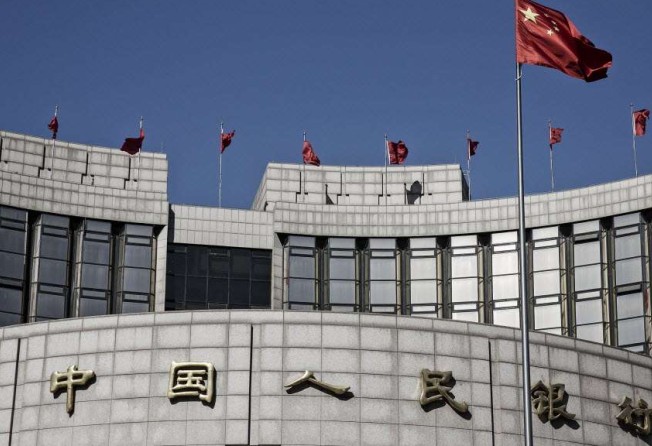

China’s central bank tightens reserve requirements for offshore yuan banks

PBOC says move is aimed at smoothing out money market fluctuations

China’s central bank has tightened the way it calculates reserve requirements for banks dealing in offshore yuan, saying on Friday that it wanted to increase flexibility in liquidity management for financial institutions and help smooth out fluctuations in money markets.

Participating banks, including Bank of China (Hong Kong), will now have to set aside a fixed sum based on a percentage of their average level of yuan deposits over a previous quarter, replacing the current more relaxed calculation based on a quarter-end figure. The change takes effect from July 15.

It also changed the calculation method for onshore banks to a 10-day period average level of deposits, replacing the previous period-end requirement.

Australian investment bank ANZ said in a note on Friday that the new rules could tighten liquidity in the offshore yuan market, as banks would be motivated to cut their yuan holdings to avoid paying up for the new requirements.

“In June, offshore entities would try to reduce the average offshore yuan deposits over second quarter, so to reduce the reserve requirement which will be submitted in July - as the offshore yuan submission in July will be calculated based on the Q2 average deposits,” said rates strategist David Qu and analyst Louis Lam in the note.

“Going forward into the medium term, the offshore entities should be less willing to take in CNH deposits,” they said.

ANZ said the change may reflect the authorities’ desire to maintain the relative stability of the yuan, by draining offshore liquidity. The new onshore rules would help to avoid sudden liquidity demand caused by deposit fluctuations, and help to stabilise liquidity swings and repurchase funding rates in the market. But it said the impact on liquidity levels should not be significant.

The PBOC had first announced its intention to apply a reserve requirement to overseas banks’ offshore yuan deposits through offshore yuan clearing banks in January this year, after the yuan-induced volatility hit global markets. In its first draft, the reserve rate was set based on the quarter-end size of deposits and banks were expected to meet the ratio in the quarter after.