Stock rally is in serious danger as global recovery loses its spark

The global economy may already be past the tipping point with stocks soon to start a steady slide south

Nearly a decade on from the global crash, there should be a better sense of hope that the world is moving onto a much safer and more secure footing. Judging by the way stock market bulls have the bit between their teeth there is clearly a lot of investor confidence that the worst is over and markets still have more upside potential.

Well that is the theory, especially as stock markets are supposed to be one of the better bellwethers for the future. Except that stocks seem to be in a world of their own, disengaged from the harsh realities of a global economy struggling to come to terms with years of post-crash debt deflation, bruising austerity and, at times, crushing economic hardship.

It is fair to say that stock markets around the world are still enjoying the rush of near-zero interest rates and all the healing balm provided by the central banks by way of rapid monetary expansion in recent years. So, who could blame investors for enjoying the feast so carefully laid before them? It was a case of tuck in and indulge, or starve in dire economic circumstances following the crash.

The liquidity-driven global rally has been a no-brainer for equity bulls. But the key question remains of how much longer the second longest bull market in history can be sustained. As sure as night follows day, this rally is living on borrowed time – literally. At some stage, there must be a reckoning and from any one of a multitude of potential hazards.

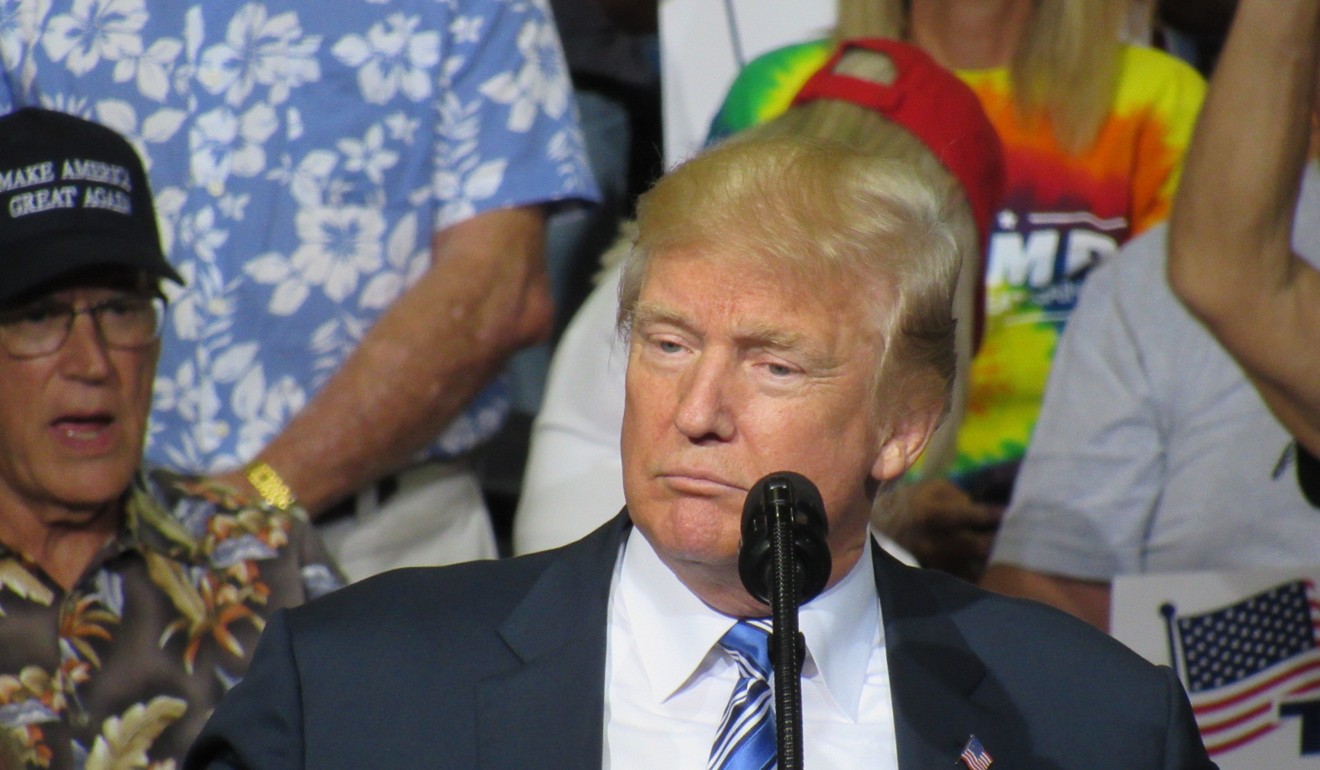

Donald Trump’s increasingly crisis-bound US presidency is only one of many possible risks but probably the most potent, especially as the US economy is expected to provide the leading edge for global recovery in the next few years. It is almost impossible to put any timescale on how the melodrama plays out and what the market impact will be. Denouement could some quickly or drag out interminably for investors.

Investment strategists simply need to take a sober look at the global macroeconomic picture to realise the world’s bill of health is well below par and much less able to bear the brunt of any super seismic shocks.

Without the support of zero interest rates and expansive monetary policies from the major central banks, the outlook suddenly begins to look much bleaker

A strong global economy and buoyant world trade growth should go hand in hand. But thanks to rising protectionism, coupled with uncertainty about the global picture, world trade flows are still stuck below pre-crisis levels and flagging again. If this persists, the chances of reaching the International Monetary Fund’s target of 3.7 per cent for world GDP growth in the next few years look remote.

Global leading indicators are already running out of steam, suggesting world economic recovery and stock market confidence are at severe risk. Without the support of zero interest rates and expansive monetary policies from the major central banks, the outlook suddenly begins to look much bleaker.

What the world desperately needs is a new shot of hope and stimulus, but this remains in short supply right now. China’s “Belt and Road Initiative”, which aims to inject US$1 trillion of new investment down the road, is a positive step but still too far in the future to make much material difference in the short term. Supranational bodies like the IMF and Group of 20 have lost any ability to marshal global recovery efforts.

The future risks lie bare and abundant. Brexit poses major risks ahead for Europe, while new sanctions levied by the US on Russia move the growing threat of global protectionism another step closer to midnight. The real worry is if an endangered Donald Trump starts lashing out with even more capricious acts of policy that trip the world into a fully-fledged trade war.

This is a prime time for cool heads and steady policy hands but they are in short supply. The global economy may already be past the tipping point with stocks soon to start a steady slide south.