German firms find US less reliable than China as trading partner after getting caught between Trump and a hard place to do business

- China ranked higher than US and Britain as trading partners in a survey of 2,000 German companies by Commerzbank

- Washington’s protectionist stance and the UK’s Brexit plans were major factors in the choices of respondents

German companies think China is a far more reliable trading partner than the US or Great Britain, according to a survey by Commerzbank.

China was ranked third in an assessment based on political and economic conditions affecting trade, with a score of 30, led by Germany itself way out ahead on 65, and France on 39. The US, in fourth place, was a long way behind on 17 points, followed by Italy (11), Russia (10), Great Britain (8), Brazil (5) and Turkey (3), according to the results of the survey issued on Wednesday.

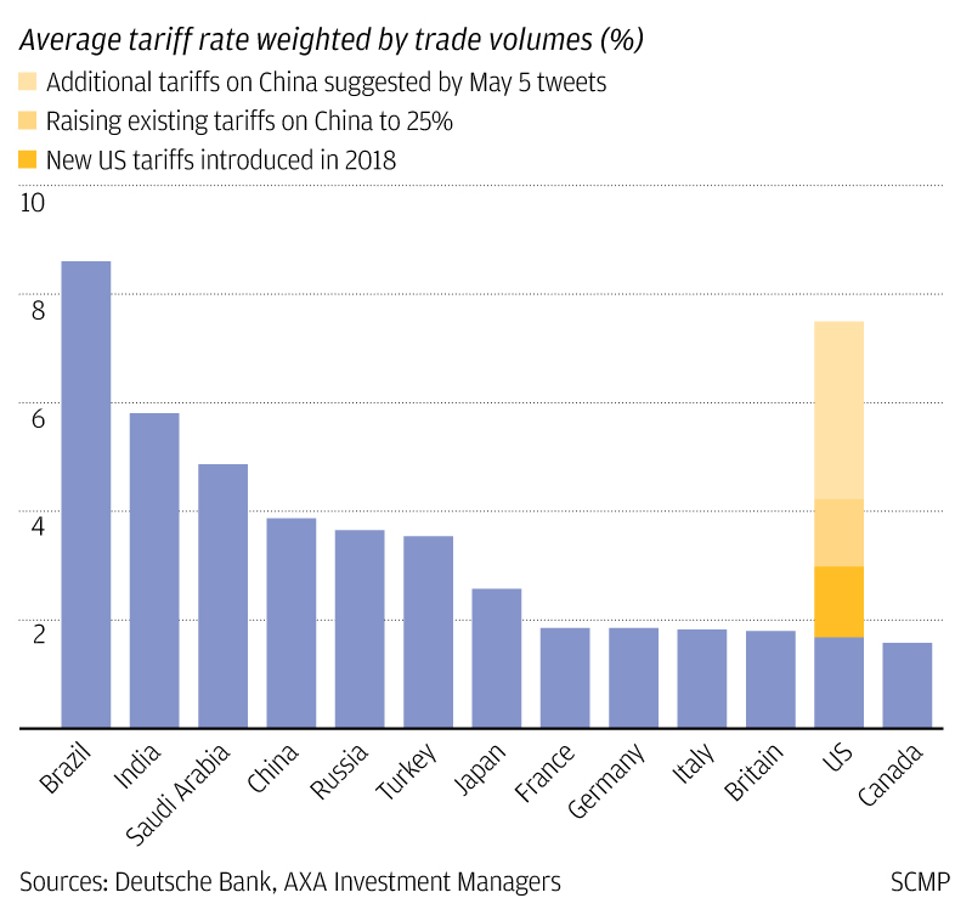

The US’ protectionist stance under President Trump counted against it with respondents. More than two thirds (68 per cent) of companies with a physical presence in the US, and 64 per cent of exporters to the US, feared the country’s foreign and trade policies would have a negative impact on business.

The UK’s imminent departure from the European Union was even more off-putting for trade partners, the survey found. As many as 82 per cent of firms with a branch or office location in Great Britain, and 60 per cent of exporters to the country, worried that Brexit would have a negative impact.

Of 115 companies considering transferring their production facilities overseas, 31 per cent said they were eyeing China, compared to 11 per cent looking at southeast Asian countries, and 9 per cent mulling a move to the US.

Commerzbank interviewed first-level managers at 2,000 German companies with an annual turnover of at least €2 million. Just over half (52 per cent) of the respondents were exporters, with most of these (77 per cent) being manufacturers.

“German companies have a bigger exposure to the Chinese market than others, given China is the biggest trading partner of Germany,” said Aidan Yao, senior emerging Asia economist at AXA Investment Managers.

“It is understandable that people feel China is more reliable, because the policies of China nowadays are more predictable than those of the US. As the trade war prolongs, more people feel China is playing a defensive role while the Trump administration seems to be the origin of trade confrontations.”

China was the biggest importer of German goods last year, worth €106.2 billion, followed by the Netherlands with €98.2 billion and France with €65.2 billion, according to Xinhua, the Chinese state news agency.

The firms surveyed said they believe German-made products are competitive and enjoy high demand overseas. They will therefore continue to pursue internationalisation plans despite rising uncertainties including the US-China trade war and the potential impact of climate change.

Half of the respondents in the survey trade directly abroad, a third trade through intermediaries. Most of them said the significance of long-term cooperation is increasing.

The respondents dismissed some challenges as not being factors in their overseas trade. They said factors like bureaucracy and higher default risks on the part of clients were controllable through support from banks and chambers of commerce.

As for problems like political uncertainties, and lack of protection for intellectual property, respondents tended to agree they could be offset by learning from successful exporters.

“Alarmism or battening down the hatches is the wrong approach. We are supporting politicians to advocate a multilateral and rules-based global trading system so that cost-effective and sustainable trading is possible at fair conditions,” said Dr Holger Bingmann, president of the Federation of German Wholesale, Foreign Trade and Services (BGA), and patron of the Commerzbank study.