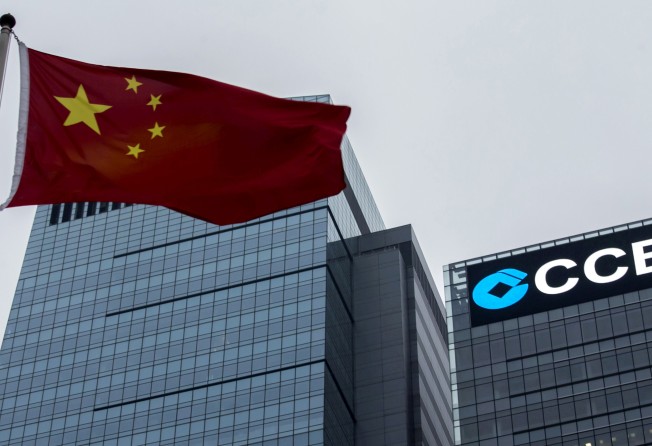

China Construction Bank profits up 3.69 per cent

Broad-based growth particularly driven by net interest income increases

China Construction Bank announced late on Wednesday that its profits rose by 3.69 per cent, a performance in line with analysts’ expectations.

The bank, China’s second most profitable, reported net profits of 138.3 billion yuan, up from 133.4 billion yuan last year.

The profit growth was broad based, with net interest income up 3.25 per cent, net fee and commission income up 1.32 per cent, and some improvements in costs.

In its statement to the Hong Kong Stock Exchange, the bank said the reason for the rise in net interest income was that it had absorbed the impact of the interest rate cuts by the People’s Bank of China, which had weighed on interest income throughout 2016, and because it had managed to increase its interest-earning assets.

The improvements in fee and commission income were thanks to a 20 per cent rise in income from credit cards.

In terms of asset quality, CCB managed to bring down its non-performing loan (NPL) ratio (the number of soured loans as a proportion of the total), but this was thanks to solid loan growth. The total number of NPLs actually increased by 10 billion yuan to 188 billion yuan.

Nonetheless, the bank set aside 60.5 billion yuan to cover impaired loans, up from 46.6 billion last year.

Chen Shujin, head of financial research at Huatai Financial, said CCB had adopted a prudent approach to its provisions, comparing the bank favourably with its big four rival Bank of China, which announced earlier on Wednesday that it had slashed its provisions for impaired loans.

All of China’s big four banks announced their results on Wednesday.