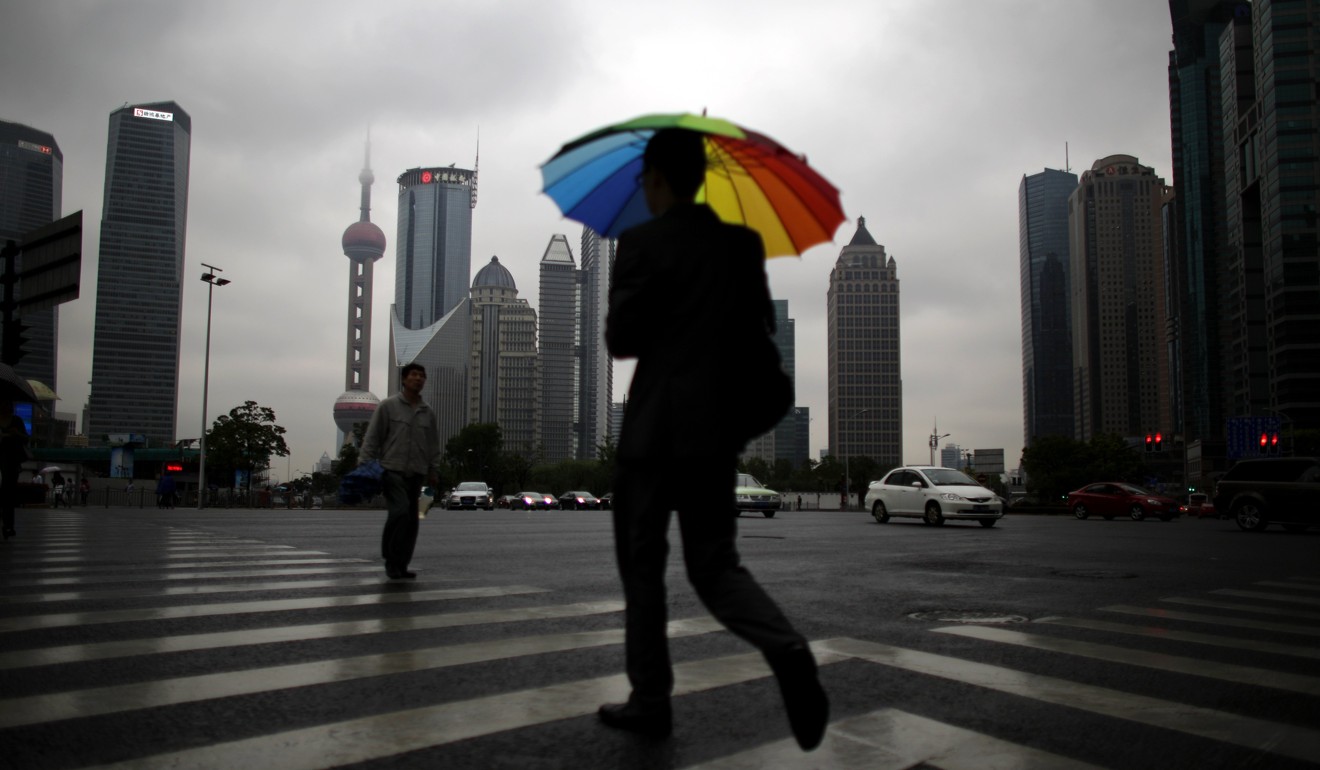

China’s asset-management growth plummets after sweeping regulations rain down on shadow banking sector

Assets under management worth a combined US$8.22 trillion at the end of 2017 – a 3.49pc annual rise, but a huge fall from the 35.6pc growth it enjoyed in 2016

China’s hopes of becoming the world’s second largest asset management market after the US by next year appear to have been seriously dented, as sweeping new regulations were introduced on the country’s vast shadow banking sector over the past 18 months, in an effort to rein in the nation’s rising debt.

The country’s assets under management, held by fund management firms, securities and futures companies, and privately offered investment funds, were worth a combined 53.6 trillion yuan (US$8.22 trillion) at the end of last year, a 3.49 per cent rise on 2016, according to the latest statistics from the Asset Management Association of China (AMAC).

But that rate has plummeted from 2016, in light of a rash of new industry rules and red tape, when the sector exploded 35.6 per cent to 51.79 trillion yuan from 38.2 trillion in 2015.

More than half of China’s asset management products (AMPs) are offered by securities institutions, with the rest provided by banks and insurers.

The country’s entire asset management industry is believed to exceed 100 trillion yuan in value, if you include cross holdings among all types of institutions.

Deloitte’s management consulting unit Casey Quirk last year suggested China would overtake the UK to become the world’s second largest asset management market as early as 2019, and forecast the industry to grow around US$17 trillion by 2030, powered by retail and high-net-worth investors.

But the association’s latest figures show just what a dramatic effect the government clampdown has had, with the slowdown most evident in investment funds, securities firms and futures companies, which have become among the most heavily regulated.

Assets under management held by fund management firms and their subsidiaries, for instance, were worth 13.9 trillion yuan, a 17.6 per cent fall on the year before.

We witnessed a remarkable shift in attitude and behaviour by Chinese regulators towards its financial sector last year

Securities firms managed assets worth 16.8 trillion yuan, a 4.44 per cent drop. While products managed by futures companies, worth 200 billion yuan, represented a 28.6 per cent fall in business.

One of the most symbolic moves made by the government included setting up a “super regulator”, the Financial Stability and Development Commission, after the 19th Party Congress in October covering the entire financial system.

And then in November the country’s central bank, the People’s Bank of China, issued a joint statement with other financial regulators, setting out new guidelines, unifying the rules covering AMPs issued by securities institutions, banks, and insurers, and setting leverage limits for all products.

“We witnessed a remarkable shift in attitude and behaviour by Chinese regulators towards its financial sector last year,” said Richard Zhu, head of financial services for north China at PwC.

He added their spotlights have been shone particularly brightly on banks’ vast off-balance sheet businesses, widely dubbed as its “shadow banking industry”, with the aim of slashing runaway debt and controlling the systemic risk growing across the country’s entire finance industry.

Ming Ming, an analyst at Citic Securities, told Bloomberg it was “the most comprehensive and most profound regulatory document ever”.

“This marks the beginning of a new era in financial regulation as it implies the end of a ‘big leap’ in the asset management industry. Going forward, it means more compliance requirements, tighter risk control, and thus slower but better-quality growth.”

Most of China’s shadow banking industry involves complicated lending by banks to other entities and intermediaries, including funds, trust firms, securities and futures companies, which then repackage the loans into AMPs and resell them.

In this way, a corporate loan can be turned into an investment in an AMP, meaning banks do not have to account for them as part of their loan book, masking their true value and risk.

The practise is also called “channel business” in Chinese, with banks enlisting the help of securities institutions to help them transfer assets into hidden channels, to bypass the regulations.