Hong Kong stock exchange operator posts record first-half earnings, as blockbuster IPOs help it reclaim No 1 fundraising ranking

Bourse operator Hong Kong Exchanges and Clearing reported on Wednesday a 44 per cent increase in interim earnings, boosted by a raft of initial public offerings that helped it regain the top spot in global fundraising rankings.

HKEX said on Wednesday its interim net profit stood at HK$5.04 billion (US$642.1 million) or HK$4.07 per share, up from HK$3.49 billion a year earlier. This is the highest half-year profit since the exchange was established and listed in 2000. It is also higher than the 37 per cent profit growth to HK$4.8 billion estimated by HSBC.

HKEX’s shares closed 1 per cent higher at HK$229 following the results announcement.

After deducting first-quarter profit of HK$2.56 billion, net profit for the second quarter from April to June stood at HK$2.48 billion, up 40 per cent from a year earlier and beating Nomura’s estimate of 22 per cent year-on-year profit growth to HK$2.16 billion.

“During the first half of 2018, the world’s financial markets experienced bouts of volatility following significant corrections across major stock markets. Investor sentiment was dominated by uncertainties over escalating US-China trade tensions, geopolitical risk in several parts of the world and policy divergence of major central banks. Lingering uncertainties are likely to cast a dark cloud over global markets for the remainder of this year,” said Laura Cha Shih May-lung, chairwoman of HKEX, in her first interim results statement.

“As the world enters a new era of fintech, there will be many opportunities as well as challenges. At HKEX, an innovation lab was established to explore the increased use of emerging technologies in various parts of our business, both operationally and strategically,” Cha said.

The bourse’s trading and clearing fee income was boosted by rising average daily turnover, which increased 67 per cent to HK$126.6 billion in the first half, compared with HK$76 billion in the first half of 2017.

Listing fee income rose as 108 companies launched IPOs in the first half, up 50 per cent from 72 last year, after the HKEX in April started accepting dual-class shareholding technology companies and biotech firms without revenue.

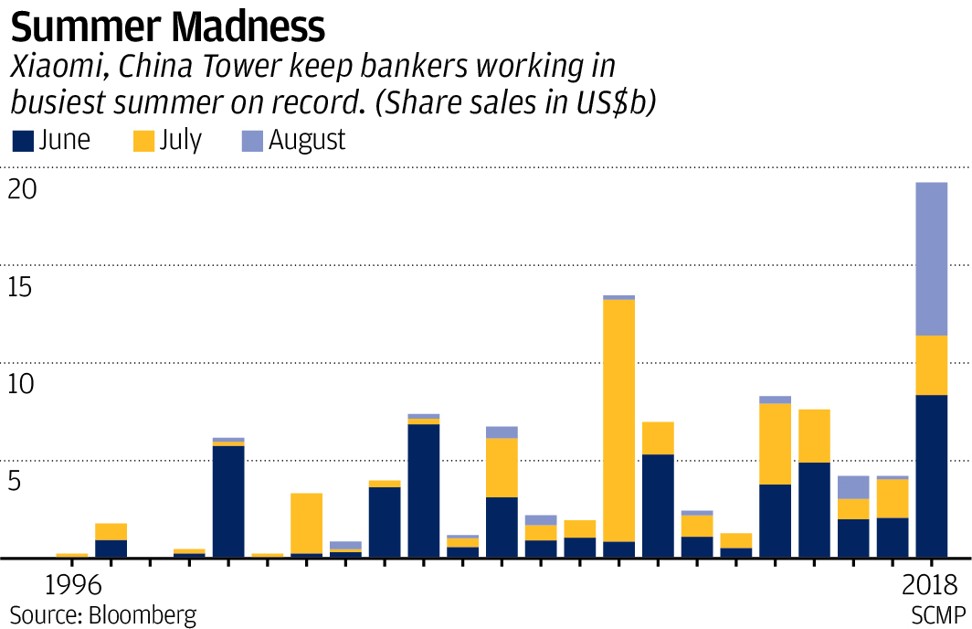

Although the reform resulted in Xiaomi, the world’s fourth-largest smartphone maker, raising HK$37.05 billion in June, the total amount of funds raised on the bourse fell 8.1 per cent in the first half to HK$50.4 billion.

HKEX chief executive Charles Li Xiaojia told reporters at a late afternoon press conference on Wednesday that Hong Kong had reclaimed the top spot in global fundraising rankings thanks to the trading debuts of China Tower and BeiGene earlier in the day.

“Hong Kong is back to No 1 worldwide in terms of IPO funds raised,” Li said.

Wednesday action catapulted Hong Kong ahead of the New York Stock Exchange and Nasdaq in terms of global rankings, bringing its year-to-date fundraising to HK$187 billion.

“We have received three weighted voting right companies and nine biotech firms applying to list in Hong Kong under the new listing regime. There are dozens of more companies making enquiries,” Li said.

He cautioned of challenges ahead in the second half due to lower turnover as investors focused on rising trade tensions between China and the US.

HKEX’s board said it would pay an interim dividend of HK$3.64 per share, up 43 per cent from HK$2.55 a year earlier.

The Stock Connect scheme linking Hong Kong with mainland China exchanges brought in revenue of HK$365 million in the first half, more than double the HK$162 million a year earlier. Funds from mainland Chinese investors into Hong Kong stocks now represent between 5 per cent and 10 per cent of market turnover.

“There is a large pipeline of ‘new economy’ listings which, in our view, could change the market dynamics and structurally lead to higher turnover,” said York Pun, an HSBC analyst, in a research note before the results announcement.

Robert Lee Wai-wang, executive director of Hong Kong-based broker Grand Finance Group, said he was upbeat on the earnings prospects for HKEX in the second half in spite of global political and economic headwinds.

“The market turnover of HKEX in the second half of this year may be affected by the poor market sentiment. The US and China trade war may continue to haunt markets. Interest rate rises would also have an negative impact. However, the listing reform could bring in more technology firms and biotech companies to list. The long-term outlook of HKEX remain positive,” Lee said.

HKEX chief executive Charles Li Xiaojia will hold a press conference in the afternoon to discuss the results.