Lessons from 1997 show it’s scary being a bear on the Hong Kong dollar

As the Hong Kong dollar sinks toward the weak end of its trading band, it’s worth looking back to 1997 for lessons of how the authorities may respond. What was back then a currency peg has since been replaced by a band, but that will not alter the determination of the Hong Kong Monetary Authority to defend it.

Although Hong Kong avoided the initial wave of currency attacks that began in July 1997 with the Thai baht’s devaluation, the city’s turn came in October. Excessive optimism in the Hang Seng Index quickly turned into panic selling and triggered a run on the currency. But the HKMA proved a brutal opponent for speculators to take on.

This time around it will be the first defence of the 7.85 level and the HKMA will need to rely on its currency reserves rather than a hard convertibility peg. Not that traders should expect any hesitation in the use of their full arsenal, worth more than US$400 billion.

And it’ll be combined with timely verbal intervention to remind investors that officials are on alert and fully engaged. Then there is China to consider.

Hong Kong’s money is Beijing’s money and the chance that Xi Jinping will sanction a devaluation of the Hong Kong dollar is very low.

Currency swaps between central banks in Asia are being widely used, thus a line from the PBOC to backstop the HKMA would be completely normal. Access to China’s currency reserve pile is a very big stick to swing, even against today’s multi-trillion dollar FX market.

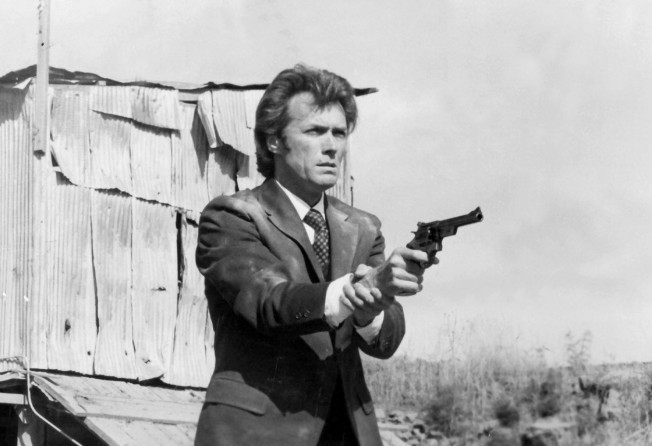

The question for Hong Kong dollar speculators in 2018 is one that Clint Eastwood once used in a movie. So, do you feel lucky?

(Mark Cranfield is a former currency trader who was working in Hong Kong in 1997, and is now a Markets Live blogger for Bloomberg)