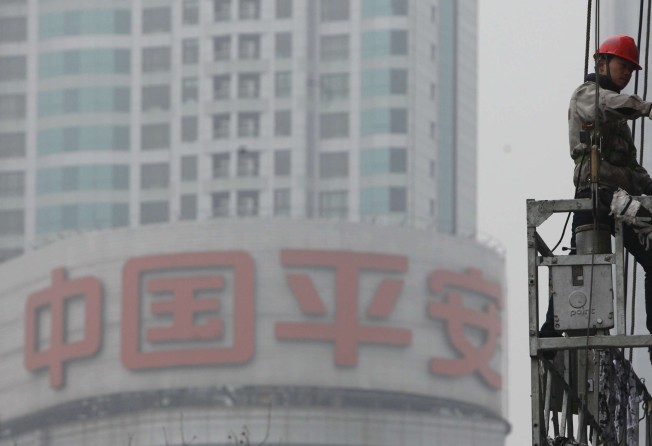

A tale of two insurers: Ping An’s nine-month profit up 17pc, China Life’s down 60pc

Ping An Insurance Group, the world’s second largest insurer by market value, said its net profit in the third quarter surged 15.4 per cent year on year to 15.73 billion yuan (HK$18 billion), thanks to steady growth in its core financial business, while the group saw rapid growth in internet finance.

That added up to a nine-month net profit of 56.51 billion yuan, up 17.1 per cent year on year. Basic earnings per share were up 20 per cent to 3.17 yuan.

“The core finance businesses such as insurance, banking and asset management maintained steady and healthy growth, and the internet finance business maintained rapid growth,” chairman and chief executive Ma Mingzhe said in a filing to the Hong Kong stock exchange.

Separately, China Life Insurance Company, the country’s second largest insurer next to Ping An, reported a 60 per cent year-on-year drop in net profit for the nine months ended September 30 to 13.53 billion yuan, with basic earnings per share falling 60.9 per cent to 47 fen. Operating income rose 7.7 per cent to 456.45 billion yuan while net investment income plunged 30.3 per cent to 84.95 billion yuan due to lower gains in equity investments.

The results were in line with its forecast last week, which said a decrease in investment income and change in the discount rate assumption of reserves for traditional insurance contracts dragged its nine-month profit down 60 per cent year on year.

Ping An’s shares fell 0.37 per cent to HK$40.5 on Thursday while China Life lost 1 per cent to HK$19.8 before the results announcement. The benchmark Hang Seng Index lost 0.83 per cent.

Ping An’s H-share price has been hovering around HK$40 to HK$42 since early September, the same level compared with the end of last year, after a gradual recovery from its one-year low of HK$30.04 in February.

The company’s stock was undervalued by 25 per cent to 45 per cent, Ping An’s chief insurance business officer Lee Yuansiong said in an interview with Bloomberg earlier this week, a rare instance of senior management of a Chinese company commenting on stock prices.

Lee said that although integrated finance companies have been out of favour in developed markets, the “conglomerate discount” to Ping An was too much.

Morgan Stanley’s target price on Ping An is HK$48, while JP Morgan’s target is HK$80.

The conglomerate discount has been a drag on the valuation of Ping An because the “Integrated Financial Services” model which Ping An is pursuing was “tried, tested, and largely failed in a developed market”, HSBC said in a research report on September 14.

HSBC said that China’s current e-finance environment is far more conducive to the success of this model than when the model was spawned in developed markets two decades ago. As an example, Ping An has managed to generate 36 per cent of new customers from its own internet ecosystem.

Consequently, HSBC upgraded Ping An’s A shares and H shares to a “Buy” from “Hold” rating after a two-year reappraisal of Ping An’s business model, removing the 20 per cent conglomerate discount, giving it a target price of HK$56.

“The shares do not currently price in the insurance business transition resulting from the full-scale healthcare insurance market opening in China, in our view,” JP Morgan wrote in a research note last week.

Analysts expect Ping An to report 58.7 billion yuan in annual net profit this year, up 8.3 per cent year on year, according to a poll by Bloomberg.