Shenzhen tech company the latest victim of China’s 100 trillion yuan wealth management market

Shenzhen-based Nationz Technology plunges by daily limit after failing to chase 500 million yuan investment

China’s sprawling but loosely regulated 100 trillion yuan (US$15.2 trillion) wealth management product sector just reported its latest casualty. A Shenzhen-listed technology company plunged by the daily limit for a second day after reporting that a 500 million yuan investment with a wealth management company was unrecoverable.

The company’s loss sheds light on a problem shared by China’s 3,400 listed companies: with investments in their core businesses having failed to generate decent returns, many are putting money they have earned or raised from the capital markets into wealth management products in the search for higher interest rates.

Shares in Nationz Technology, a Shenzhen-based producer of Chip products and internet authentication service provider with a market cap of 7.1 billion yuan, tumbled by 10 per cent, the daily downwards limit, as trading started on both Wednesday and Thursday.

The company had announced in a Tuesday night filing to investors that an investment made by them, worth 500 million yuan, might cause “significant losses to the listed company”, as executives of the fund management company were “out of contact”.

“The outstanding investment in wealth management products by listed companies has surpassed one trillion yuan this year. It shows listed companies are not confident in their core businesses,” said Guo Shiliang, a financial columnist based in Guangzhou.

“On the other hand, we keep witnessing wealth management institutions without formal licences raising and managing billions of yuan in assets, largely above the registered capital, which cries for tighter regulation,” he added.

Financial products, from mutual and privately raised funds to trusts and peer-to-peer loans, are usually put either under the general term wealth management products or asset management products.

And these high-interest products are starting to backfire as defaults or even fraudulent activities emerge with a slow down in economic growth, and as regulatory tightening put in place this year by Beijing moves to curb financial risk.

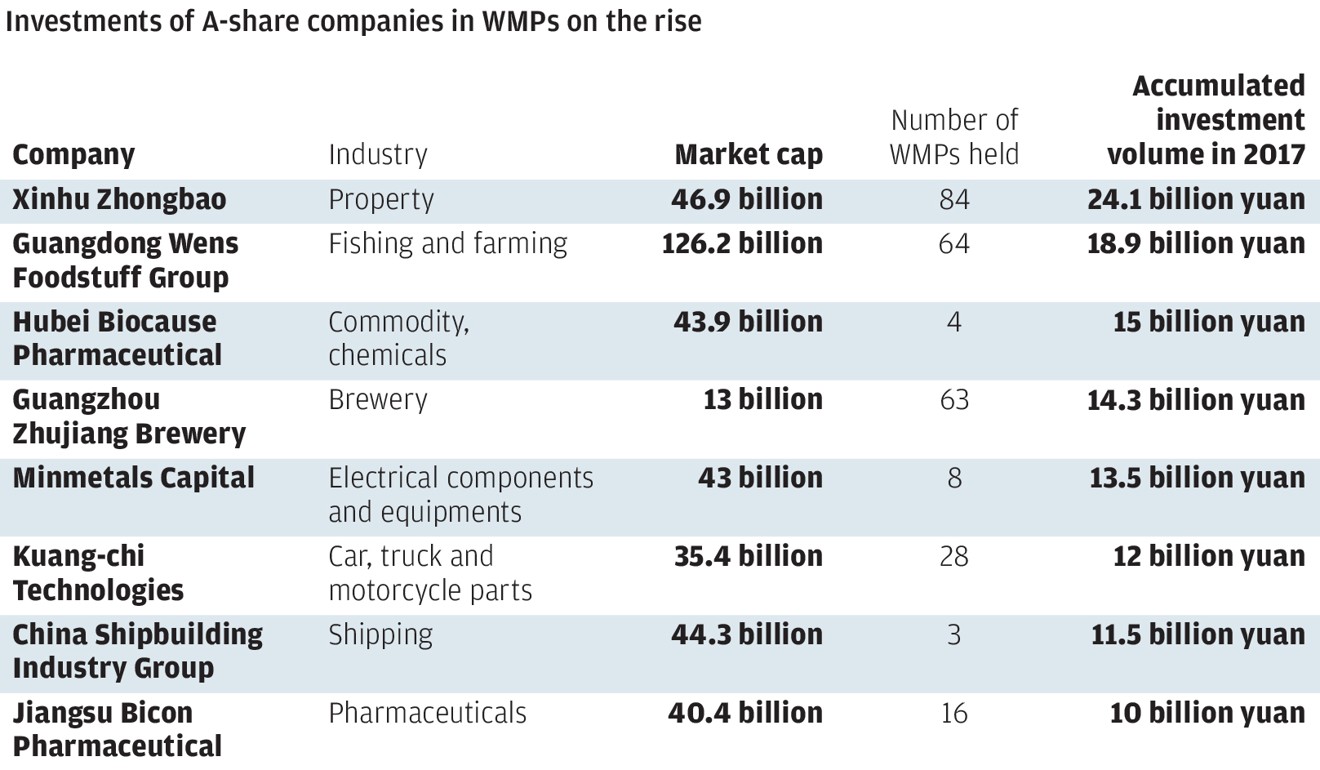

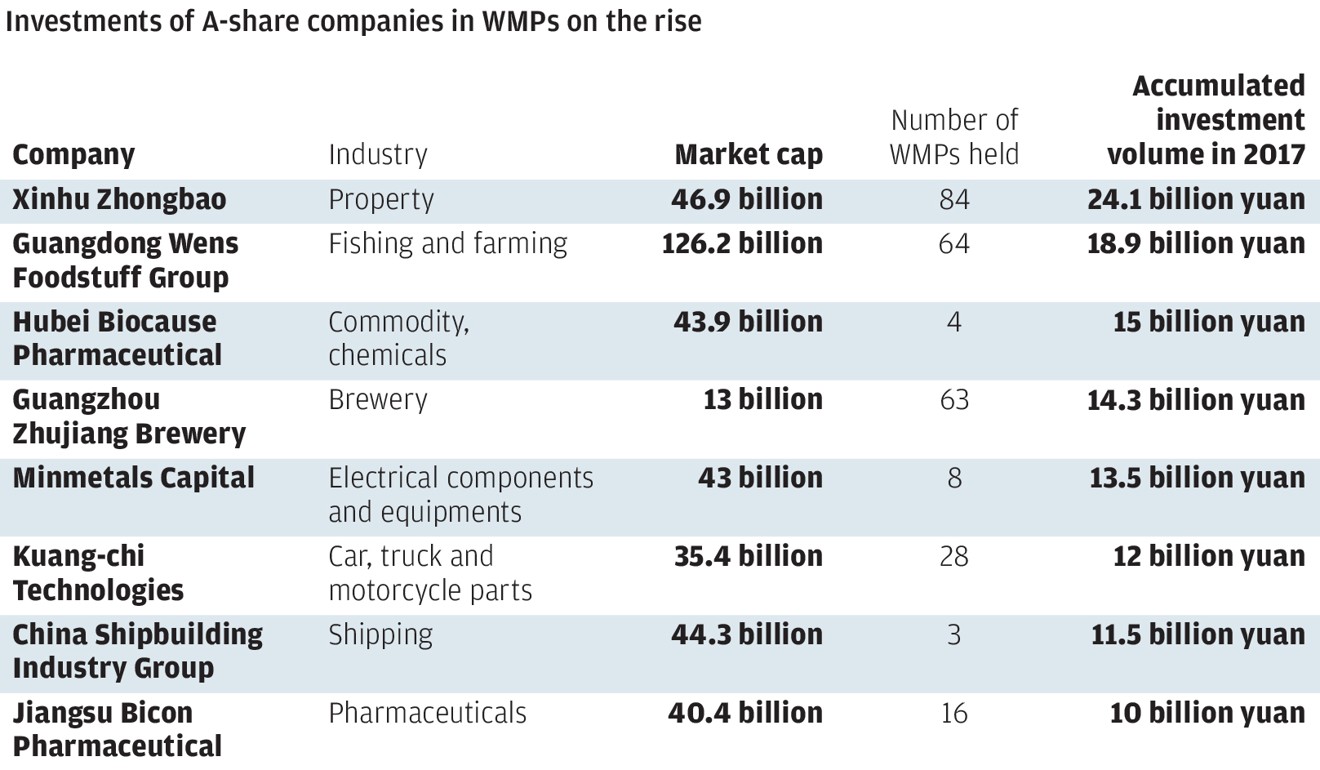

A total of 1,126 listed companies had invested into wealth management products by December 21, 28.5 per cent up year on year. Among them, eight listed firms have seen accumulated investment into WMPs exceeding 10 billion yuan, according to data provider Wind.

According to earlier filings, Nationz Technology had in late 2014 invested 200 million yuan in a wealth management product developed by an equity investment company called Shenzhen Qianhai Khan Fund Management, and managed to get back its principal and promised returns by the end of 2016.

During that period, Nationz Technology made an additional 500 million yuan investment in Qianhai Khan and set up a private equity fund with it, in which it was a limited partner.

But later it found that there was no way for it to chase its principal and returns, as the Qianhai Khan executives were “out of contact”, and had to report the case to the public security department on November 28.

The company applied for trading suspension the next day and got approval from the Shenzhen bourse. Trade in its shares had resumed on Wednesday morning, when its stock tanked.