Bank defaults viewed as dark side of deposit vows

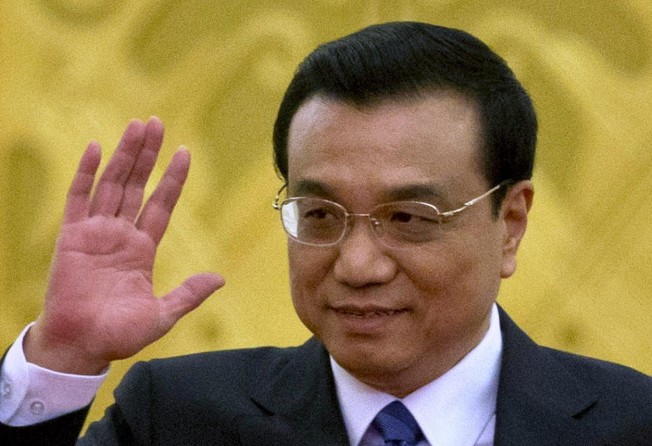

Premier Li Keqiang's plan to introduce deposit insurance is meant to comfort the mainland's savers as bad loans mount. In the bond market, it is fuelling speculation that he is preparing to let some banks collapse.

"With the deposit insurance coming … the government is signalling they may be willing to let some of the smaller banks default or be consolidated," he said.

The premier pledged last month to introduce protection for savers this year as he shifts towards letting the market set rates, a move that may push up borrowing costs for smaller lenders even as it forces them to pay higher interest to depositors.

Failures of high-yield trust products have sparked investor protests, highlighting the potential for unrest that deposit insurance would seek to preclude. At least 30 people faced special-forces officers in front of a China Construction Bank branch in Taiyuan last week, as they demanded their money back from a troubled 973 million yuan (HK$1.2 billion) trust product.

As it moves to limit the risks from any defaults, the government would "encourage consolidations among the smaller banks, and mergers of the smaller banks with the bigger ones", Kwong Chung Li said.

People's Bank of China governor Zhou Xiaochuan in November identified deposit insurance as a mechanism needed to handle risks as the mainland moves to a system in which interest rates are set by the market and not regulators.

The dominance of state-owned lenders has left savers believing in an implicit government guarantee, even though the mainland is the only major Asian economy without a formal insurance system, according to Citigroup.

Brian Ingram, the chief investment officer at Ping An Russell Investment Management, said the introduction of a deposit insurance scheme did not imply authorities would tolerate bank defaults given the risks such failures would pose to the financial system.

"Even a default in a small bank could have consequences the government itself might not be able to foresee," Ingram said.