Investors cheer Standard Chartered settlement with New York

Formal hearing called off as bank reaches settlement with New York regulators, but battle is not over

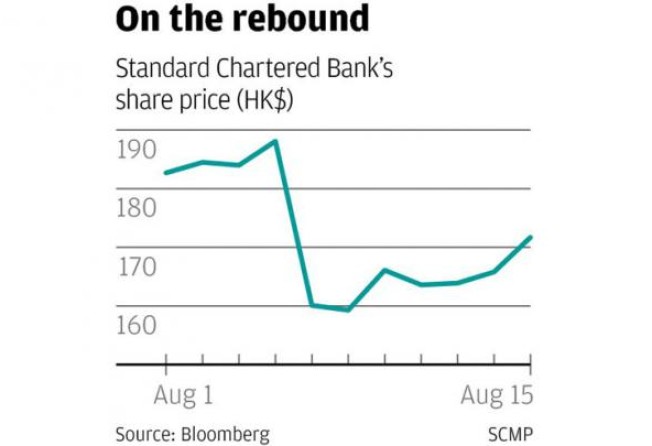

Investors in Hong Kong cheered news that Standard Chartered bank had reached a settlement with New York financial regulators by sending the British bank's shares higher, in a weaker overall stock market.

The agreement came just a day before the bank was scheduled to defend its operating licence in a formal hearing over allegations it dealt improperly with Iran. That hearing has been called off, but Standard Chartered still faces challenges from other US regulators.

According to the settlement, Standard Chartered will pay a fine of US$340 million, a record for a single US state. It also agreed to install a monitor who will report directly to the New York State Department of Financial Services to track anti-money-laundering compliance.

The bank's share price rose 3.56 per cent, or HK$5.90, to HK$171.70 yesterday in Hong Kong.

Standard Chartered continued to deny a claim by Benjamin Lawsky, New York's superintendent of financial services, that transactions violating sanctions reached at least US$250 billion. A spokeswoman at the bank in Hong Kong said yesterday that nearly all of those disputed transactions were compliant.

The bank previously conceded that some transactions might have been in violation of United States sanctions on Iran, but the amount was less than US$14 million.

Analysts said the settlement was a big price to pay. Yet rapid resolution helped the bank avoid a formal hearing, which would have put its New York operating licence at stake.

"The bank's state banking licence and US dollar clearing business is no longer at risk, which was the key issue spooking the market," said Adam Chan, an analyst at CCB International in Hong Kong, who added that the settlement should ease tensions between US and British regulators.

The bank still faces more battles with other regulatory bodies, including the US Department of the Treasury, the Federal Reserve, the US Department of Justice and the Manhattan District Attorney.

"It seems a near certainty that there will be a second fine imposed in a month or two," said James Antos, a senior analyst at Mizuho Securities in Hong Kong, who added that the bank could be looking at as much as US$700 million in total fines when the issue is brought to an end.

The incident had shown the fragmented and overlapping characteristics of US regulations, said Simon Morris, partner at law firm CMS Cameron McKenna in London, who added that if Lawsky suspected misconduct, he could go after other institutions with equal vigour.

The US$340 million fine represented less than 5 per cent of Standard Chartered's estimated full-year pre-tax profit, analysts said. If the bank had lost its ability to process US dollar payments for clients, its annual profit could have been reduced by about 40 per cent, said Chirantan Barua, an analyst at Sanford Bernstein Research in London.