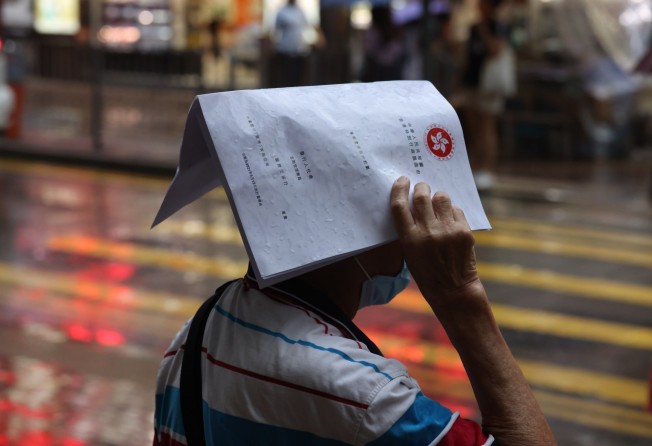

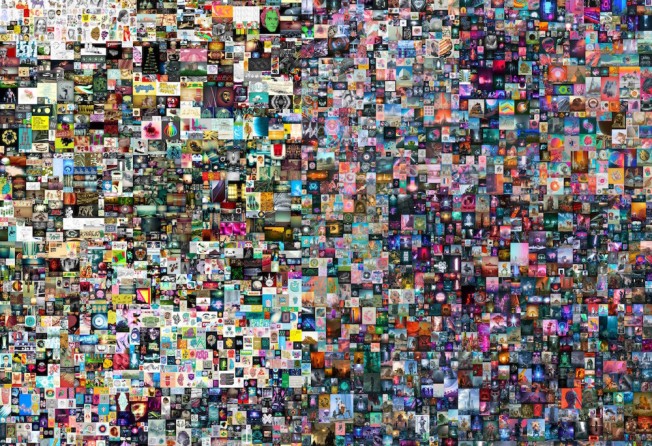

Non-fungible tokens (NFTs), the units of data stored on a blockchain that guarantees each digital asset to be unique, rounded off the bottom of the top 10 list.

Collectors and speculators alike had been making headlines this year by pouring record amounts of money into NFTs, with the digital artist Mike Winkelmann, also known as Beeple, fetching US$69 million for his artwork called “Everydays – The First 5,000 Days”.

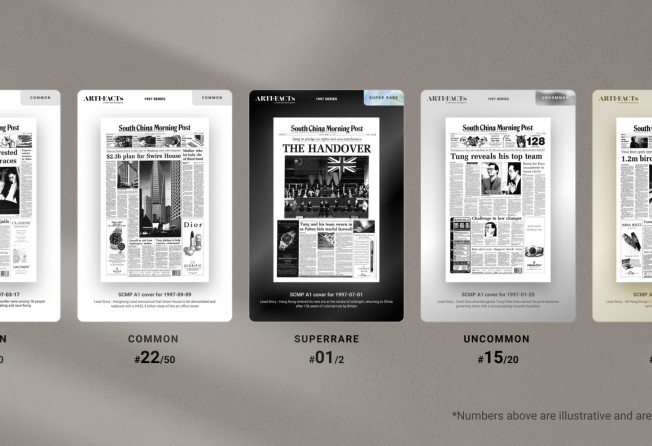

South China Morning Post launched its own “ARTIFACT” NFT standard in July, followed by an inaugural drop on November 23 of NFTs comprising collectable digital cards commemorating some of the most notable events of 1997, including the Handover ceremony, as well as the passing of Deng Xiaoping and Princess Diana.