Owning a home in the world’s most expensive property market just got tougher as banks raise mortgage rates

Home loan rates offered by HSBC, Bank of China (HK) and Hang Seng Bank to rise by 10 basis points in line with Citibank’s increase on new borrowers, while all existing homeowners are expected to pay more by the end of August, in what will be the first prime rate increase for 12 years

New borrowers in Hong Kong will have to cough up higher mortgage rates as more than a dozen top banks have raised the interest on home loans by 10 basis points, signalling an end to more than a decade of cheap home loans that has in part fuelled the dizzying rise of property prices in the city.

Existing homeowners, who have an outstanding HK$1.258 trillion (US$163 billion), have not yet felt the pain but can expect to pay more too, with banks expected to increase their prime rate by the end of this month – the first rise in 12 years.

After Citibank increased its mortgage rates for new borrowers by 10 basis points on Tuesday – Hang Seng Bank, HSBC and Bank of China (Hong Kong), Standard Chartered, and Bank of East Asia, said in separate statements late on Wednesday night they too would be raising their mortgage rates by 10 basis points from next Monday.

Wing Lung Bank and China Construction Bank (Asia), however, said their increases would be effective from Thursday.

Five more banks joined the rate rise on Thursday. While OCBC Wing Hang Bank and Fubon Bank said they would increase their mortgage rates from Friday, ICBC Asia, China Citic International, Dah Sing Bank will increase it from August 13.

DBS on Friday also announced it would increase its mortgage rates by 10 basis points from August 20.

Chong Hing Bank on Friday also said it would increase its Hibor-linked mortgage cap to 2.35 per cent on Monday but will keep its prime rate-linked mortgage rate unchanged at 2.25 per cent.

That means 15 banks, including all top 10 mortgage lenders which have combined 86 per cent of mortgage market share, have increased their mortgage rates.

Home loan rates offered by HSBC, Bank of China (HK) and Hang Seng Bank are expected to rise by 10 basis points in line with Citibank’s increase while the rest are making similar moves.

Their new Hibor-linked mortgage cap has now increased to 2.35 per cent with their new prime rate-linked mortgage rate 2.25 per cent.

New mortgage borrowers from those banks will have to pay about an additional HK$50 per month (US$6.37) for every HK$1 million of lending over a 30-year term.

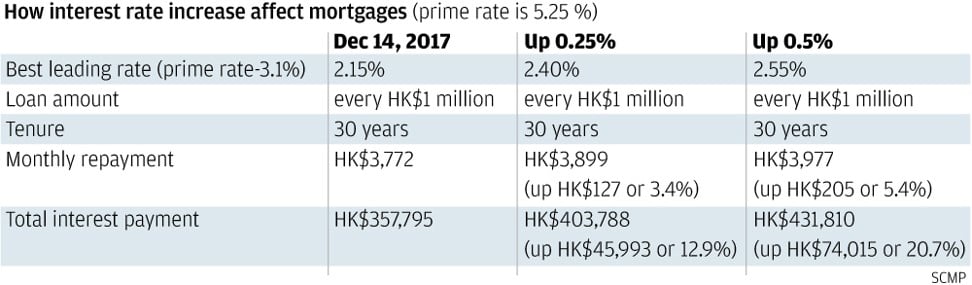

For a typical HK$4 million, 30-year mortgage loan, the monthly repayment for a prime-linked mortgage will be increased from HK$15,086 to HK$15,289 representing an increase of HK$203 per month. A Hibor-linked mortgage under the new cap would see its monthly repayment increased from HK$15,289 to HK$15,494, representing HK$205 per month.

“After the banks increase their mortgage loans this week for new borrowers, the next step is to increase the prime lending rate which would apply to all existing mortgage loans and other types of lending,” said Jasper Lo, chief investment strategies at Eddid Securities and Futures.

“This may happen as soon as the end of this month or early September, well before the initial expectation of a US Federal Reserve rate rise at the end of September.

“The poor stock markets recently have led to some capital outflow which has dried up liquidity in the interbank market. Funding [in the interbank market] has become more expensive and they [banks] have had to increase the deposit rate to compete for funding. This has added cost, hence the increases in the mortgage rate and later the prime rate,” he said.

“The rate rise is minimal and only applies on new mortgage loans. As such, it will not have a big impact on the property market as a whole,” said Ivy Wong, managing director of Centaline Mortgage Broker.

But existing mortgage borrowers in Hong Kong, who have a total HK$1.258 trillion total outstanding in mortgage loans, according to the Hong Kong Monetary Authority, may soon also need to pay more.

Once banks increase their best lending rate, or the so-called prime rate, all existing mortgage loans interest rates will also be raised.

Even Hibor-linked mortgage loans are capped by the prime rate. HSBC, Hang Seng Bank and Bank of China Hong Kong have kept their prime rate at 5 per cent, while the rest sit at 5.25 per cent.

This is a record low level for Hong Kong and has stayed unchanged for over 10 years, providing cheap funding that has helped propel the local property market into the most expensive worldwide.

Centaline’s Ivy Wong said even with interest rates starting to edge higher, it will not mark any turnaround in property prices.

“The interest rate rise was expected but it is coming faster than expected,” she said, with many bankers having suggested rates would likely start going up from next month.

“Even with an anticipated two rate rises in Hong Kong for a combined 0.5 per cent, it is not high enough to discourage homebuyers,” she said.

Eleanor Wan, chief executive of BEA Union Investment Management, added: “US interest rates have increased twice this year. The market is expecting another two rate rises before the end of this year end, and there may be another two next year.

“The spread between Libor and Hibor has become much narrower. The mortgage rate had not changed so far and therefore the recent rise will narrow the gap.”

Louisa Cheang Wai-wan, chief executive of Hang Seng Bank, said at its result media briefing on Monday that Hong Kong banks could increase their best lending rate in this half of the year.

“If that happens, it will benefit our net interest margin in the second half.”