Hong Kong to be staging point for plan to draw 100 billion yuan of capital into China’s bond market

International investors own less than 2 per cent of bonds in China’s US$9.3 trillion market, a tiny fraction compared with the average 20 per cent to 30 per cent in other emerging markets

China’s government will allow foreign investors to trade in the country’s US$9.3 trillion bond market, a vital step in helping to internationalise the yuan and help deepen the capital market.

A scheme called the Bond Connect (債券通) will use Hong Kong as the staging point to access China’s interbank bond market, one of several economic gifts that Beijing has bestowed on the city to mark the 20th anniversary of the former British colony’s return to mainland China’s rule. The scheme will officially commence on Monday, July 3.

News of the Bond Connect’s official launch came on the eve of festivities to mark the 20th anniversary of Hong Kong’s return to Chinese rule.

China wants to attract foreign capital, which currently holds less than 2 per cent of Chinese bonds, a tiny fraction compared to global averages where international capital own between 20 per cent to 30 per cent of emerging market bonds.

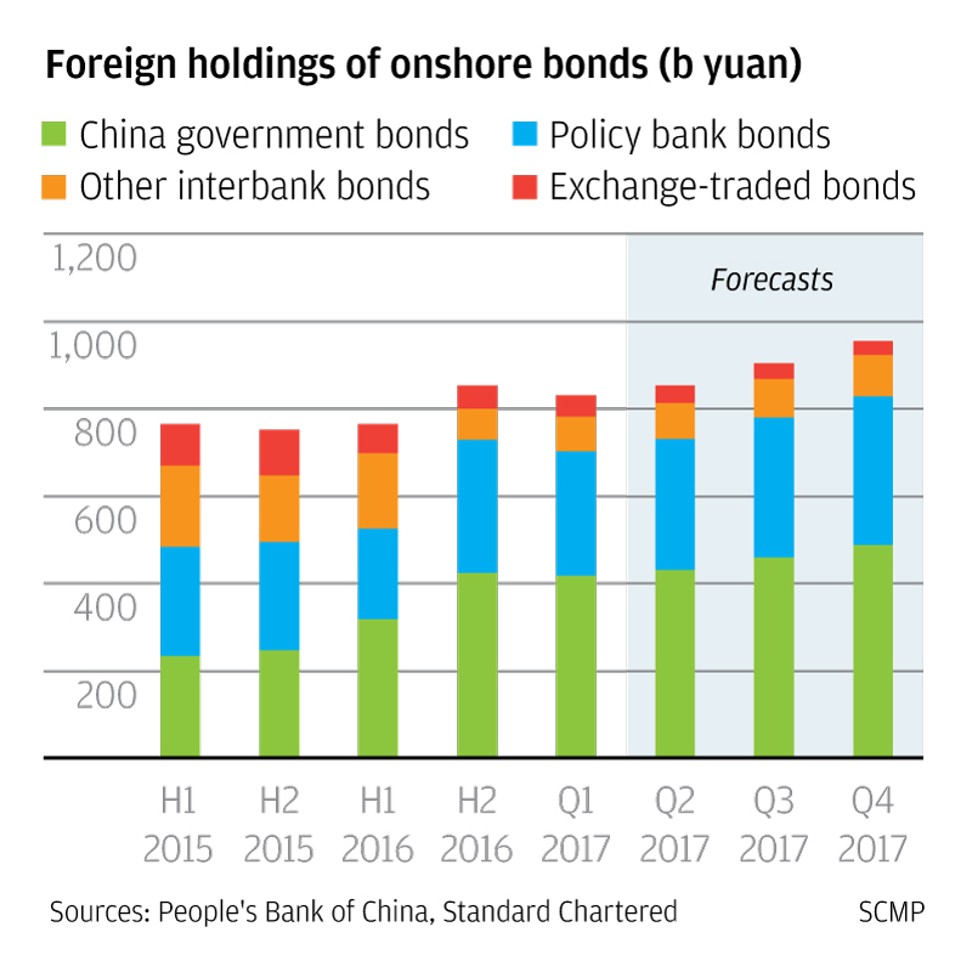

“We expect strong uptake of the Bond Connect programme, and an increase in foreign demand for China onshore bonds,” which may draw in as much as 100 billion yuan (US$14.75 billion) of capital inflows in the second half of 2017, said Standard Chartered Bank’s head of China macro strategy Becky Liu.

All this capital will be routed through Hong Kong, further cementing the city’s role as an integral part of China’s effort to integrate its financial system with global financial markets.

A successful Bond Connect is very much in line with Hong Kong’s goal of strengthening its position as a global financial centre by developing its own fixed income and derivatives market, said Charles Li, the chief executive of the Hong Kong Exchanges & Clearing Ltd.

The Bond Connect will use Hong Kong’s settlement facilities, which are more convenient and acceptable to international investors compared to previous schemes which required the opening of onshore settlement accounts. Restrictions and infrastructure differences to global standards have partly led to their slow uptake.

Such a design will also mean that the redemption of bond investments will circumvent strict, mainland capital controls, boosting foreign investors’ willingness to buy onshore debt.

Under the initial programme, only “northbound” trades – trading of Chinese bonds by foreign and Hong Kong investors – will be permitted. “Southbound” trades are not expected to be opened for another couple of years, Li said.

Citi and Bloomberg Barclays have also launched new ‘alternative’ emerging market bond indices this year, that include Chinese bonds to meet demand amid easier access while keeping their main global bond benchmarks largely unchanged.

The launch, is the fourth cross-border bond trading programme, on top of the China Interbank Bond Market direct access scheme, the Qualified Foreign Institutional Investor and Renminbi Qualified Foreign Institutional Investor schemes.

The Shenzhen-Hong Kong Stock Connect programme, the second mutual access scheme for trading equity markets, was launched at the end of last year after the Shanghai-Hong Kong Stock Connect system two years earlier.

The average daily turnover of northbound trading via the Shanghai and Shenzhen stock connects was a mere 10 billion yuan (US$1.48 billion), representing less than 1 per cent of the entire market.

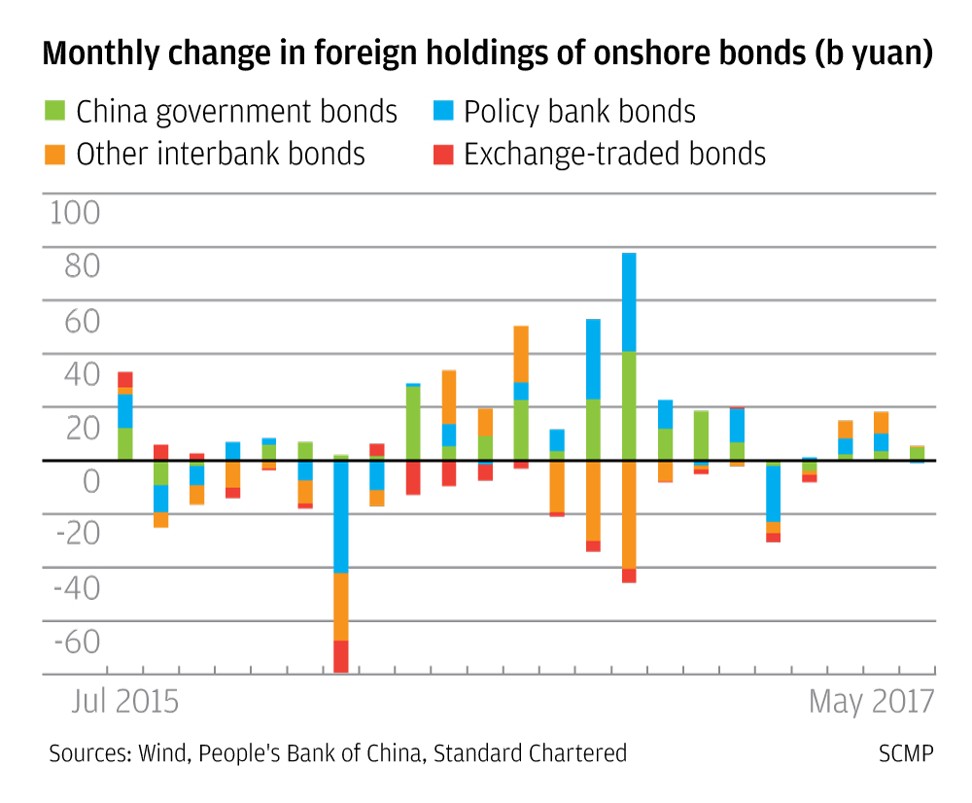

And current foreign appetite for China onshore bonds, albeit improving, still trails foreign appetite for A-shares at the start of Stock Connect, Standard Chartered said.