Home sellers trim prices as Hong Kong’s decade of cheap money ends with higher interest rates

Homeowners are bracing for a hit in the pocket as Hong Kong’s lenders raise their prime rates for the first time in over a decade

Some Hong Kong homeowners are discounting the prices of their lived-in flats by up to 16 per cent in the secondary sales market, hours after 11 of the city’s banks raised their lending rates for the first time in more than a decade.

HSBC, Standard Chartered, Hang Seng Bank and other lenders increased their lending and local currency savings rates effective Friday , after Hong Kong’s de facto central bank increased its base lending rate in lockstep with a move by the US Federal Reserve, formally ending 12 years of unchanged rates in the city.

The base lending rate was raised by 25 basis points to 2.5 per cent, the Hong Kong Monetary Authority (HKMA) said on its website. That paved the way for commercial banks to raise their so-called prime rates, hitting homeowners in the pocket.

“This will put an end to an era of extremely cheap lending, and is set to bring volatility to the investment and property markets,” the HKMA’s Chief Executive Officer Norman Chan Tak-lam said . “It would be unrealistic to expect property prices to only go up. The public will need to be aware of the risks related to asset-price changes caused by the interest rate [increase].”

The latest move by the US Fed – the third in 2018, and the eighth since the end of so-called quantitative easing in December 2015 – immediately caused reactions in Hong Kong, as the city runs its monetary policy in step with the US to maintain the Hong Kong dollar’s peg to the US dollar.

Separately, the People’s Bank of China kept interest rates unchanged, extending a financial lifeline to industries and state companies that are still grappling with the ongoing trade war with the US, as the world’s two largest economies took on divergent monetary policies.

The base lending rate is the interest that the HKMA charges commercial banks. A higher rate translates to higher mortgage payments for loans that are tied to it.

Eleven banks, with more than 74 per cent of Hong Kong’s mortgage loans between them, announced they would raise their rates.

HSBC was the first to raise its lending rate by 12.5 basis points to 5.125 per cent. Standard Chartered, Citibank, Bank of East Asia, Chong Hing Bank, ICBC Asia, Bank of Communications, Dah Sing Bank and HSBC’s Hang Seng Bank unit followed with the same increments. Bank of China (Hong Kong)’s prime rate will rise by the same amount to 5.125 per cent, starting October 2, while OCBC Wing Hang Bank announced a 25 basis-point increase to 5.5 per cent.

There are two types of mortgage loans in Hong Kong: those tied to the prime rate, and those tied to the interbank offered rate (Hibor).

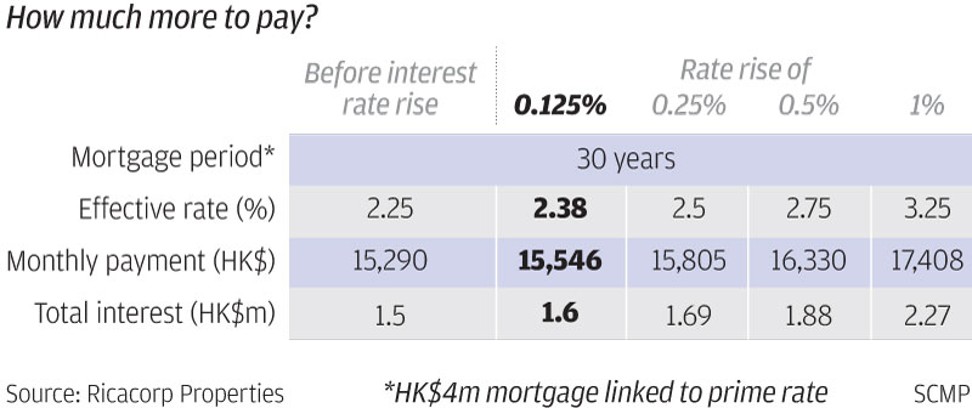

Borrowers who tie their mortgages to the prime rate will face higher payments when the move kicks in. For a typical HK$4 million, 30-year loan priced at prime minus 2.75 per cent, a 12.5-basis point increment raises the monthly payment by HK$256 to HK$15,546, according to Ricacorp Mortgage, a mortgage broker. Total interest payments on the loan will increase by HK$93,000 to about HK$1.6 million.

Higher payments add to Hong Kong’s increased housing supply forced into effect since June, causing analysts to predict that the city’s median home price - the most expensive among global urban centres - has arrived at a tipping point.

Property stocks fell across the board on the Hong Kong stock exchange after the interest rate move, pulling down the benchmark Hang Seng Index by as much as 0.6 per cent. The shares of China Resources Land, CK Hutchison Holdings and Sun Hung Kai Properties all declined.

The US central bank raised interest rates by a quarter percentage point, and affirmed its outlook for further increases well into 2019.

“The US [Fed] had expected to increase interest rate one more time this year and three more times next year,” Chan said, adding that higher rates will add to a deteriorating US-China trade war to the uncertainties facing the property market. “The Fed rate would go up to around 3 per cent, and Hong Kong would follow suit.”

Hong Kong’s cost of money soared to a 10-year high on Thursday as it became harder for banks to obtain funds. The one-month Hibor, a measure of how much banks charge each other for short-term loans, added 6 basis points to 2.27 per cent, its highest level since 2008.

Still, the city’s financial system is flushed with liquidity, with only HK$100 billion flowing out of Hong Kong since April, representing about 10 per cent of the HK$1 trillion that has flowed into the city since 2008, Chan said.

“The banks hold a combined HK$1 trillion in Exchange Fund notes while the aggregated balance is over HK$70 billion,” he said. “The US also plans to increase its interest rate gradually. The market may have volatilities during this process, but the economy should be able to cope with the rate rise. The normalisation of interest rates would allow the [Hong Kong] economy to grow in a more healthy manner,” Chan said.

With additional reporting by Georgina Lee in Hong Kong